A reader asks:

I don’t work in finance however I do know sufficient math to get me into hassle (I’m an engineer). All else equal, the next low cost price ought to imply a decrease current worth of future money flows. I do know all isn’t at all times equal however with charges rising once more and the prospect of upper for longer now firmly on the desk, shouldn’t that be a headwind for shares? What am I lacking right here?

Good query.

Finance idea does state that the current worth of an asset is the longer term stream of money flows discounted by an affordable price of curiosity.

If PV = CFs / (1+price)time and the speed goes up, all else equal, the current worth ought to go down.

The issue with this line of considering is there’s a big distinction between idea and actuality. Plus, all isn’t ever equal.

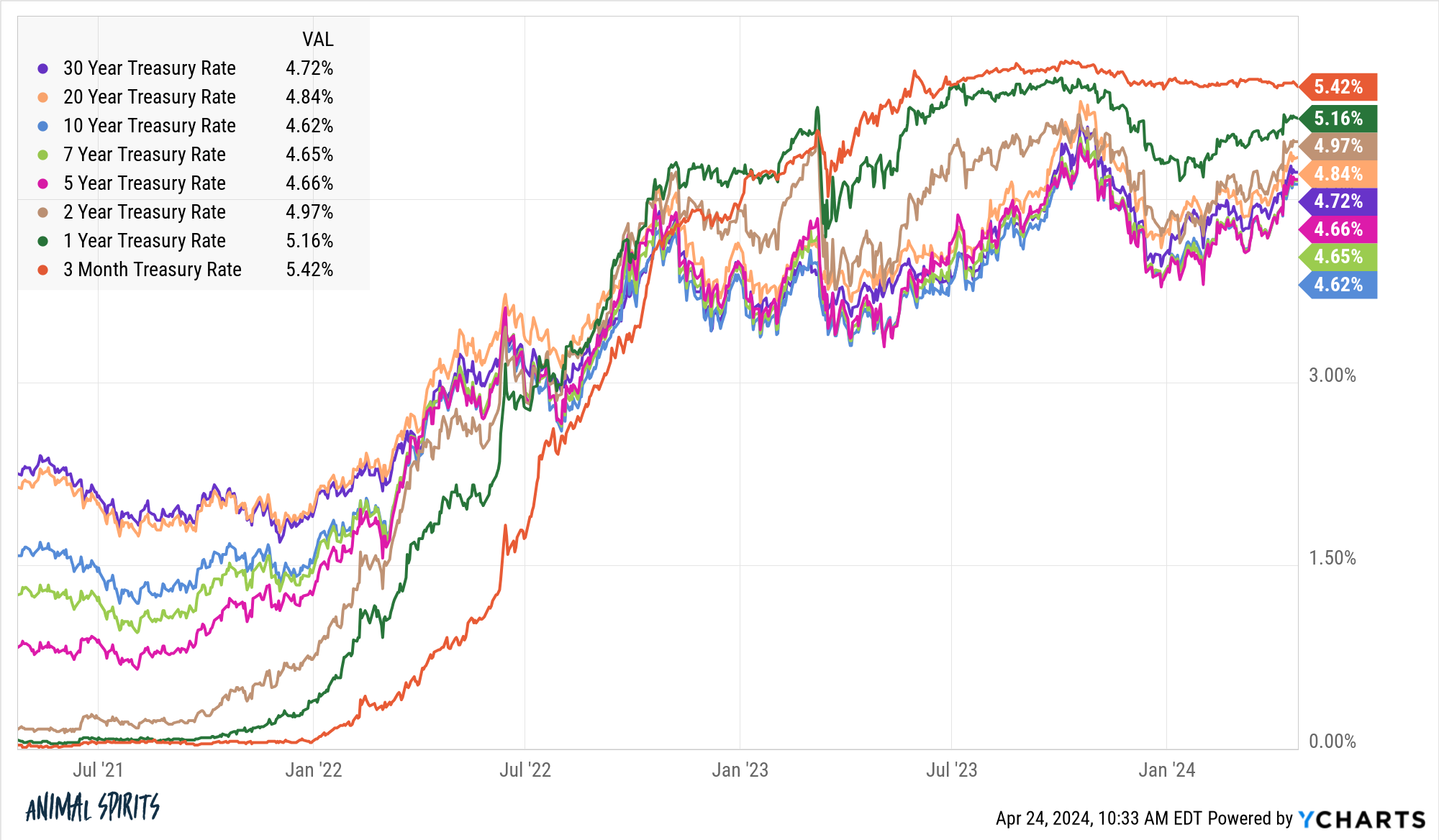

After rising at a quick clip final fall, rates of interest dipped however they’re now going again up once more:

The unfold between the brief and lengthy ends of the curve is compressing.

This needs to be dangerous for the inventory market, proper?

Sure, in idea, however the historic observe report suggests rising rates of interest usually are not the tip of the world for the inventory market.

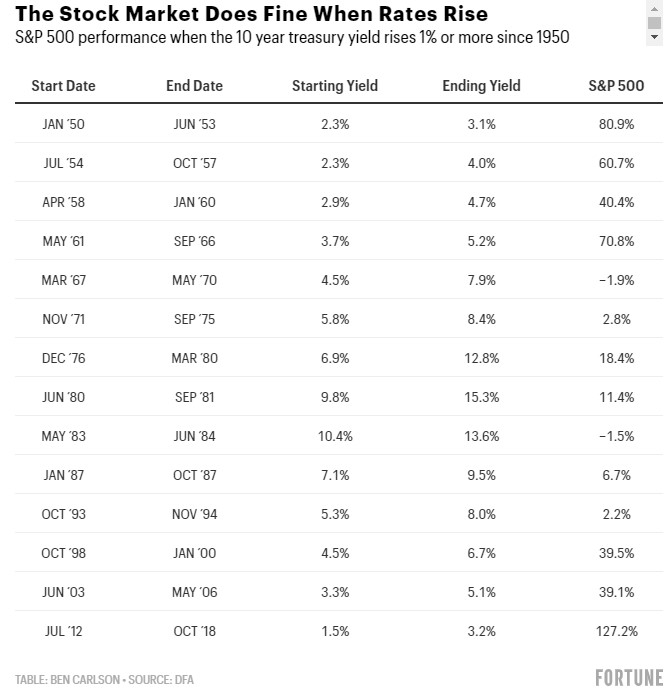

In reality, the S&P 500 has executed simply fantastic throughout rising rate of interest cycles prior to now. I’ve written concerning the inventory market vs. rising charges prior to now:

From 1950 by the pre-pandemic period, the common annualized return when the ten yr yield jumped 1% or extra, was simply shy of 11%. That’s mainly the long-term common efficiency for the U.S. inventory market. It was solely down twice when this occurred and the losses have been minimal.

That’s rising charges however how does the precise stage of charges influence future inventory market returns? Certainly, investing when charges are larger ought to result in decrease returns, proper?

The connection between rates of interest and inventory market efficiency is murky at greatest.

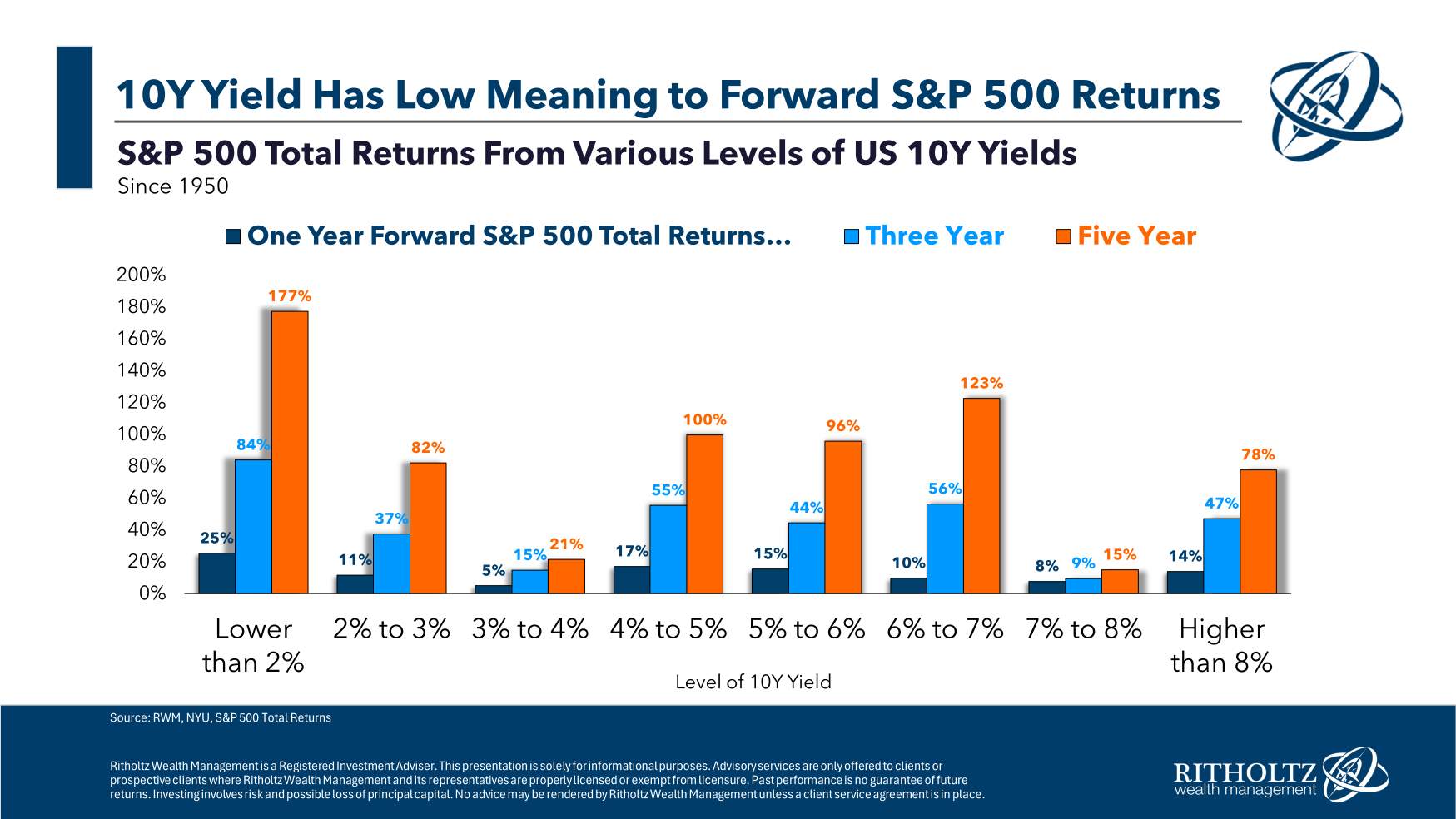

Going again to 1950, I broke down the ahead 1, 3, and 5 yr common returns from numerous rate of interest ranges:

It’s actually not a one-to-one correlation the place larger charges result in decrease returns. The bottom returns have come within the 3-4% and 7-8% ranges. The very best returns have come when charges are 2% or much less, which is sensible when you think about charges have been solely that low throughout two of the largest crises this century (the GFC and Covid).1

Take a look at the 4% to six% vary, which is the place we are actually. The returns have been fairly good. Possibly one of many causes for it’s because the common 10 yr yield since 1950 is 5.4% (the median is 4.7%). Charges like this happen throughout regular occasions (if such a factor exists).

There’s actually no rhyme or cause to the connection between rate of interest ranges and ahead inventory market returns.

You could possibly slice and cube this information in one million alternative ways (charges rising/falling, inflation rising/falling, progress rising/falling, and so forth.), however crucial query is that this: Why are charges larger within the first place?

Within the Seventies, larger charges have been a headwind to shares as a result of inflation was uncontrolled and the economic system was experiencing stagflation.

The most important upside shock to the economic system on this cycle is charges are larger for longer as a result of financial progress is larger for longer. The Fed hasn’t needed to minimize rates of interest but as a result of the economic system stays comparatively robust. Charges have been larger for some time now but financial progress accelerated on the finish of 2023.

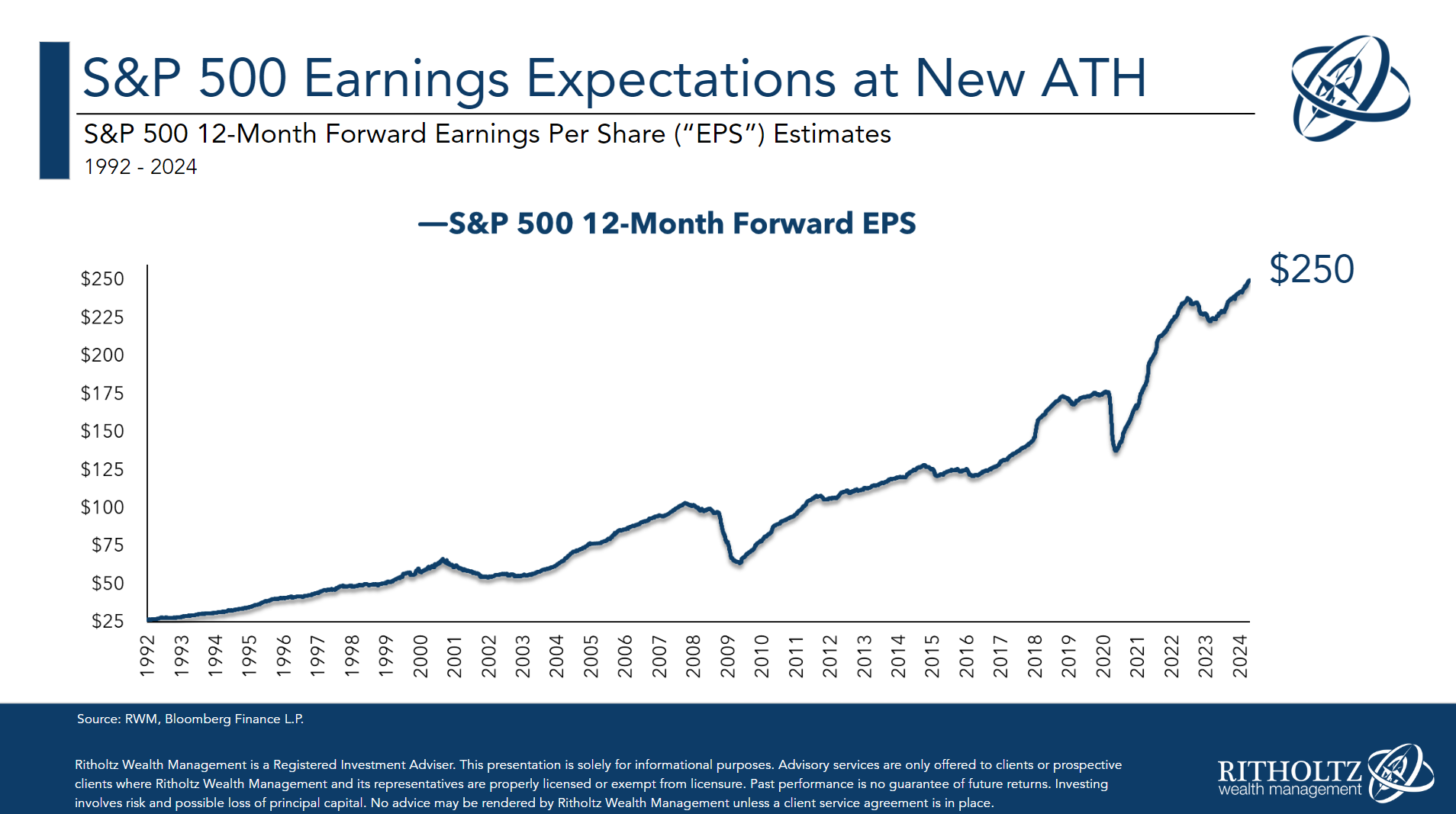

If you mix larger financial progress with inflation and pricing energy by companies, guess what you get?

Increased earnings!

The inventory market likes larger earnings.

Increased charges with larger financial progress are higher for the inventory market than decrease charges with decrease financial progress. If charges fall considerably from present ranges, that’s in all probability a foul signal if it’s occurring due to an financial slowdown.

It doesn’t at all times work out like this and I don’t understand how lengthy the present state of affairs will final.

The purpose right here is which you could’t merely look at any variable in isolation. Financial and market information require context.

We spoke about this query on the most recent version of Ask the Compound:

Invoice Artzerounian joined me once more this week to deal with questions on automating your funds, the tax implications of an organization sale, how you can offset RWM taxes and the professionals and cons of a Roth 401k.

Additional Studying:

Inflation Issues Extra For the Inventory Market Than Curiosity Charges

1It’s additionally value stating that rates of interest underneath 2% have been uncommon traditionally. Charges have been at these ranges lower than 7% of the time since 1950.