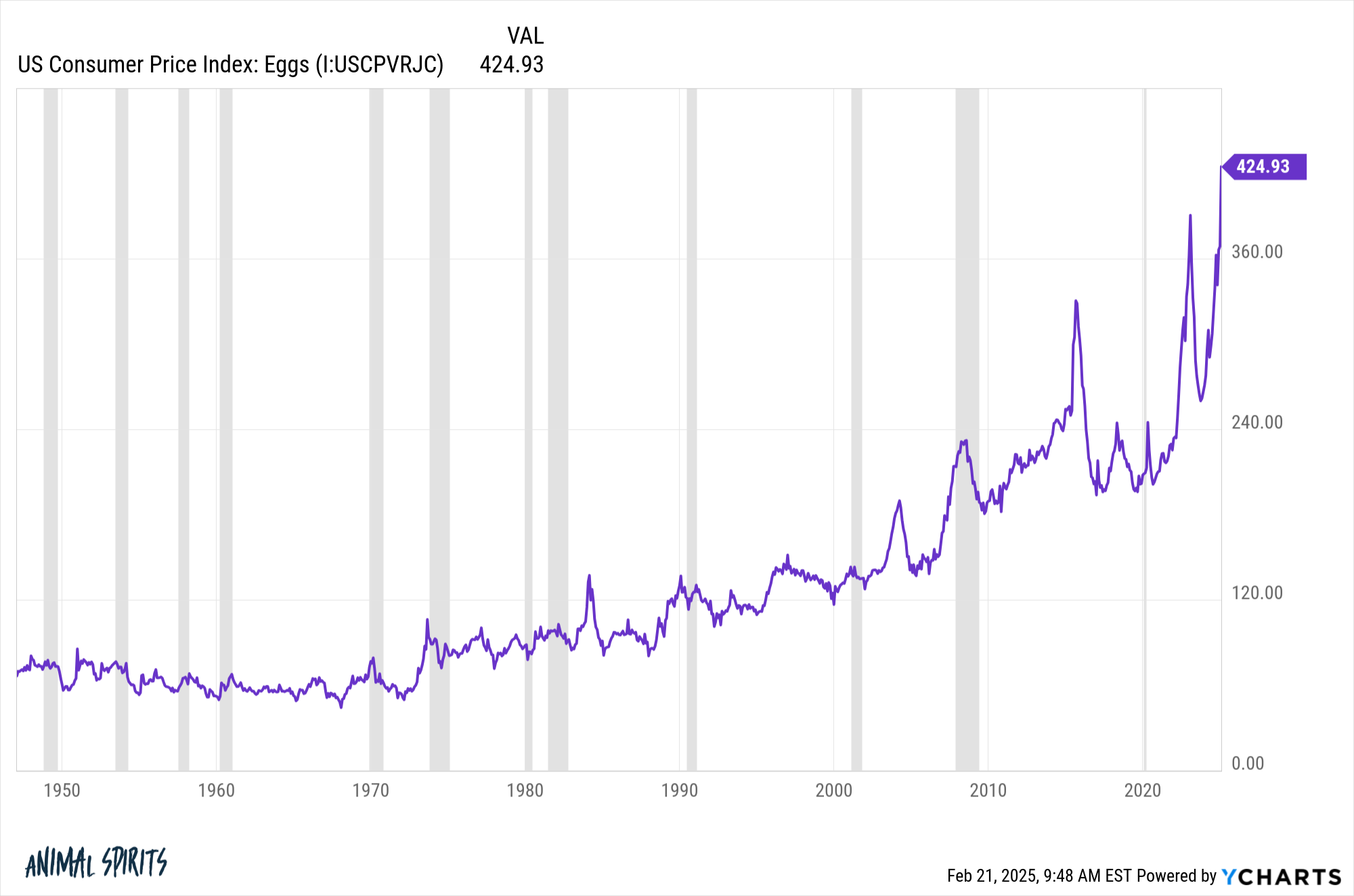

The most popular chart within the markets proper now is just not Nvidia, Fartcoin or one of many quantum computing shares…it’s the worth of eggs:

It seems to be like a chart of Bitcoin, Gamestop or the most well liked AI inventory on the road.

Since 1947, the worth of eggs has grown at an annual price of two.4%, multiple p.c decrease than the general annual inflation price of three.5%.

However over the past 5 years egg costs have gone up an en extraordinary 15.5% versus the general inflation price of 4.1%. Egg costs have kind of doubled up to now yr.

A nasty pressure of chook flu has impacted our egg-laying buddies, constrained provide, and raised costs. It’s estimated that greater than 100 million hens have been misplaced for the reason that chook flu broke out in 2022. Issues are getting loopy on the grocery shops.

That is from Bloomberg:

Grocery shops from New York to Chicago and Los Angeles have already restricted purchases, whereas Waffle Home added a brief egg surcharge of fifty cents per unit.

The scenario has gotten so dire that at a busy Entire Meals in Chicago’s Lincoln Park neighborhood, the egg cabinets had been solely empty on Tuesday night, rendering purchase-limit indicators redundant.

Egg costs have change into the latest member of the inflation zeitgeist this decade. There are memes like this on social media on a regular basis now:

It’s not simply social media. I’ve had loads of conversations with individuals about quickly rising egg costs, a scarcity of provide and, for some, a wrestle to seek out eggs on the retailer.

Clearly, larger costs on the grocery retailer are painful to your backside line. Eggs are a great supply of protein so it’s comprehensible why individuals are so up in arms about paying extra on the checkout counter.

However there’s one thing else occurring right here. Egg costs are extremely unstable. Finally one would anticipate costs to come back again to Earth. When that occurs it’s not like individuals are going to rejoice. The ache of upper costs is all the time worse than the enjoyment one receives from decrease costs.

Daniel Pulter, a professor at Purdue College, studied weekly egg sale knowledge in California to find out how the modifications in worth impacted shopper demand. Ori and Rom Brafman sum up Pulter’s work of their ebook Sway:

Now, conventional financial principle holds that folks ought to react to cost fluctuations with equal depth whether or not the worth strikes up or down. If the worth goes down a bit, we purchase just a little extra. If the worth goes up a bit, we purchase rather less. In different phrases, economists wouldn’t anticipate individuals to be extra delicate to cost will increase than to cost decreases. However what Putler discovered was that consumers fully overreacted when costs rose.

It seems that, with regards to worth will increase, egg patrons are a delicate bunch. In case you cut back the worth of eggs, customers purchase just a little extra. However when the worth of eggs rises, they in the reduction of their consumption by two and a half occasions.

Egg costs have an uneven demand profile.

When costs drop individuals purchase just a little extra. However when costs rise they minimize means again on egg consumption.

Folks overreact to cost positive factors as a result of losses sting twice as dangerous as positive factors really feel good. You could possibly name this irrational, however I want to assume it’s simply who we’re as people–it’s in our DNA.

Because of this loss aversion is crucial idea in all of finance.

It shapes your actions, overreactions and notion of danger.

That feeling of loss aversion by no means goes away, so the trick is discovering methods to cope with actual and perceived losses in a means that retains your feelings out of the decision-making course of.

Additional Studying:

Why the Inventory Market Makes You Really feel Dangerous All of the Time

This content material, which accommodates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will likely be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.