It’s no secret that I used to be on Group Cashback all through my 20s. Again then, as a single feminine who was spending lower than $800 every month, cashback playing cards made probably the most sense for me as a result of even when I clocked 4 miles for each single greenback, I might solely have sufficient for a 1-way enterprise class flight to Philippines (3 hours) at most after a whole 12 months. Naturally, getting 1 month again in bills was much more engaging to me!

Now, in case you have the same life profile and like to have chilly, onerous money again in your pocket so that you can spend on different stuff, then cashback playing cards should make sense for you.

TLDR: When you spend lower than $1,000 a month, then cashback playing cards might attraction to you. Usually, this might be the recent grads, or people of their 20s / 30s who aren’t but married with children and hold their spending to a minimal.

How do you select between miles or cashback?

By now, you clearly perceive that relating to profitable on the bank card sport, your spending habits and private preferences take the entrance seat.

| Professionals | Cons | |

| Cashback | Get a proportion of your spending again within the type of rebates. It’s credited again into your bank card account to offset your invoice so that you pay much less. | To earn increased cashback charges, some bank cards require you to spend a minimal quantity every month. There may be a cap to the quantity of cashback you’ll be able to earn. |

| Miles | Earn miles for each greenback you spend. Whether or not in economic system class or first-class, these miles can be utilized to redeem your subsequent flight out of Singapore. | It takes time to build up ample miles to a vacation spot exterior of Southeast Asia, except you spend huge. Your miles may also expire earlier than you’ve gotten the possibility to make use of them. |

Abstract: A cashback card is probably the most simple relating to incomes rewards in your bank card spend. With a cashback card, you get rewarded with money credited into your bank card, which helps you pay a decrease bank card invoice so you’ve gotten much less money leaving your pocket.

Who ought to get cashback playing cards?

- When you suppose money is king. You’re rewarded with money in your bank card that can be utilized instantly, in your subsequent buy, no matter that is perhaps.

- When you don’t spend a lot. You continue to get pleasure from cashback whatever the measurement of your spending, and the cashback cap doesn’t trouble you.

- When you favor quick gratification. Your cashback is credited into your bank card every month. However, miles and rewards playing cards require months and even years of miles/reward factors accumulation earlier than you’ll be able to redeem one thing substantial.

Downsides of cashback playing cards embrace:

- Minimal month-to-month spend required (often $500 – $800)

- There’s a restrict to the utmost quantity you’ll be able to earn in cashback every month

- Some playing cards make this even more durable by limiting the cap on classes (e.g. 5% cashback however $20 max per class = you’ll be able to’t spend greater than $400 on eating out every month)

- They’re so much more durable to trace and handle, as a result of the banks don’t provide you with visibility in-app on how a lot you’ve spent per eligible class this month thus far. You must manually observe it your self.

Who ought to get miles playing cards?

Miles playing cards are simpler to handle, since you’ll be able to optimise by merely utilizing particular excessive (4 mpd) specialised playing cards for every class of your expense, and placing the whole lot else on a basic (1.2 – 3 mpd) card.

You solely want to fret about hitting the utmost spending cap every month, which is simple to trace as a result of it’ll present in your financial institution app.

Who ought to get a much card?

- If you need playing cards with NO MINIMUM SPENDING, then miles are the way in which to go. At this stage of my life, I hate having to consider “grasp on, have I spent sufficient on my Citi Money Again this month to get my rebates?!”

- When you favor to trace your complete spending fairly than per-category spending. e.g. I solely want to fret about not exceeding S$1,500 on-line for my DBS Girl’s World card, as an alternative of getting to obsessively observe to make it possible for I don’t exceed $312 for every of my groceries / meals / transport on the 8% cashback Maybank Household & Associates card.

- When you like to journey. There’s nothing like redeeming your hard-earned miles for a ‘free’ flight, particularly in the event you’re travelling on non-budget airways the place paying for the precise ticket can value you extra.

- If you wish to expertise travelling in luxurious. Can’t bear to pay for a enterprise class flight however want to have the ability to lie flat in your long-haul flights on account of your aching bones (or epidural-induced hip ache)? That’s me, however I’ve gotten them without cost due to my miles.

- If you need free lounge entry at airports. As an alternative of sitting round in crowded ready areas, unlock premium lounge entry along with your miles bank cards the place you get to eat all you need / free therapeutic massage chairs / bathe rooms / free-flow alcohol, and extra!

- You probably have big-ticket purchases developing. Whilst you can undoubtedly get cashback in your big-ticket objects in the event that they fall into totally different classes, it may be much less effort to place them on miles playing cards as an alternative particularly in the event you’re doing a lodge banquet the place the whole lot is charged to a single vendor.

Downsides of miles playing cards

- No immediate gratification. Since you’ll want to accumulate ample miles in an effort to alternate without cost flights or lodge stays (often at the very least 20k miles for a begin), this might require a number of months of spending earlier than you’re eligible for a redemption.

- Poor conversion worth on price range airways. So please don’t make this error, you must also redeem your miles on nationwide and worldwide carriers reminiscent of Singapore Airways, Cathay Pacific, Emirates, and so on.

- You often want to carry a number of playing cards to get optimum miles rewards. When you’re somebody who simply needs ONE card, a generic miles card will solely provide you with 1+ mpd which suggests you’ll take eternally to qualify for a free redemption. Oh however FYI, the identical applies to cashback playing cards the place you additionally get a depressing 1+% limitless cashback…so this undoubtedly cuts each methods!

My private expertise

Quick ahead to at present (a decade later) the place I’m now a mom of two and CFO of my family. Sadly, that additionally means I can not hold my bank card bills low, since I’m the primary particular person paying (upfront) for the majority of our household’s bills, which provides as much as a cool $7,000+ each month.

For the primary 2 years, I attempted to proceed my cashback playing cards sport technique…however failed miserably because the cashback limits stored slapping me throughout the face.

Finally, I spotted it was time I converted to Group Airmiles.

Which was why 2 years in the past, I made peace with my former on-line nemesis The Milelion after I advised him I lastly gave up on cashback playing cards and was now accumulating miles. The funniest factor is, he thought I used to be joking – I used to be not.

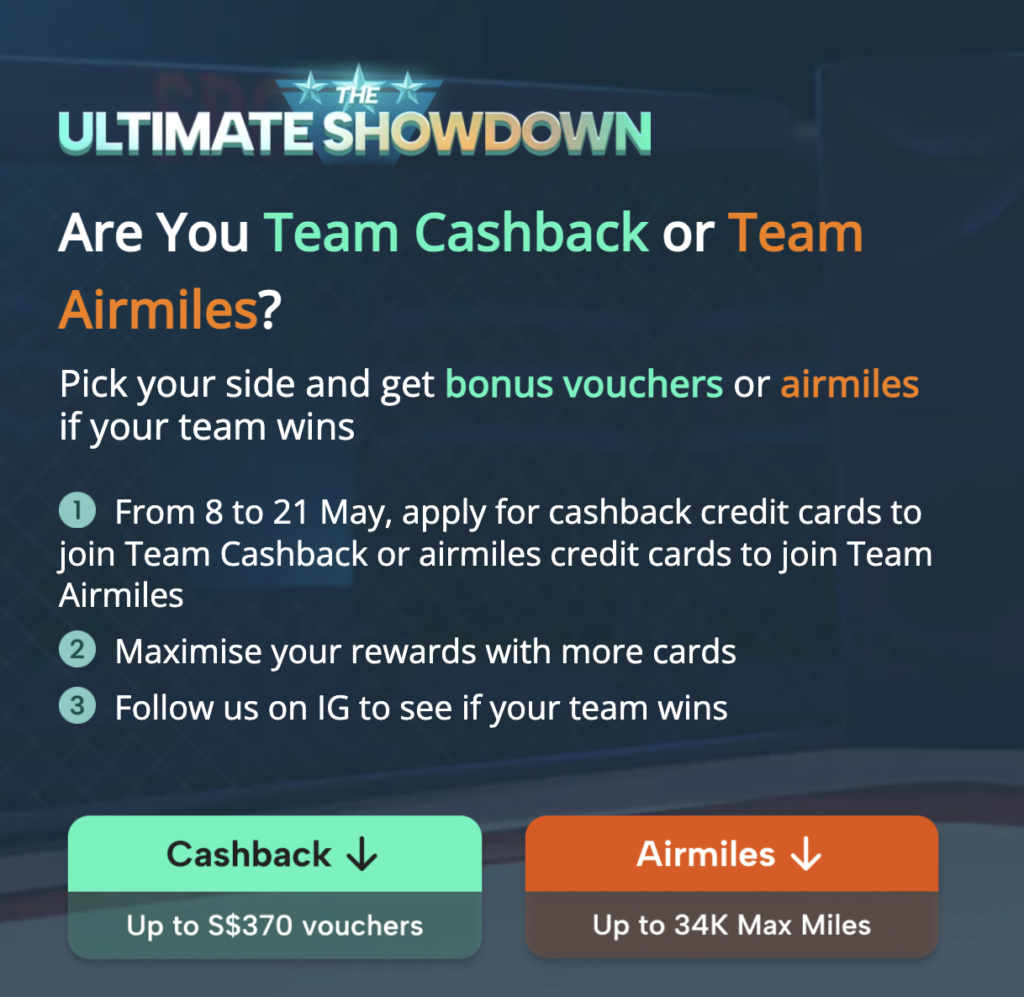

Which is why at present, we’re combining forces in SingSaver’s Final Showdown between cashback and miles. It is a nationwide digital marketing campaign to see if Singapore shoppers are extra in direction of miles or cashback, which is all of the extra purpose it’s best to take part by getting the very best bank card for you this month.

Within the meantime, in the event you’re a father or mother like me, you would possibly discover the beneath to be just like your personal family spending habits:

Limits of cashback playing cards

(particularly in the event you’re a father or mother)

Let’s discuss how cashback playing cards reallllly maintain you again when your bills are simply 4 to five digits a month.

For example, the Maybank Household & Associates card can provide 8% cashback in your groceries, meals, transport, telco invoice, Netflix and even live performance tickets (amongst others) – these usually cowl nearly all of my spending classes. The one drawback? That is capped at S$25 cashback every for five classes (S$312 spending), and you will get not more than S$125 in complete per calendar month even in the event you cross the $800 month-to-month minimal spend. However hey, take a look at how a lot my bills are in these classes:

| Class | Month-to-month Spend | 8% Cashback |

| Groceries | $600 | $48 (max $25) |

| Meals | $800 | $64 (max $25) |

| Transport | $200 | $16 |

| Telco & Web | $70 | $6 |

| Netflix | $19.98 | $2 |

| Complete | $1,690 spent | $74 cashback (as an alternative of $136 so = $62 “misplaced”!) |

I may, after all, shift my groceries over to my UOB One card to attempt for as much as 10% cashback to mix with my on-line purchasing, because the card offers the very best rebates solely once we spend $2,000 a month on it. However right here’s the issue – we store extra regularly on FairPrice fairly than Chilly Storage! The cashback can be given out quarterly, and is capped at $50 / $100 / $200 (for $500 / $1k / $2k month-to-month spend respectively). I’m not the one one who has been having hassle managing this card after all of the financial institution adjustments (take a look at this Reddit thread), and the one purpose why I’m nonetheless retaining it in my wardrobe (the place it doesn’t see the sunshine of day anymore) is as a result of we nonetheless have some money in our high-yield UOB One financial savings account.

In any other case, I may additionally hold my groceries on Maybank and shift my eating over to the UOB EVOL card for 8% after I pay through cell contactless, however with the cashback capped at $20 per class and requiring $600 minimal spend on the cardboard monthly, which means I’m restricted to $250 for on-line purchasing and eating respectively every month, and having to discover a approach to spend at the very least $100 elsewhere each, single month in some way.

If all of that discuss is already providing you with a headache, simply think about the frustration I confronted in really executing it. After monitoring for a couple of months and receiving paltry cashback, I used to be near giving up.

The ultimate kicker got here after I realized there was nearly no approach for me to earn respectable cashback on my earnings taxes, household insurance coverage premiums and youngsters’s schooling charges ever since lots of the banks nerfed the cashback advantages on CardUp. This leaves simply Financial institution of China Household and Maybank Platinum Visa because the final remaining contenders (however capped at $2,400 spend month-to-month i.e. $28.8k a 12 months). And guess what? Final 12 months alone, these 3 classes already added as much as a cool $75,000 for us.

Regardless of how I labored inside my arsenal of cashback playing cards, the capped class cashback limits ($250 – $300) monthly made it nearly inconceivable for me to match each greenback to at the very least some type of acceptable cashback yield.

So after attempting for a 12 months, I lastly gave up and converted to miles bank cards as an alternative.

The second I switched to Group Miles, my monetary life immediately grew to become so much much less worrying! I used to be lastly free of the foolish class spending caps which might be a mainstay in most cashback playing cards, and solely wanted to look at:

(i) which classes,+

(ii) the utmost spend

that I placed on every miles card each month.

No kidding, check out how these the classes and max month-to-month spend seems to be like on these 4 mpd playing cards:

Is it any surprise why I switched?! In truth, I ought to have finished it sooner – from as early as 2018 as soon as I grew to become a father or mother.

Earn as much as 34,000 bonus miles plus items while you apply for miles playing cards this month

Now, in the event you’ve been pondering of making use of for any bank card to up your miles sport, I counsel you do it from now between 8 Could to 4 June 2024 through SingSaver. That’s as a result of not solely do you get extremely beneficiant sign-up rewards, you additionally get to vote (along with your card purposes) to find out whether or not Group Miles or Group Cashback will win.

A lot of you ask which playing cards I personally use and would suggest, so I might counsel that you simply first get these 3 playing cards to begin incomes 4 miles for each greenback throughout the next classes:

| UOB Girl’s | Eating, Transport (consists of petrol and public transport), Magnificence, Leisure, Journey (select any 2) | max $1,000 spend monthly (or $2,000 for Solitaire) |

| HSBC Revolution | Buying, Journey-hailing, Air Tickets, Cruises | max $1,000 spend monthly |

| Citi Rewards | On-line (consists of subscriptions), Medical, Journey (paired with amaze) | max $1,000 spend monthly |

However after all, if you wish to really earn most miles by placing even your children’ schooling charges, household insurance coverage premiums and earnings taxes in your bank card, then I might suggest that you simply learn my article right here to see the entire miles bank card stack to get.

Within the meantime, right here’s a fast overview of what I personally use for the beneath classes (in my capability because the family CFO) each month:

One of the best half is that in contrast to cashback playing cards, miles playing cards don’t require you to hit a minimal month-to-month spend earlier than you’re eligible to begin incomes rewards. That lets you begin incomes miles out of your very first greenback.

My pricey nemesis-turned-ally Milelion insisted that I wanted to publicly clarify why I had switched sides, so I hope this submit lets you perceive why.

TLDR: Finances Babe grew up, had children and therefore spends 4-digits each month for her family and dependents…so cashback playing cards not match her spending wants.

On the finish of the day, the selection between miles vs. cashback playing cards actually comes right down to a person’s way of life profile and preferences. I mentioned this similar line earlier than in 2017 so nothing has modified…apart from my life stage spending habits.

It was good to have been capable of hold my bank card payments beneath $1,000 a month after I was a younger, single feminine with no children to be financially accountable for…however hey, all of us develop up sometime 🙂

After all, in the event you’re younger and frugal (like I used to be!), miles playing cards might not essentially serve you nicely as a result of it’ll take a very long time earlier than you clock sufficient in your first free flight; however in the event you’re a father or mother paying for greater than 1 particular person’s monetary dues (i.e. your children or the aged), then cashback playing cards will solely maintain you again. Want I even remind you ways worrying it may be attempting to handle your cashback playing cards whereas juggling your job and younger children who don’t all the time hear?! 🤣

Your selection between a much and cashback bank card ought to align along with your spending habits and way of life. Nothing has modified.

Apply now for the very best miles (or cashback) playing cards for you right here + vote along with your card purposes on SingSaver earlier than June!

You’ll additionally get as much as 34,000 bonus miles plus items like Apple iPad, Dyson, Samsonite luggages, amongst different items and fortunate attracts (which could simply see you win a free return Enterprise Class journey to Switzerland)!

Singapore, let’s see whether or not it’ll be Group Airmiles or Group Cashback to emerge champion when the outcomes are out subsequent month.

With love,

Finances Babe