There was a serious selldown within the markets during the last 2 buying and selling days, and the VIX touched ranges not seen because the pandemic and the 2008 World Monetary Disaster. However how did Japan set off this large market meltdown, and the way precisely does the yen carry commerce work? Extra importantly, what ought to buyers do on this present market local weather?

I woke as much as a shock yesterday after I noticed the VIX – a measure of the market concern ranges – shoot previous 65, which has not been seen since March 2020 (COVID pandemic) and the 2008 World Monetary Disaster.

The Nikkei 225 dropped by 13%, sending shockwaves by way of the Asian markets. The Straits Occasions Index (STI) was not spared and sank shut to five%; the final time the STI misplaced greater than 100 factors in a single day alone was in March 2020 on the outset of the Covid-19 pandemic.

This was largely because of the unwinding of the yen carry commerce, however what precisely is that and why did it have such a big impact?

What’s the yen carry commerce?

For near a decade, Japan had adverse rates of interest – which made borrowing extraordinarily enticing, because you have been being paid by the banks to borrow (and never having to pay curiosity on the mortgage). Because of this, this gave rise to the yen carry commerce the place buyers all over the world have been borrowing yen (low cost cash) and utilizing it to purchase currencies or in any other case make investments abroad whereas they stored the unfold.

This was a very whole lot – borrow at near 0% and park it within the US / UK the place banks have been paying 5% curiosity. In order you possibly can think about, many massive gamers have been leveraging this bananas rate of interest setting to actually create cash out of skinny air for themselves.

What’s extra, given the BOJ’s historic coverage of low and steady rates of interest, the Japanese yen is the default funding foreign money for the worldwide FX carry commerce.

As a result of the Financial institution of Japan had but to lift rates of interest, this commerce labored fabulously nicely — it even helped the Japanese firms that export as they have been in a position to rack up excessive earnings based mostly upon a depressed home foreign money.

What might presumably go flawed?

Effectively, all of sudden, the circumstances that made the yen carry commerce enticing have began to reverse, and we noticed a collection of the next occasions occur altogether:

- The weak US jobs report revealed unemployment charge climbed to 4.3% in July, which is the best in 3 years and triggered the so-called Sahm Rule has been triggered. Coined by former Federal Reserve economist Claudia Sahm, it says that when the typical jobless charge over three months is 0.5 proportion level above the 12-month low, a recession is coming.

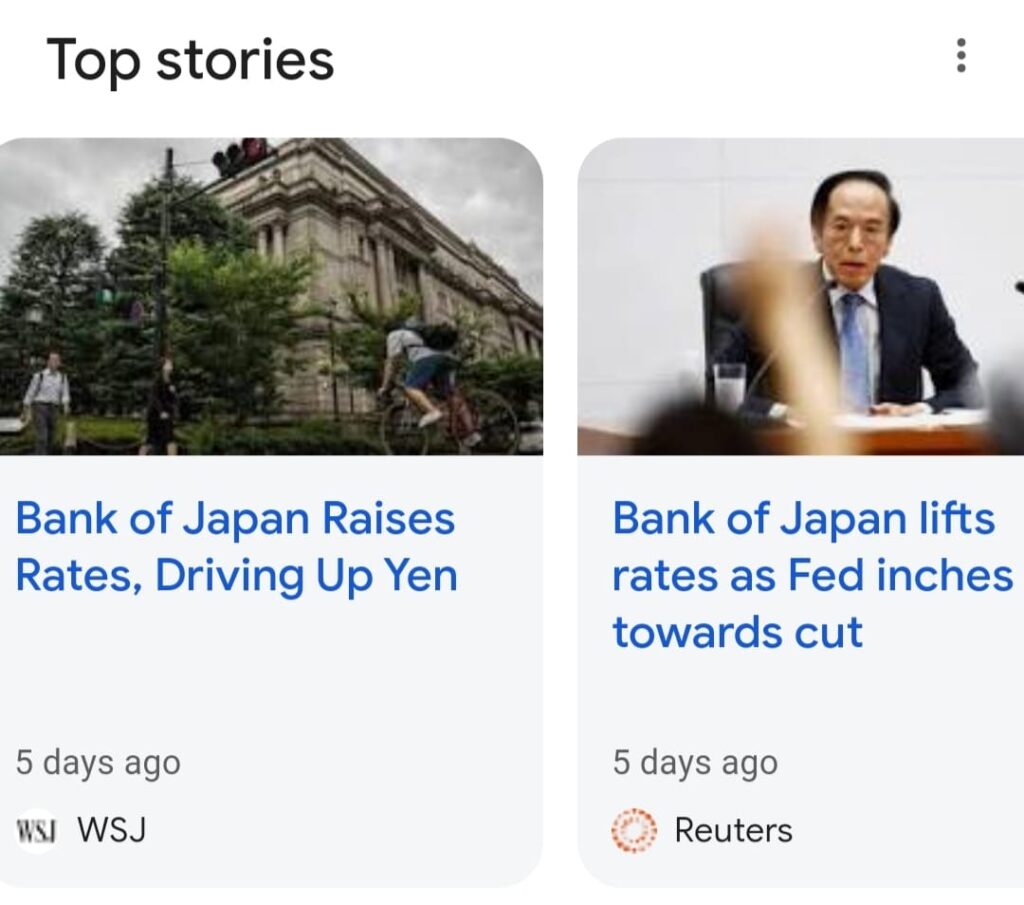

- The Financial institution of Japan determined raised rates of interest to 0.25%, and stated that they wouldn’t rule out extra hikes within the close to future.

By way of the yen carry commerce, this meant that

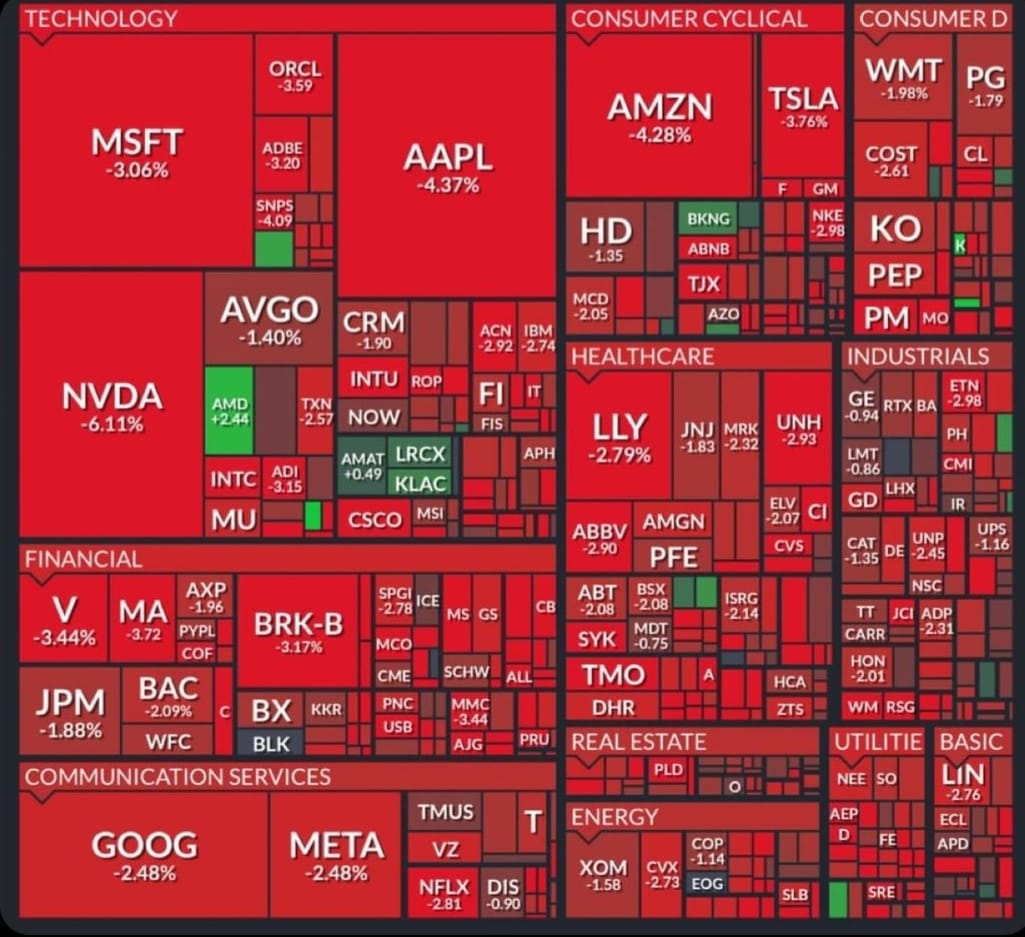

- those that borrowed / leveraged the yen to speculate have been now getting margin calls

- to pay the rates of interest on their loans, they needed to unload their property – these have been principally shares, US equities and cryptocurrencies like Bitcoin – and convert it again to yen to repay their money owed

- the promoting stress additionally triggered a meltdown within the JPY-USD foreign exchange markets, sending the yen from 162 to 142

- in consequence, the leveraged gamers needed to promote much more property to lift extra funds to repay their money owed.

All of sudden, Japanese equities bought destroyed (down 25% in a month!), the yen skyrocketed, and importantly, all of these property all over the world that had been bought with borrowed, yen-backed cash needed to be unwound.

That is undoubtedly one other one for the historical past books.

If you happen to favor to observe me visually breaking down the yen carry commerce, right here’s my 1+ minute explainer video:

I produced the above video for Moby, a premium investing subscription service which offers bite-sized monetary insights to assist retail buyers such as you and me make investments higher. You may learn my evaluation of Moby right here to seek out out why I feel the $99 price ticket is value it, or just join their FREE publication right here to get a abstract of their insights delivered straight to your inbox.

I wrote the beneath at midnight for my unique Patreon group yesterday whereas the US markets have been melting down, and am reproducing right here for public schooling:

So to sum it up, the market meltdown was triggered by 4 important occasions:

- 1. The unwinding of the “yen carry commerce”. Many buyers had borrowed yen at just about no price to fund investments in different property (together with US property) as they took benefit of the ultra-low rates of interest. With the speed hike, these leveraged positions have turn into dearer to take care of, resulting in a rush to unwind them. All of the leveraged buyers bought margin calls right now so that they needed to promote their USD investments in a rush to lift funds. However truthfully, until that may be a commerce that YOU made, that is all only a non permanent occasion to be endured.

- 2. The Japan’s Nikkei 225 Index dropped 12.4% right now, its worst single-day efficiency since 1987, formally plunging Japan’s inventory market right into a bear market and wiping out the index’s complete yr’s good points. This follows from the above level. Semiconductor large Tokyo Electron (TYO:8035) (OTC: TOEL.Y) noticed its shares crumble by 43% since July 10 whereas manufacturing conglomerate Hitachi (TYO: 6501) (OTC: HTHIF) is down greater than 30% from its excessive a month in the past.

- 3. A crypto crash. There was large liquidation within the crypto markets as buyers offered, inflicting a 15% outflow in below 24 hours alone! Bitcoin has misplaced virtually 20% from its all-time excessive, and plenty of altcoins are down 50% or extra. With the fears over US market stability, buyers are ditching “danger” property like crypto and flocking in the direction of protected havens like bonds as an alternative.

- 4. Recession fears. That is almost definitely the principle driver of the most recent promoting stress. With the disappointing jobs depend report final Friday, the unemployment charge within the US is now the best in 3 years, with indicators pointing {that a} recession may very well be incoming.

Now, none of yesterday’s meltdown had something to do with the basics of the affected firms. Nobody might have seen yesterday’s saga coming, so if what has occurred has made you are feeling dumb, or like you must have recognized it was coming, you aren’t, and also you couldn’t.

To maintain up with the monetary markets, think about signing up

What ought to we do as buyers?

Truthfully, there’s nothing to concern at this stage. Positive, for these of you who have already got sizeable portfolios, the drop could seem scary – however that’s a characteristic of the market.

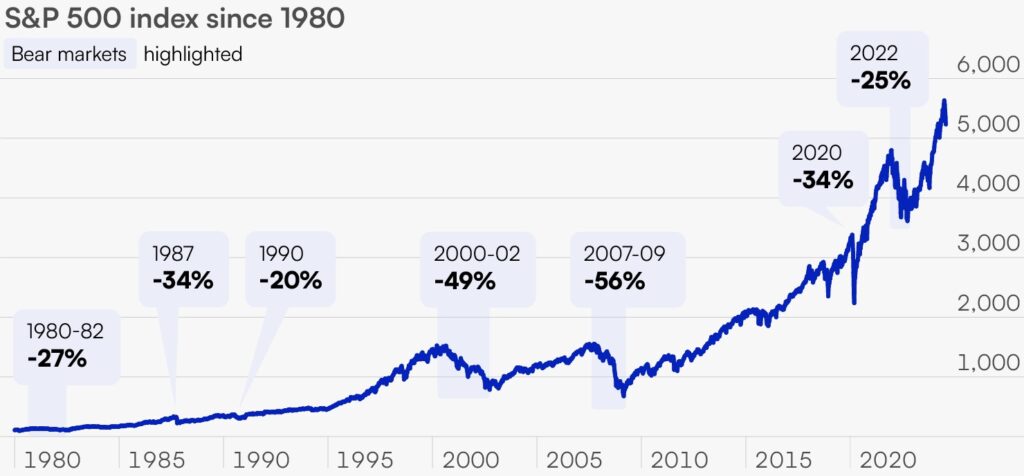

Promote-offs like this are part of the journey we’ve got to undertake as buyers within the inventory market. Historical past reveals us to anticipate a ten% market decline roughly as soon as per yr on common. We noticed 4 corrections in 2022 and one in 2023. The S&P500 has been too bullish this complete yr, which can be what I’ve been declaring in my Instagram Tales – so I’m not stunned that that is starting to pullback. If something, the bullishness of the markets all by way of this yr was making me begin to fear, and I’ve confided in my nearer investor associates for fairly a while now that I used to be getting vibes paying homage to the 2021 bull market proper earlier than the 2022 crash.

As buyers, we’d need to watch out of recency bias as nicely, the place we take latest historical past and assume that it’ll repeat. As an illustration, those that lived by way of the GFC drawdown and the 2020 pandemic crash might very nicely have fooled themselves into considering “I’ll pull the set off and begin shopping for when the S&P falls beneath 34%” again in 2022. Besides that it by no means did, and so they missed the boat utterly.

The identical factor occurred final evening – with most shares down between 3% to twenty%, you’d have missed the boat for those who have been ready for extra. Coinbase’s share value, as an example, fell 20% however climbed again up 18% inside simply 3 hours.

Whereas I bought a way yesterday that it’ll rebound rapidly – and I ended up being proper, nevertheless it might have turned out the opposite method as nicely. Nobody actually is aware of.

For us long-term buyers, days like these characterize a possibility to purchase the shares that we haven’t been in a position to get our fingers on. These are the equal of a sale within the inventory market, so as a internet purchaser of shares for long-term good points, that is the place we begin buying.

I don’t learn about you, however I had fairly a lot of BUY orders crammed up within the final 2 buying and selling days alone – for those who’d like to seek out out what they have been and why I invested in them, click on right here to learn my full thesis on every place.

That is what occurs while you attempt to time the markets

If something, the latest spate of occasions function a very good reminder that it’s silly to try to time the markets. Let’s take a fast look:

Day 0 (Wednesday): The Financial institution of Japan broadcasts that they’ll be elevating rates of interest to 0.25%, with extra hikes probably to come back. Nothing occurs within the markets.

Day 1 (Thursday): The Fed provides its clearest sign but that charge cuts might are available September (17 – 18). Markets spike up. Retail buyers purchase in, apprehensive they’ll miss out on an incoming rally.

Day 2 (Friday): US jobs information report drops, reveals weak point and a 4.3% unemployment charge, its highest in 3 years. Markets slide, NASDAQ drops 10%.

Day 3 (Monday): The Nikkei abruptly free-falls shut to fifteen% and sends Asian markets sliding down. Buyers get spooked by recession fears. The yen carry commerce begins to unwind. The VIX spikes to its highest ranges not seen because the 2020 pandemic and 2008 GFC. US markets open crimson, however regain floor earlier than the buying and selling day ends.

We’re now on Day 4 (Tuesday) and most shares have recovered some floor. The US markets simply opened, and my app is now exhibiting a principally inexperienced marketplace for US equities proper now.

It’s an awesome reminder that nobody can persistently get market timing proper. Any try to take action can be futile.

We’ll be higher off specializing in firms fundamentals as an alternative – that features constructing our watchlist (for low cost days like yesterday), in search of firms that persistently reveal or outperform profitability metrics, and consider for margins of security earlier than we enter.

Spend money on good shares, and let the markets do its factor.

Keep protected, and let’s make investments higher.

With love,

Finances Babe