Lots of people are turning bearish on housing costs.

Cullen Roche and Nick Maggiulli, two monetary voices I respect, each predicted in latest weeks that housing would be the worst-performing asset class over the following decade.

Their case is smart.

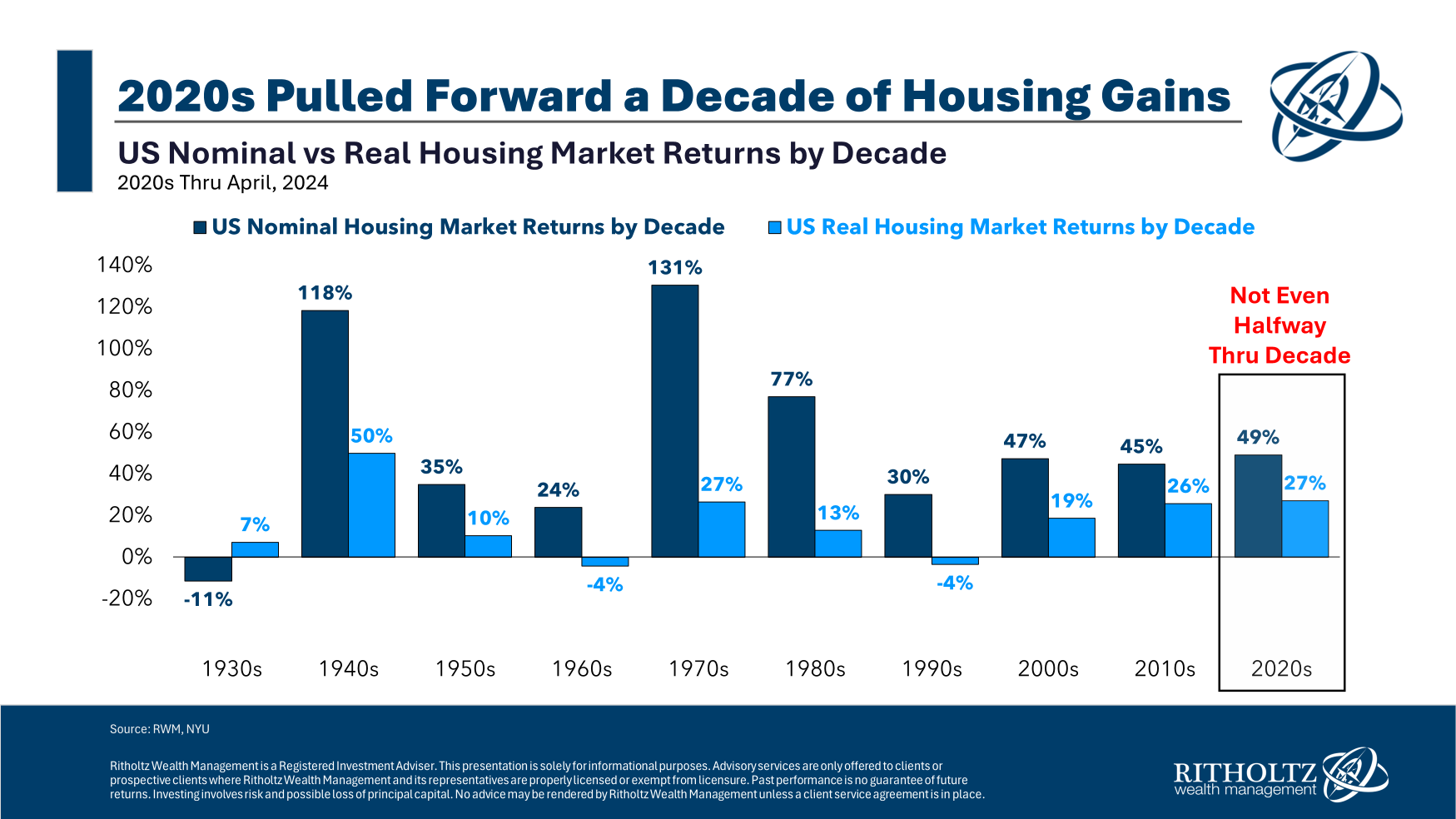

We pulled ahead a decade’s price of returns within the first a part of the 2020s:

Costs are excessive. Mortgage charges are nonetheless excessive (relative to the value strikes). This makes housing unaffordable to a big portion of the inhabitants.

It definitely wouldn’t shock me to see housing costs languish for a lot of years as incomes play catch as much as costs to make issues extra inexpensive.

The bearish case is compelling.

What concerning the bull case? What may trigger housing costs to defy each gravity and sensible expectations?

Let me give it a strive:

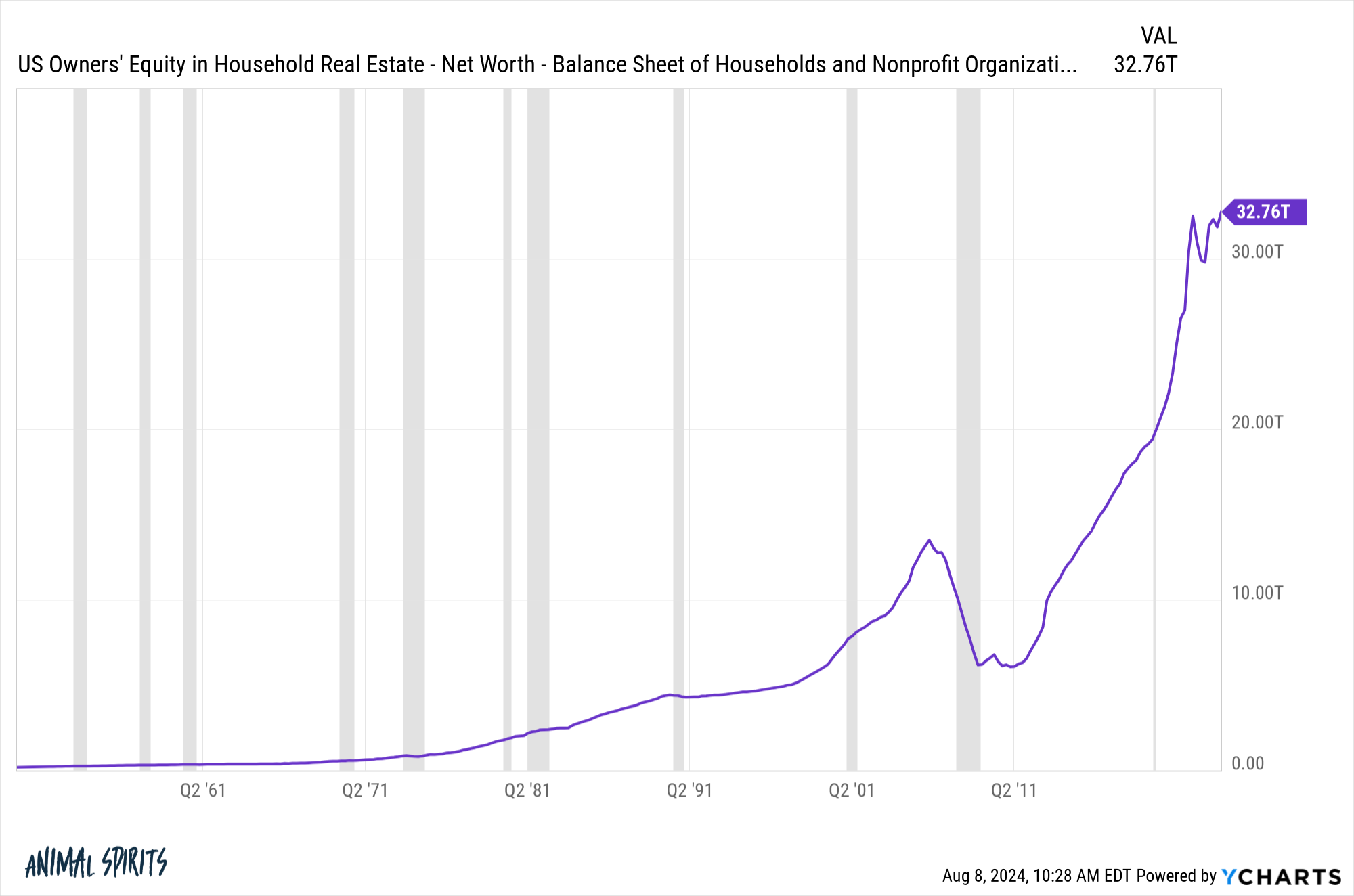

There’s a buttload of residence fairness. It’s turning into exceedingly tough for first-time homebuyers in in the present day’s housing market however there are trillions in dry powder if present owners want it:

Because the begin of the pandemic, U.S. owners have added greater than $13 trillion in residence fairness. As just lately as 2015, that was the complete quantity of residence fairness.

If mortgage charges proceed to say no, there may be loads of money on the sidelines for these owners who’ve felt trapped by the excessive value of borrowing these previous couple of years.

They will use that fairness as a wholesome down fee on a brand new home.

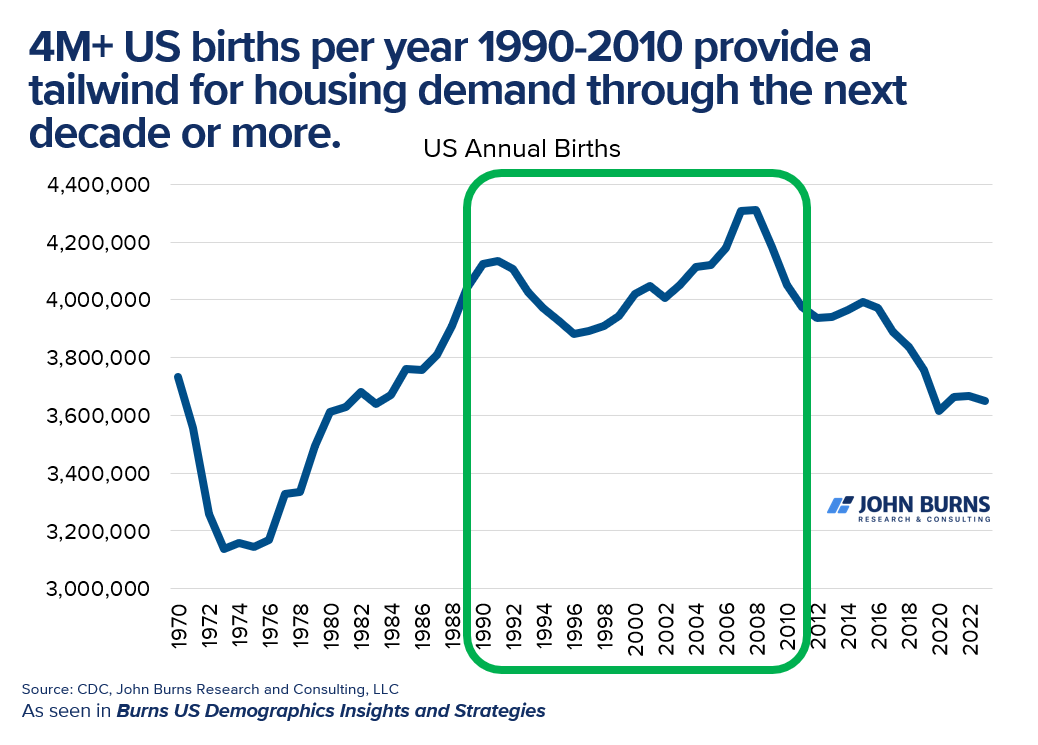

Demographics are future. On the one hand, there are 10,000 child boomers retiring each single day. A few of them may really feel compelled to promote their home to fund retirement or downsize, however most of the boomers personal their houses outright and can be in no hurry to promote.

Younger folks, however, are coming for the housing market in massive numbers.

The most typical age in america is people who find themselves 31 and 32. Births spiked within the Nineteen Nineties and first decade of this century, peaking round 2007/2008:

So we’re speaking folks within the 17-37 age vary. That’s 20 years’ price of residence demand proper there.

Proper or improper, most younger folks nonetheless really feel that purchasing a home is a obligatory step in maturity.

A few of these younger folks received’t be capable of afford homes at present costs however loads of them will stretch to make it occur.

Perhaps Gen Z will go towards the grain with the American dream however I wouldn’t guess on it.

We may flip into Canada. Housing costs in Canada went loopy a lot of years in the past. As a substitute of mean-reverting, they turned it as much as ludicrous velocity and acquired even crazier.

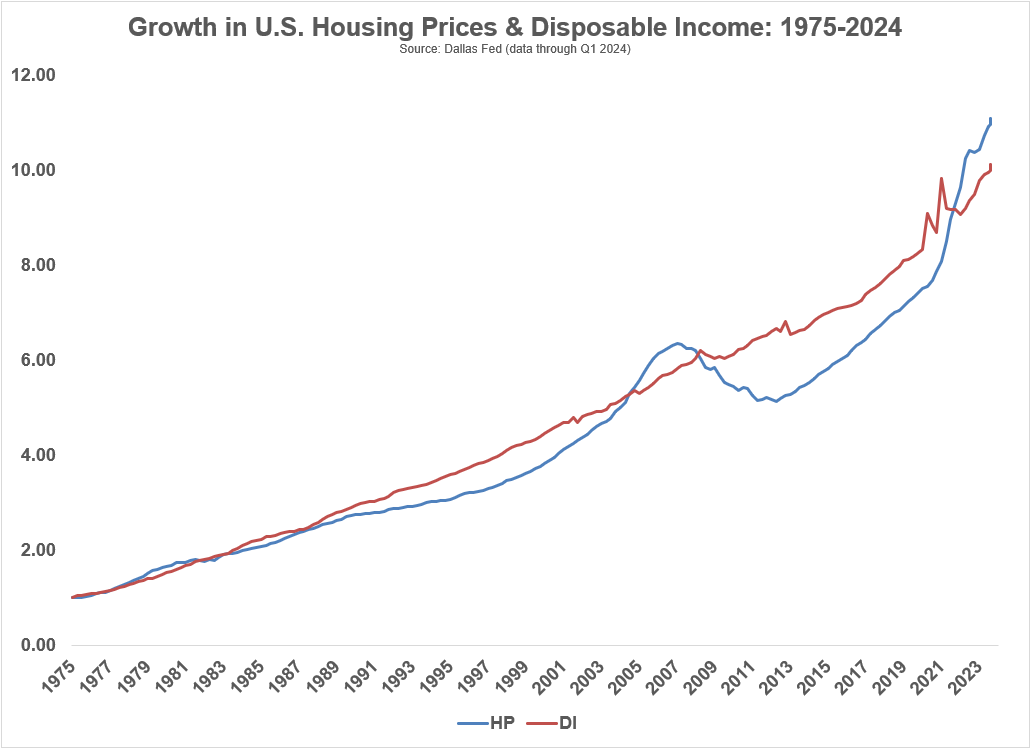

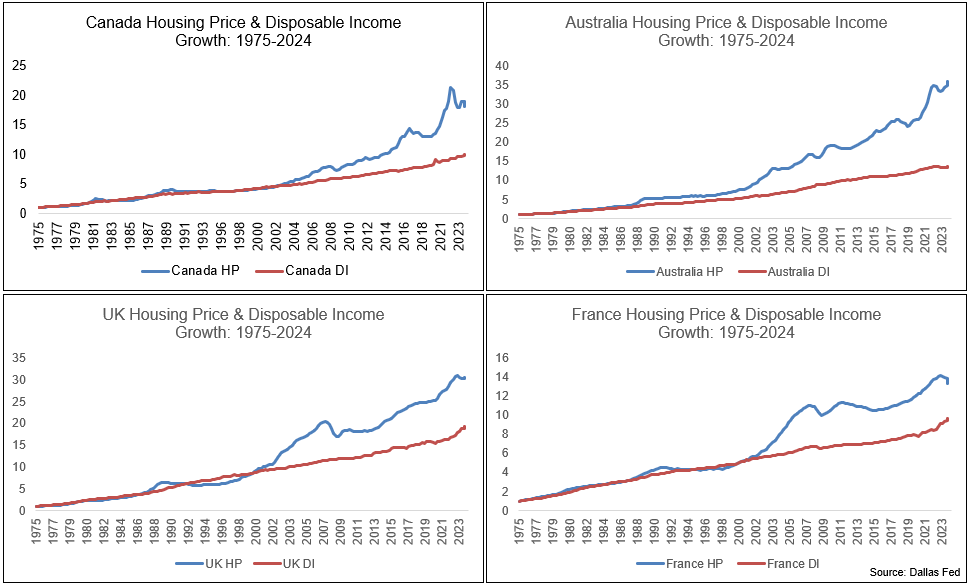

For those who examine disposable earnings to housing costs amongst a handful of developed international locations, issues look tame in america:

Costs are much more out of whack in Canada, Australia, the UK, and France than they’re in America.

What if the dearth of housing provide continues to push housing costs larger because it did in these different international locations?

I’m not guaranteeing this consequence however it’s not out of the realm of potentialities.

A rational individual would count on housing costs to sit back out for some time. That might be my baseline assumption as properly.

Nevertheless, human beings should not all the time rational.

You possibly can’t rule out the likelihood {that a} lack of provide, mixed with favorable demographics and an enormous piggie of residence fairness may probably take costs even larger.

Michael and I talked concerning the bull and bear circumstances for the housing market and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Shopping for a Home on the Prime of the Market

Now right here’s what I’ve been studying currently:

Books:

This content material, which comprises security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here can be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or provide to supply funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.