Boy that escalated rapidly.

The S&P 500 closed at a brand new all-time excessive on February nineteenth. Since then it’s mainly gone down in a straight line.

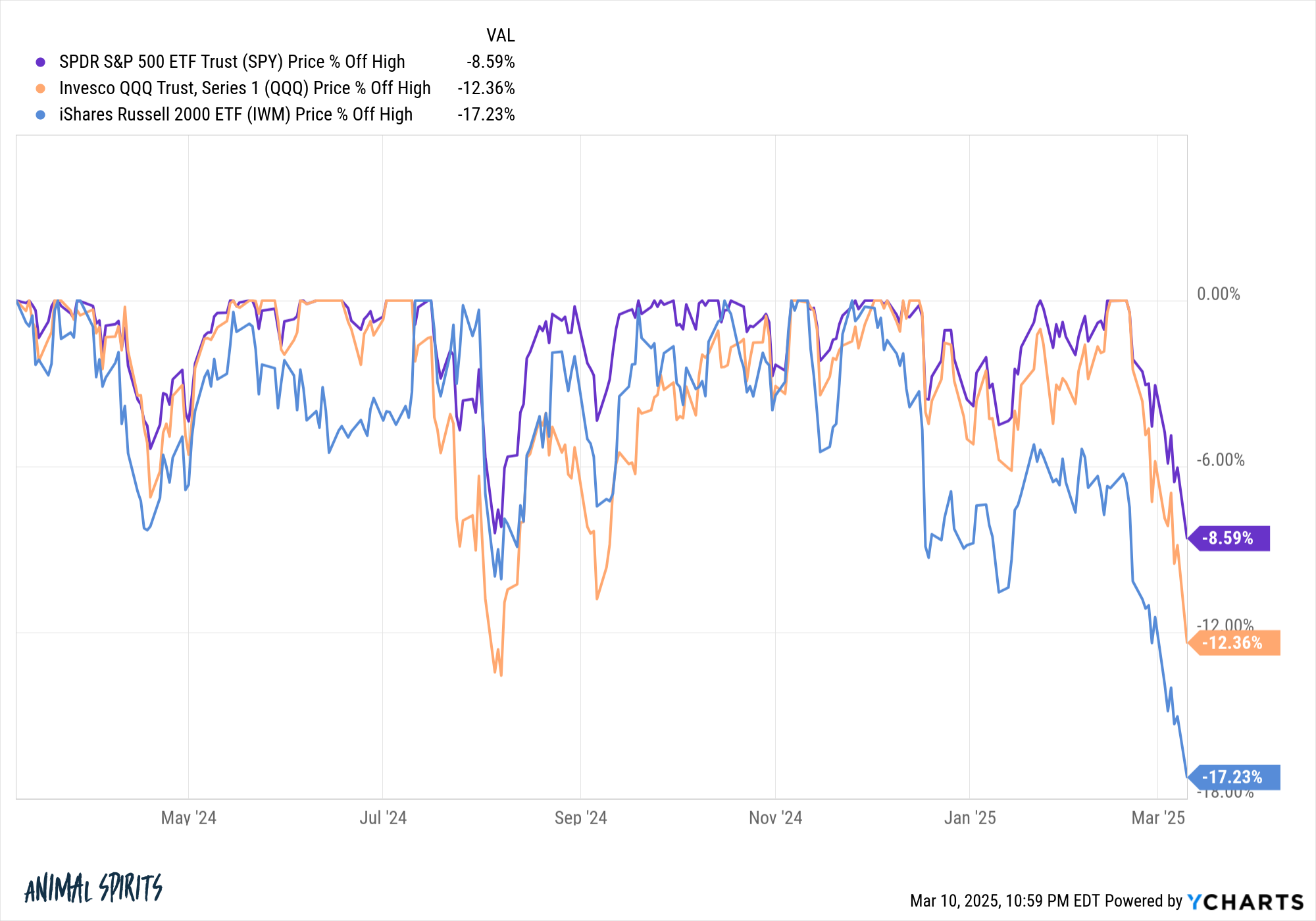

Via the shut on Monday the S&P 500 was down almost 9%. The Nasdaq 100 is in a 12%+ correction whereas the Russell 2000 is flirting with bear market territory, down 17%.

I’m not an enormous fan of this-year-is-just-like-that-year charts as a result of folks typically take too many liberties with their comparisons. Having mentioned that, the pace and timing of this correction jogs my memory of the beginning of the Covid crash:

This chart is useful as a result of it exhibits that these items can occur rapidly. It additionally exhibits the present correction is insignificant within the grand scheme of issues. That is merely a flesh wound (up to now).

Clearly, I don’t assume we’re due for an additional Covid-like plunge by any means. It’s simply price remembering these items can occur in a rush.

Each correction appears wholesome in hindsight and this one can be no completely different as soon as we’re far sufficient away from it. However we’re in it now so the query is that this: How do you make this a wholesome correction?

I’m going to reply a query with extra questions as a result of context at all times issues with these items:

Are you continue to saving? Decrease inventory costs are a very good factor. Preserve saving and investing.

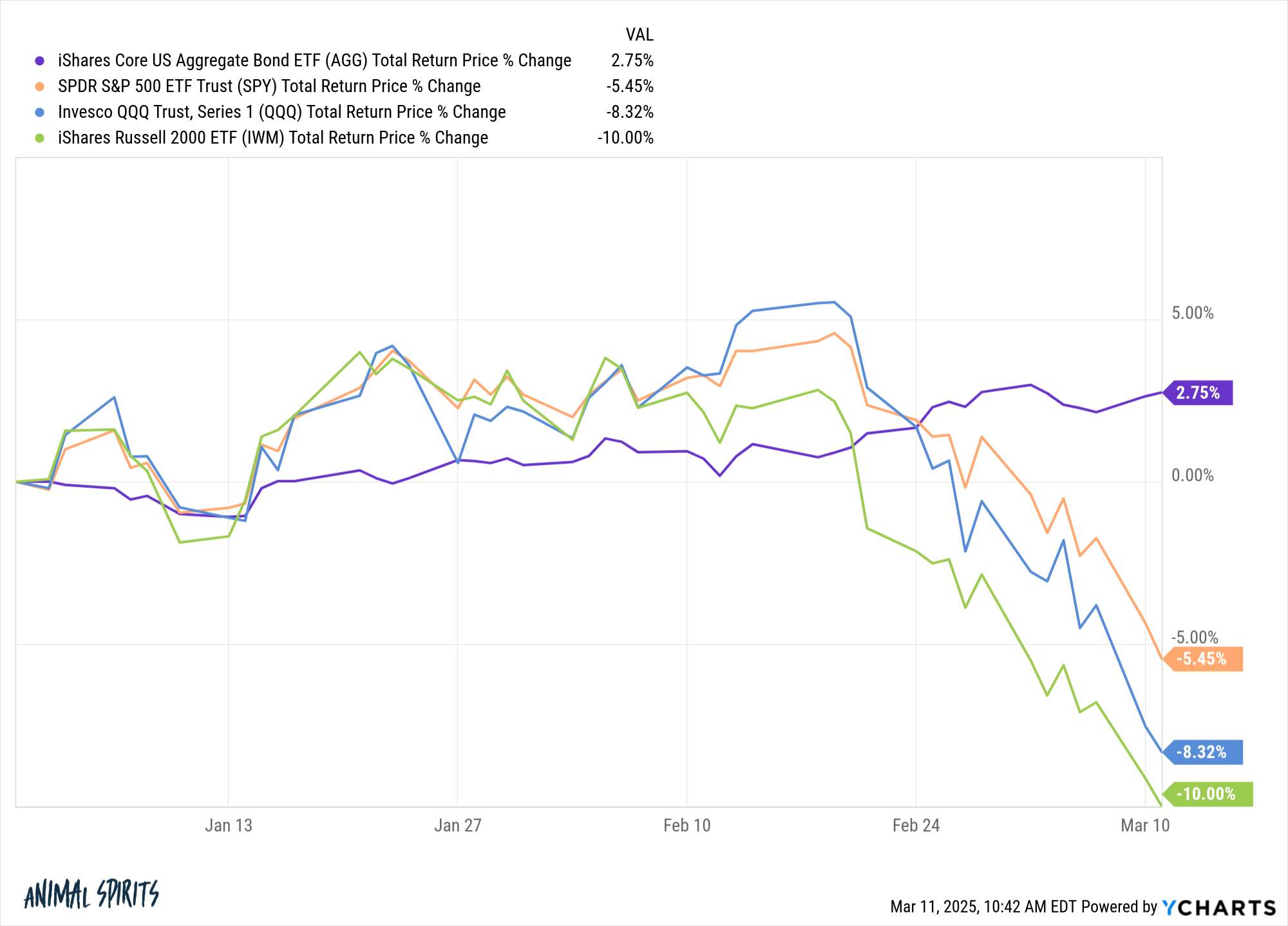

Do you will have dry powder? Bonds are working once more as a portfolio stabilizer this 12 months:

You not solely have greater beginning yields however value appreciation from falling charges. Bonds can present an incredible supply of dry powder throughout a market correction should you rebalance to lean into the ache.

Did you’re taking an excessive amount of danger? We’re not in a bear market or a crash, only a correction. These items occur. The common intra-year inventory market correction since 1950 is a peak-to-trough drawdown of roughly 14%.

We’re not even there but.

I’m not a fan of going all-in or all-out of the market as a result of market timing performs head video games with you. But when a minor correction like this forces you into the conclusion that you’ve got an excessive amount of fairness danger, there isn’t any disgrace in going from 90/10 to 80/20 or 70/30 to 60/40 if it helps you stick along with your funding plan.

Are you a compelled vendor? Fairness danger could be painful at instances however it’s momentary in nature. Blow-up danger, then again, can have long-lasting results. If you happen to invested on margin you may blow your self up. If you happen to went heavy into 3x levered ETFs you may blow your self up. If you happen to attempt to time the market you may blow your self up.

There are essential and pointless dangers in the case of investing. Keep away from pointless danger so you may dwell to battle one other day.

Are you ready for the mud to settle? Each market crash began out as a correction, morphed right into a bear market and obtained uncontrolled earlier than falling aside. Because of this corrections are so worrisome once you’re within the eye of the storm. Nobody is aware of how far issues will go.

Simply know that nobody shouts an all-clear sign to warn you when it’s time to get again in. Markets don’t backside on excellent news simply information that’s much less unhealthy.

Issues might worsen earlier than they get higher or this might be over by the top of the day. Nobody is aware of for positive. The market desires you to lose your cool. So does the monetary media.

It’s a wholesome correction once you don’t panic.

It’s a wholesome correction when you will have dry powder within the type of future financial savings or liquid belongings to deploy.

It’s a wholesome correction once you dwell to battle one other day within the markets.

It’s a wholesome correction once you maintain your wits about you when others are shedding theirs.

And it’s a wholesome correction should you keep the course.

Additional Studying:

What Does a Wholesome Correction Look Like?

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There could be no ensures or assurances that the views expressed right here can be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.