A convention courting again to the times of FundAlarm was to yearly share our portfolios, and reflections on them, with you. My portfolio, indolent in design and execution, makes for fearfully boring studying. That’s its major attraction.

This isn’t a “right here’s what it is best to personal” train, a lot much less an “envy me!” one. As a substitute, it’s a “right here’s how I feel. Maybe it would aid you do likewise?” train.

My portfolio and my life

By design, my portfolio is supposed to be largely ignored for all durations as a result of, on the entire, I’ve significantly better methods to spend my time, vitality, and a spotlight. For many who haven’t learn my earlier discussions, right here’s the quick model:

Shares are nice for the long run (suppose: time horizon for 10+ years) however don’t present enough reward within the quick time period (suppose: time horizon of 3-5 years) to justify dominating your non-retirement portfolio.

An asset allocation that’s round 50% shares and 50% earnings offers you fewer and shallower drawdowns whereas nonetheless returning round 6% a yr with some consistency. That’s engaging to me.

“Beating the market” is totally irrelevant to me as an investor and fully poisonous as a aim for anybody else. You win if and provided that the sum of your sources exceeds the sum of your wants. If you happen to “beat the market” 5 years operating and the sum of your sources is lower than the sum of your wants, you’ve misplaced. If you happen to get crushed by the market 5 years operating and the sum of your sources is bigger than the sum of your wants, you’ve received.

That is likely to be the only most vital perspective you may take away this month. Investing is about having affordable safety in help of a fairly wealthy life. Not yachts. Not followers. Not bragging rights. Life.

“Successful” requires having a wise plan enacted with good funding choices and funded with some self-discipline. It’s that easy.

My portfolio is constructed to permit me to win. It’s not constructed to impress anybody.

My asset allocation choices

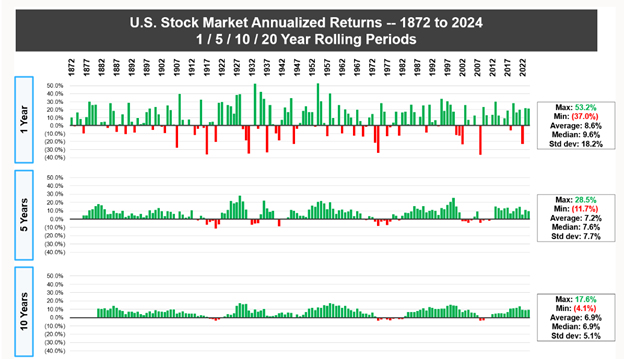

Shares are rewarding in the long term, gut-wrenching within the quick run, and continuously depressing disappointments within the medium run. The “depressing – medium” sentence interprets to this: it’s painfully frequent for the inventory market to go 5 – 10 years with out a acquire. A Canadian monetary training web site, A Measure of a Plan, supplied this 150-year chart of US market efficiency.

So, on a rolling foundation, there seem to have been 14 decade-long durations and two dozen five-year durations through which traders made no cash. On the entire, I would like regular good points to mixing spectacular good points, sickening losses, and years of futility. That led me to an unconventional asset allocation: 50%.

“50% what?” you ask. 50% all the pieces. My portfolio targets 50% fairness and 50% not, which interprets to 50% progress and 50% stability. My fairness portfolio targets 50% US and 50% not. My stability portfolio targets 50% bonds and 50% not.

That’s based mostly on loads of analysis from T. Rowe Worth on the return/volatility tradeoff as portfolios enhance their publicity to shares. Quick model: you pay a really excessive worth within the short- to medium-term for a potential acquire of two or three p.c in returns. A 50% portfolio affords the prospects of returns of 6-7% on common with a small fraction of the market’s draw back. That works for me.

My year-end 2024 allocation

| Home fairness | Shut sufficient | Conventional bonds | Nailed it |

| Goal 25% | 2024: 23% | Goal: 25% | 2024: 25% |

| Additionally managed a 50% large-cap / 50% small to mid-cap weight. | Stunning sources: Palm Valley Capital is 30% short-term bonds | ||

| Worldwide fairness | Obese | Money / market-neutral / liquid | Shut sufficient |

| Goal 25% | 2024: 31% | Goal: 25% | 2022: 22% |

| This has been a reasonably long-lasting chubby. The common US investor has 15% of their equities in worldwide shares whereas I’m concentrating on 50% and sitting at 60%. | Fairly loads of my managers have discovered motive to carry loads of money of late. FPA, Leuthold, and Palm Valley all sit at or above 20%. | ||

Right here’s what that appears like when it comes to efficiency and volatility.

| Annual return | Max Loss | Customary Deviation | Sharpe Ratio | Ulcer Index | |

| 2024 | 6.7 | -2.0 | 5.3 | 0.32 | 0.9 |

| Three yr | 2.7 | -16.2 | 9.4 | -0.14 | 6.9 |

| 5 yr | 7.1 | -17.6 | 11.1 | 0.42 | 6.6 |

The three-year efficiency seems dangerous as a result of it consists of 2022 when the inventory market dropped 23% and the bond market fell 13%. The Indolent Portfolio did higher than both in 2022 and about 4% higher than a hypothetical portfolio with the identical weightings. And that’s been true most years: 1-2% higher than a peer-weighted portfolio, 6-9% returns, volatility in examine.

My funding decisions

I personal 11 funds. Sure, I do know that’s greater than I would like. Among the sprawl represents my curiosity in monitoring newer and revolutionary funds, some symbolize a tax entice (I’ve loads of unrealized good points) and a few is indolence. A fund is doing wonderful, so why trouble to alter?

Basically, my core funds are equity-oriented however the managers have the liberty (and the accountability) to speculate elsewhere when equities will not be providing rewards that match their dangers.

Core progress funds – 2024

| Weight | APR | Max Loss | Customary Deviation | ||

| FPA Crescent | Versatile Portfolio | 22% | 14.0 | -2.0 | 6.1 |

| Palm Valley Capital | Small-Cap Development | 8% | 4.2 | -0.4 | 0.0 |

| Leuthold Core Funding | Versatile Portfolio | 6% | 7.7 | -5.0 | 10.3 |

| Brown Advisory Sustainable Development | Multi-Cap Development | 6% | 20.2 | -5.5 | 12.0 |

Leuthold and FPA are two very completely different variations of disciplined “go wherever” funds; every seeks equity-like returns with sub-market threat. Leuthold is a quant fund, and FPA’s bias is “absolute worth.” Palm Valley Capital is the fourth incarnation of Eric Cinnamond’s strict small-cap self-discipline: he loves nice shares however would quite sit on sizzling coals than purchase shares that aren’t priced for distinctive good points. Lots of money for lengthy durations, which is irritating for some and simply wonderful for me. Brown Advisory was my selection for the most effective sustainable fairness fund I might discover. Their consideration to high quality and valuations was destructive in 2024.

Core earnings / market impartial funds – 2024

| Class | Weight | Return | Max loss | |

| T Rowe Worth Multi-Technique Complete Return | Different Multi-Technique | 10.0% | 5.3 | -0.7 |

| T Rowe Worth Spectrum Revenue | Multi-Sector Revenue | 5.0% | 4.0 | -1.6 |

| RiverPark Strategic Revenue | Versatile Portfolio | 8.0% | 8.2 | 0.0 |

| RiverPark Quick Time period Excessive Yield | Quick Excessive Yield | 8.0% | 5.3 | 0.0 |

Multi-Technique is Worth’s model of a hedge fund for the frequent investor. It’s rising on me with a low correlation to the market, and low draw back seize. Spectrum is a fund-of-income fund. And the 2 RiverPark funds are low-risk, credit-oriented investments. Quick Time period made cash in 2022 when all the pieces else faltered.

That complete “worldwide chubby” factor – 2024

| Class | Weight | Return | Max loss | |

| Seafarer Abroad Worth | Worldwide Small / Mid-Cap Worth | 4.0% | -3.3 | -7.3 |

| Grandeur Peak World Micro Cap | World Small- / Mid-Cap | 14.0% | 3.2 | -6.0 |

| Seafarer Abroad Development and Revenue | Rising Markets | 9.0% | -5.4 | -9.2 |

Basically, I’ve by no means understood why shopping for shares of huge multinational companies nominally headquartered in London would logically produce outcomes completely different from shopping for shares of huge multinational companies nominally headquartered in Boston. Consequently, my impulse was to have a look at smaller markets and smaller firms. In concept, that ought to work splendidly. In apply, it’s so-so.

Options to my decisions

It’s not essential to personal greater than two or three funds to create an indolent portfolio. The important thing selection is whether or not you wish to construct substantial money (or cash-like securities) into the combo or keep on with shares and bonds alone.

The Bogleheads endorse a three-fund portfolio which doesn’t think about “money” to be an funding. Their course of has two steps: (1) choose the asset allocation that’s best for you and (2) purchase three low-cost index funds that provide you with publicity to the belongings you’re looking for. Their default set is:

- Vanguard Complete Inventory Market Index Fund (VTSAX)

- Vanguard Complete Worldwide Inventory Index Fund (VTIAX)

- Vanguard Complete Bond Market Fund (VBTLX)

Step One – “work out your asset allocation” – is the tough one there. A quite simple two-fund portfolio – one versatile fund within the palms of a prime tier supervisor and one incoming producing fund equally skippered – break up 50/50 might replicate my portfolio and would require negligible upkeep.

The small investor’s indolent portfolio

| Lipper Class | Weight | APR | Max Loss | |

| Portfolio | – | 100.0% | 6.8 | -2.2 |

| RiverPark Quick Time period Excessive Yield | Quick Excessive Yield | 50 | 5.3 | 0.0 |

| Leuthold Core Funding | Versatile Portfolio | 50 | 7.7 | -5.0 |

Alternately …

| Lipper Class | Weight | APR | Max Loss | ||

| Portfolio | – | 100.0% | 11.1 | -0.9 | |

| FPA Crescent | Versatile Portfolio | 50.0% | 14.0 | -2.0 | |

| RiverPark Strategic Revenue | Versatile Portfolio | 50.0% | 8.2 | 0.0 | |

Backside Line

The most effective portfolio, like the most effective water heater or finest automotive, is the one that you simply by no means want to consider. My portfolio assumes a balanced allocation with the typical fund being within the portfolio for greater than a decade. That technique doesn’t make me wealthy, it makes me completely satisfied. And that’s quite the aim!