In July 2024, Morningstar.com revealed a promising however in the end disappointing article entitled “The Greatest Small-Cap Funds” (7/18/2024). “Content material growth editor” Tori Brovet has been publishing a sequence of “The Greatest” articles (Vitality Shares, Worth Funds, Bond ETFs). The article guarantees there are

![]()

They aren’t.

You are able to do higher should you’re considering small cap choices.

The essay has three issues. (1) It claims a short-term payoff (“for 2024”) for what ought to be a long-term funding. (2) It has no standards for inclusion apart from “our analysts say these are Gold.” There’s no evaluation of the person funds, no distinction between them, no dialogue of what makes them Gold. In brief, Morningstar has entered the Age of the Clickbait Listicle. Lastly, (3) the listed funds aren’t notably compelling.

A “Gold” score signifies that Morningstar’s analysts (or algorithms) have concluded that the fund has a powerful likelihood of outperforming its friends within the years forward. That’s completely sane but it surely additionally raises the query, “How have they performed to this point?” Our reply is: not uniformly effectively. Sorry.

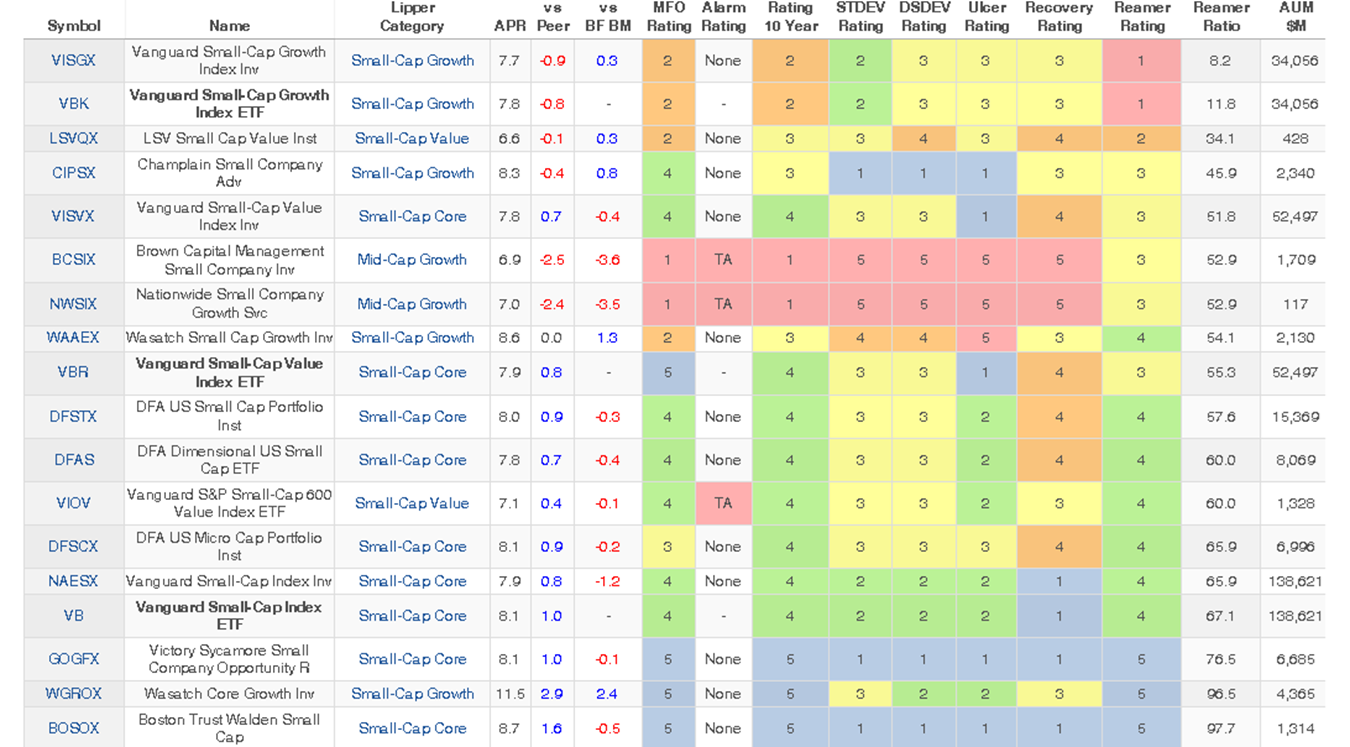

Right here’s the info. We entered all 18 within the MFO Premium multiscreener and pulled up the fund’s 10-year document. We checked out three units of outcomes:

- Uncooked returns: how a lot did they make, how did it examine to their Lipper peer group and the way did it examine to their best-fit benchmark?

- Threat and risk-adjusted returns: which embrace MFO and FundAlarm rankings, and volatility rankings (commonplace deviation, draw back deviation)

- Consistency of efficiency: if an investor held every fund for 3 years, what are the possibilities they’ve would beat their friends’ uncooked returns? The consistency measures we’re utilizing right here (although the MFO Premium screener presents others) is the Reamer Ratio which appears to be like on the efficiency of an funding in each rolling three-year interval. January 2020 to December 2022 is one three-year interval, then February 2020 to January 2023 is the following, and so forth. Over 10 years you get 85 rolling three-year durations.

You possibly can simplify your scan with this rule: you need to see heaps of blue and inexperienced (a lot above common and above common rating), you’ll be able to dwell with some yellow (kind of mediocre) however actually need to query any orange or crimson (beneath common and far beneath common).

Right here’s the ensuing image.

10-year efficiency of Morningstar’s Gold, sorted by Reamer Ratio

Full information or metric definitions are publicly out there at MFO Premium.

How do you learn the chart? Take the Vanguard Small-Cap Development Index for an illustration. It had 85 alternatives to outperform its friends however managed above-average outcomes solely 8.2% of the time. It returned 7.7% yearly which trailed its common peer (by 0.9% a yr) however beat its Lipper benchmark index. It had common volatility (all these yellows) however ended up as a below-average performer.

By these measures, Morningstar recognized three distinctive funds – Victory Sycamore Small Cap Alternative, Wasatch Core Development, and Boston Belief Walden Small Cap – plus three considerably disappointing funds and twelve which were … principally okay-ish?

You are able to do higher.

We can assist.

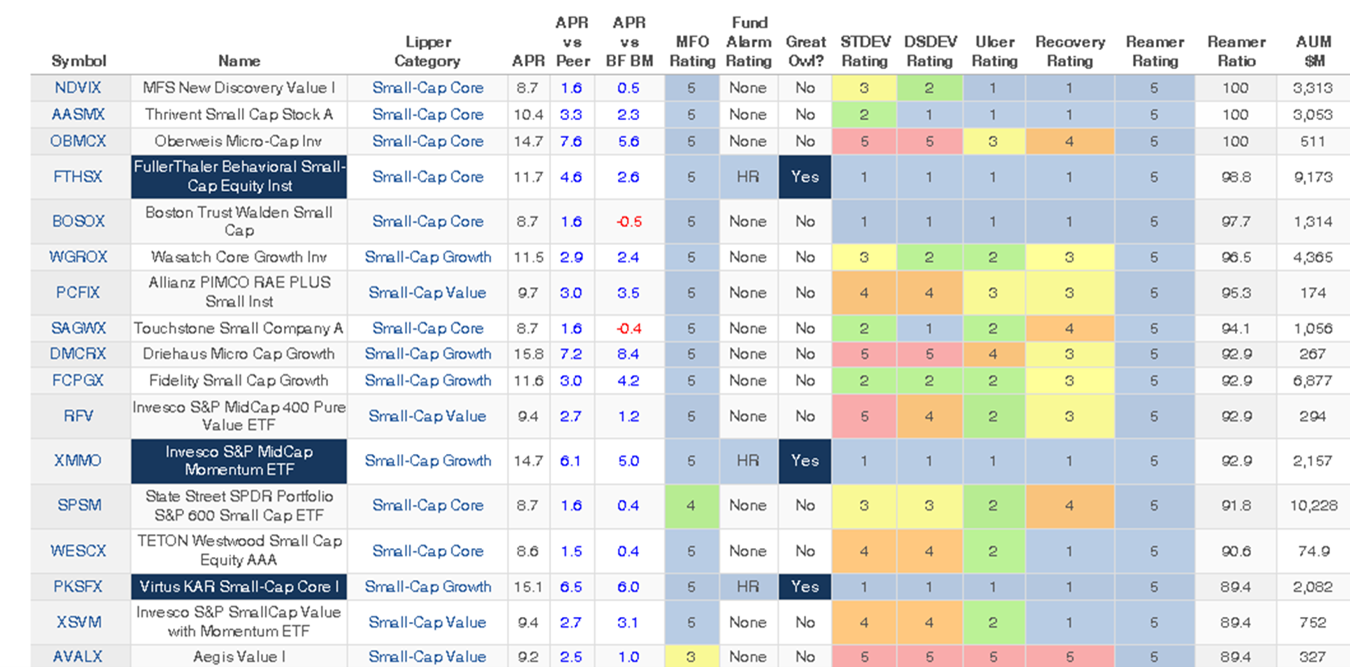

We requested the MFO Premium multiscreener to have a look at all small cap funds and ETFs and to determine these with the best Reamer Ratio. That’s, we appeared for funds that might persistently win should you had been prepared to carry them for a minimum of three years. All the columns and color-coding guidelines are the identical: completely happy traders have blue containers!

10-year efficiency of probably the most persistently profitable small cap funds, sorted by Reamer Ratio

What do you see?

First, solely two Morningstar “Gold” funds make the minimize:

Boston Belief Walden Small Cap (BOSOX): the managers are quality-at-a-reasonable-price traders, the fund holds 70 shares, has an extremely excessive energetic share (99), a slowly evolving administration group with substantial insider funding, and an ESG-sensitivity. Good guys who’re provided a covert endorsement of the Crimson Sox.

Wasatch Core Development (WGROX): the managers are quality-at-a-reasonable-price traders (“defensible enterprise fashions and nice administration groups” at “probably the most valuation delicate Wasatch development fund”) who store for each small and midcap shares with the latter representing 20% of its 56-stock portfolio, has a really excessive energetic share (93), a slowly evolving administration group with large insider funding.

Second, people who wished Morningstar’s LSV Small Cap Worth carried out higher have a fantastic various, FullerThaler Behavioral Small Cap Fairness. Each funds are run by behavioral finance PhDs, guys who’re pretty certain that one of the simplest ways so as to add worth is to know the predictable irrationality of different traders, and revenue from it. Each teams are well-known; Fuller Thuler, although, practically doubles the returns of LSV.

FullerThaler Behavioral Small Cap Fairness (FTHSX) “goals to capitalize on behavioral biases which will trigger the market to overreact to historic, unfavorable data or under-react to new, constructive data. Seems for firms with one or each of:

-

-

- important insider shopping for or inventory repurchases (over-reaction)

- massive earnings surprises (under-reaction)”

-

The fund owns 120 shares, about 70% of that are categorized as small caps. Turnover is 35%, the energetic share may be very excessive (92) and the managers have every invested over $1 million within the fund.

Third, bloated small caps hardly ever make the checklist.

A 3rd of Morningstar’s “Gold” funds weigh in at $10 billion-plus. All are index or smart-beta funds. None are nice. And no bloated energetic fund made it. Among the many constant winners, just one – once more, an index fund – made the highest 17.

Fourth, two exceptional micro-cap funds make the minimize.

Oberweis Micro-Cap (OBMCX): firmwide, Oberweis has dedicated to a variation of the behavioral finance technique utilized by FullerThaler and LSV: they’re into “uncovering and capitalizing on the persistent and recurring inventory pricing inefficiencies in international equities brought on by a lag in investor response to new data.” The group has 80% of the 80-stock portfolio in microcaps. It has a reasonably excessive energetic share (84) and is managed by a group led by James Oberweis and Keith Farsalas who’re each closely invested.

Aegis Worth (AVALX) is, frankly one in all our favourite small cap funds as a result of it simply retains beating prejudices, friends, and expectations. It begins with the identical basic perception: most small cap traders don’t know what the hell they’re moving into, and we are able to work with that. “Fairness markets are inherently emotional and infrequently overreact to occasions. This creates exploitable dislocations that provide extra return alternative for contrarian, long-term-oriented traders. Small-cap shares can expertise bigger dislocations. Lack of analyst consideration, much less transparency, and decrease liquidity all enlarge the impacts of emotional investor conduct.” The supervisor since inception is Scott Barbee, who Devesh designates “a legend,” who owns the agency and has over $1 million within the fund. He owns about 70 shares with equal publicity to small- and mid-caps, a microscopic turnover ratio of two%, and an astronomical energetic share (99.2). The excessive volatility scores mirror the distinctive dedication to extremely small, out-of-favor shares.

Lastly, three funds earned Nice Owl designations. “Nice Owls” signify our try and determine these funds whose risk-adjusted returns, conservatively calculated, at all the time within the prime tier over a wide range of measurement durations: 3-, 5-, 10- and 20-year durations, primarily based on the age of the fund.

FullerThaler Behavioral Small Cap Fairness, profiled in level two, above.

Virtus KAR Small-Cap Core (PKSAX): they name it “core,” Morningstar and Lipper see “mid-cap development” and “small-cap development,” respectively. In any case, the fund closed to new traders in July 2018. Sorry.

Invesco S&P Mid Cap Momentum ETF (XMMO): the fund replicates the S&P Midcap 400 Momentum Index. Its investable universe is the S&P 400 mid-cap shares, and it invests within the 80 shares with the upper momentum scores, computed by measuring the upward value actions in comparison with the remainder of the S&P Midcap 400. It’s rebalanced each six months and has a turnover ratio of 132%.

Backside Line

There isn’t a such factor as “a greatest fund.” There’s solely “one of the best fund, given your specific wants and considerations, from what we are able to see simply now.” That’s, because it seems, not click-baitable.

In assessing funds, MFO usually appears to be like for 2 issues first: (1) managers who’ve gotten it persistently proper throughout time and markets and (2) funds which have distinctive draw back controls. As Analysis Associates just lately famous, “Traders search solely to keep away from draw back volatility whereas they’re happy to profit from upside volatility.” This essay stresses one measure of constant success: the Reamer ratio and its concentrate on efficiency over three-year durations. Utilizing it, we recognized three funds which were their friends in 85 consecutive durations and 14 extra which have gained 90% of the time.

Our suggestions: (1) know your self. Take into consideration what you worth in a companion, how affected person you’re, how anxious volatility has made you prior to now, and so forth. (2) Begin with the numbers, however don’t finish with them. Each funding, as with each relationship, goes to have durations of stress and disappointment. The bottom line is whether or not you’re capable of see previous the short-term noise and concentrate on the long-term worth.