There are only a few certainties in investing and one of many certainties is uncertainty – monetary markets don’t like uncertainty. Sadly, uncertainty is operating rampant and has been driving the market efficiency this 12 months and it makes for tough conversations along with your shoppers.

Has your name quantity from involved shoppers elevated not too long ago in response to the uptick in volatility?

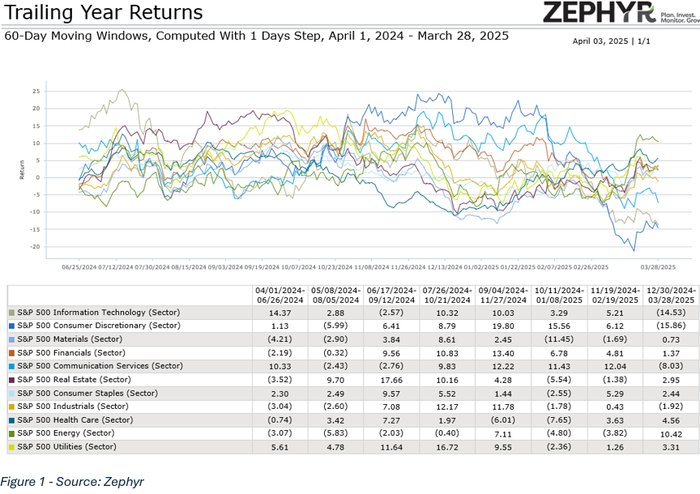

The beginning of 2025 has been a wrestle for equities because the S&P 500 index is down over 7.5% and the poor efficiency has worn out the entire post-2024 Presidential Election good points. Moreover, a shift in fairness leaders and up to date Treasury yield actions sign traders are turning bearish. The very fashionable mega tech inventory commerce, that carried markets for the previous few years has unwound, which has resulted within the NASDAQ 100 falling over 15% from its peak in February, marking a correction for the know-how heavy index. The rotation into defensive sectors like well being care, power and utilities from the as soon as outperforming cyclical sectors can also be eye-opening (Determine 1). Lastly, falling Treasury bond yields have signaled that traders have turn into extra involved in regards to the long-term financial progress versus short-term inflation.

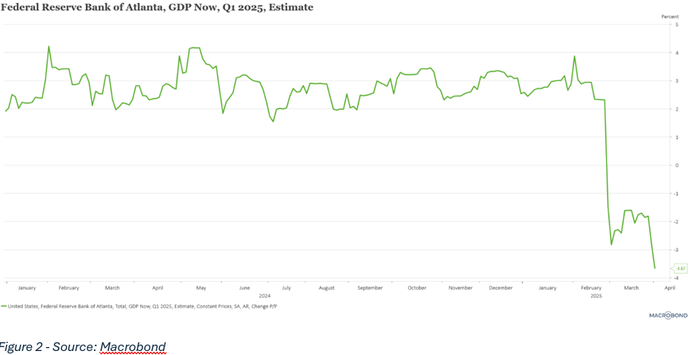

In the meantime, a unsure macro-economic atmosphere provides to the gloomy outlook for equities. The enhance from Donald Trump’s election victory on account of his pro-growth initiatives pale shortly as the joy turned to uncertainty as issues over a attainable commerce warfare took the shine off. Unpredictable tariffs and the continuing commerce rhetoric proceed to weigh on markets and can proceed to take action till there’s a clear and outlined decision. Moreover, some cracks throughout the economic system are beginning to present themselves as financial knowledge is beginning sign slowing. The Atlanta Federal Reserve’s GDPNow mannequin is now forecasting a 3.67% annualized decline for the primary quarter (Determine 2). Vital to notice, the GDPNow Forecast is simply that, a forecast.

Including to the financial uncertainty is the Institute for Provide Administration’s (ISM) February survey displaying weakening general situations, new orders and employment. In the meantime the unemployment fee has held regular not too long ago and retail gross sales, whereas slowing, rose in February.

Taking the Emotion Out of Investing

We all know that investing may be very emotional, and worry is the strongest emotion. It’s comprehensible that traders are on edge because of the latest shift in fairness efficiency and the lower than rosy outlook, which requires monetary advisors placing on their “psychologist hat”.

Conversations with shoppers throughout these risky occasions are sometimes the toughest as monetary advisors attempt to take away emotion and get their shoppers to take a look at the larger, long-term image, which is less complicated mentioned than completed. It’s necessary that monetary advisors steadiness empathy and data when making an attempt to verify the shoppers take a long-term method fairly than making near-term irrational selections pushed by worry. Listed here are some issues to think about when having these shopper conversations.

Study extra about probably the most dominate emotion in investing.

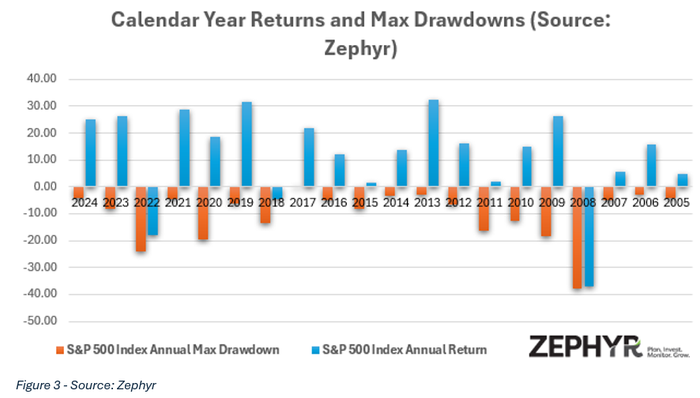

Mid-year Corrections are Frequent

Whereas a ten% pullback in inventory costs will be powerful to swallow and a trigger for concern, mid-year corrections are frequent. Not solely are mid-year corrections frequent, however they’re additionally frequent throughout years of strong fairness efficiency. Since 2005, the S&P 500 index skilled a correction (lack of 10% or extra) through the calendar 12 months seven occasions. Of these seven occasions the S&P 500 index ended the 12 months constructive 4 of the seven. In reality, the S&P 500 index posted +10% returns three of these seven occasions (Determine 3). Whereas unnerving, a correction doesn’t point out a foul 12 months is upon us.

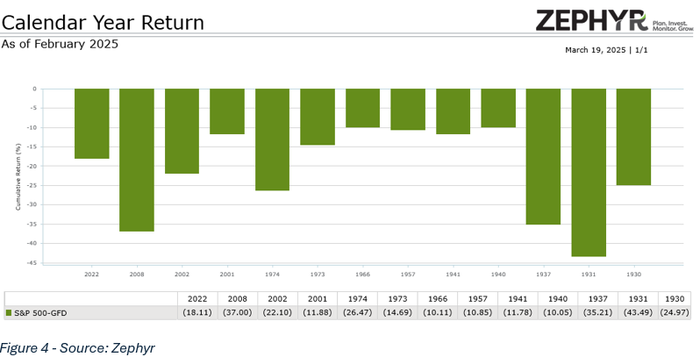

Calendar 12 months Declines of Extra Than 10% In a 12 months Are Uncommon.

Massive pull backs of greater than 10% are rather more unusual and correspond to one thing actually unhealthy, reminiscent of a recession or warfare. Since 1922 (102 years) the S&P 500 index has been down greater than 10% solely 13 occasions on a complete return foundation. Eight of these occurrences corresponded to a recession (1930, 1931, 1937, 1957, 1973, 1974, 2001, 2008), 4 had been throughout a warfare (1940, 1941, 1966) or heightened geo-political tensions (2002) and one was on account of a Fed fee shock in 2022 (Determine 4).

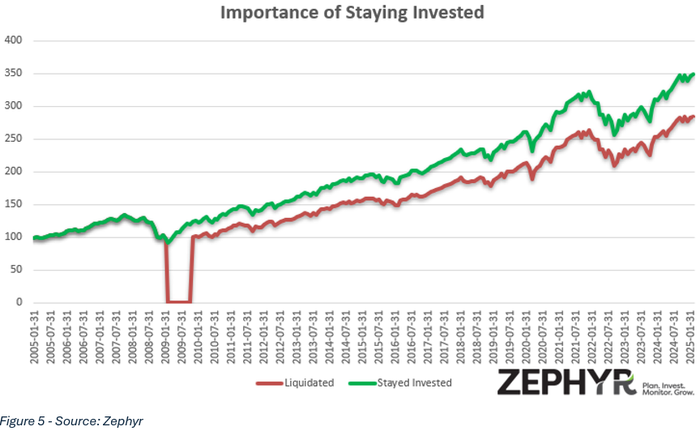

Significance of Staying Invested

Throughout these powerful conversations, the subject of liquidating or staying invested is all the time mentioned. In some circumstances, displaying knowledge and graphs, just like the under state of affairs, could make that dialogue simpler.

Say your shopper invested $100,000 20 years in the past (January 2005) in a world allocation portfolio (Russell 3000 index 30%, MSCI ACWI ex USA index 20%, Bloomberg U.S. Authorities/Credit score index 40%, Wilshire Liquid Various index 5%, FTSE Nareit Composite REITS index 5%). The funding portfolio climbs to $133,600 in late 2007 earlier than the Nice Monetary Disaster (GFC) begins to take its toll. She does her finest to remain invested earlier than her nerves get the very best of her and he or she liquidates in February 2009 after her portfolio falls to $97,480. The GFC backside is reached shortly thereafter, however your shopper remains to be shaken and doesn’t really feel snug leaping again in till later in 2009. In November 2009 she decides to leap again into the market and invests the $97,480 again into the identical international allocation portfolio. The portfolio recovers and by the tip of February 2025 the portfolio is value $284,710 which seems to be good till you take a look at the choice. Had your shopper stayed the course, her portfolio could be value $348,640 on the finish of February. Being out of the marketplace for simply ten months price your shopper $63,930. What may’ve been (Determine 5).

Markets transfer faster than ever, each on the way in which down and up, so it’s very arduous to catch the underside or high which places the portfolio in danger when traders liquidate. Historical past exhibits that issues must go very badly, like a recession, to ensure that fairness markets to fall greater than 10%. Nobody is aware of if a recession is on the horizon, so it’s necessary to create diversified funding portfolios that may steadiness each danger mitigation and capturing the upside.

Consumer conversations throughout occasions of heightened market volatility and uncertainty are arguably your hardest conversations, however your most necessary. As arduous as it’s, it’s necessary to maintain your shoppers targeted on attaining their long-term goals fairly than making hasty strikes that might put these goals in danger.