The registered funding advisor trade is present process a profound transformation, with consolidation changing into an plain power reshaping the aggressive panorama. Pushed by the rising complexity of compliance, know-how calls for and shopper expectations, companies are looking for scale and effectivity via mergers and acquisitions. A big catalyst behind this wave of consolidation is the rising involvement of personal fairness companies, that are actively investing in and buying RIAs, together with retirement plan advisor practices.

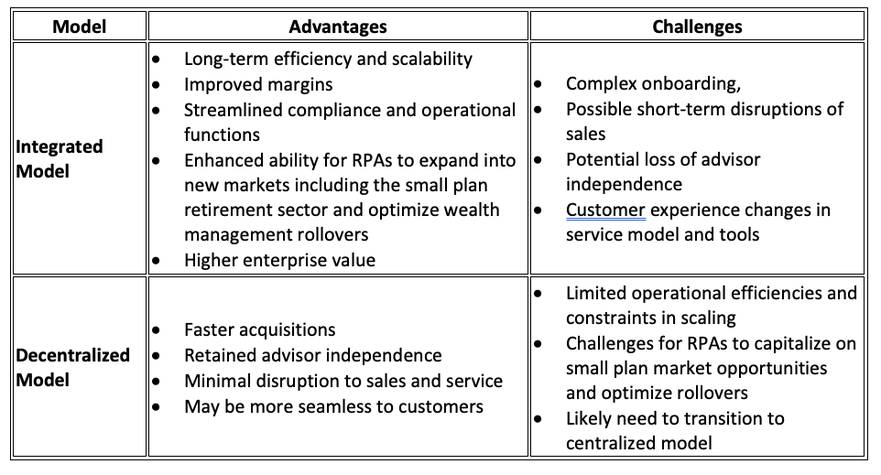

As companies navigate this evolving panorama, two major acquisition fashions have emerged: a centralized integration construction and an independence-preserving method. Every mannequin presents distinctive alternatives and challenges, influencing a agency’s skill to scale, optimize operations and maintain long-term development. Evaluating these fashions is essential for companies aiming to stay aggressive in an trade that more and more rewards scale and effectivity. It’s very true for RPAs centered on the retirement trade alternative

Two Basic Fashions of Acquisition

Centralized Construction Integration

The centralized integration mannequin consolidates acquired companies right into a unified operational framework, typically seen in unbiased or PE-backed transactions. This method focuses on reaching long-term scalability and price efficiencies by aligning vital operational capabilities corresponding to platforms, knowledge programs, supplier relationships, product choices, compliance insurance policies and authorized buildings.

The advantages of this mannequin are evident in its skill to drive value discount, streamline reporting and optimize useful resource allocation. By unifying back-office operations and aligning know-how programs, companies can improve compliance efficiencies and considerably broaden into new markets. For RPA companies, this consists of the more and more essential small plan retirement market, the place scalability and operational efficiencies can create vital development potential. Moreover, optimizing the rollover alternative for wealth administration providers presents a significant avenue for income era, as companies can higher transition retirement belongings into managed funding portfolios.

Nevertheless, the transition to a centralized mannequin will not be with out challenges. Onboarding complexities, operational disruptions, buyer expertise adjustments and advisor resistance to relinquishing independence can create short-term hurdles. Regardless of these preliminary challenges, companies adopting this mannequin typically discover themselves higher positioned for long-term development and profitability.

Independence-Preserving Mannequin

Alternatively, the independence-preserving mannequin prioritizes minimal disruption to an acquired agency’s operations. Beneath this construction, companies retain their current CRM programs, funding platforms, and compliance and authorized frameworks.

This method notably appeals to advisors who worth autonomy and like sustaining their established shopper relationships and revenue-generation fashions. By permitting companies to proceed working as they did pre-acquisition, this mannequin facilitates sooner transactions and reduces integration dangers. It’s also a pretty technique for PE companies centered on short-term income era and advisor retention.

Nevertheless, whereas this mannequin gives short-term benefits, its long-term viability stays questioned. Corporations working below decentralized buildings typically wrestle to attain the operational efficiencies required to compete at scale. Restricted synergies and inefficiencies in compliance and reporting can hinder their skill to broaden into broader markets. It’s notably problematic for RPAs and the small plan retirement sector, the place scale is important for profitability. Moreover, with out centralized infrastructure, companies with RPAs might wrestle to optimize wealth administration rollover alternatives, limiting their skill to seize further income streams from transitioning retirement belongings into managed portfolios. In consequence, many companies following this mannequin finally transition to a extra centralized construction to unlock the complete advantages of consolidation.

Weighing the Advantages and Challenges

Key Takeaways

As consolidation reshapes the RIA and RPA trade, companies should fastidiously consider the trade-offs between autonomy, integration, and timing. Whereas a decentralized mannequin gives instant stability, the long-term benefits of a centralized construction can’t be ignored. Corporations that efficiently steadiness short-term gross sales retention with long-term operational efficiencies shall be finest positioned for sustainable development and market growth.

For companies with RPAs contemplating their subsequent transfer, the time to evaluate their mannequin is now. The trade’s fast evolution presents each dangers and unprecedented alternatives—those that act decisively will optimize the profitable retirement and rollover alternative.