For a lot of advisors, the choice to outsource funding administration activates a want to raise their enterprise. That is notably true for fee-based and fee-only advisors who’d prefer to ship extra value-added providers to shoppers however are already working at full capability. Outsourcing presents a horny method to unencumber the substantial time they direct to portfolio administration whereas additionally offering their shoppers with extra various—and probably higher—funding options.

So what’s the issue? Usually, advisors are reluctant to outsource as a result of they fear about:

-

Dropping management over the funding course of

-

Taxation ramifications of shifting accounts

-

Doubtlessly greater prices for his or her shoppers or themselves

Nowadays, nevertheless, such presumed obstacles are rather more fantasy than actuality. To get to the guts of the matter, let’s check out the important thing the reason why outsourcing funding administration has turn out to be a recreation changer for a lot of advisors.

Why Outsourcing Doesn’t Imply Dropping Management

The truth of in the present day’s outsourcing applications is that you could proceed to play a crucial position within the administration course of.

It’s as much as you to decide on which managers you wish to use on your outsourced accounts—and there are a selection of choices accessible, from turnkey asset administration applications (TAMPs) supplied by third events to in-house managed portfolio fashions which may be provided by your agency associate. By monitoring the managers’ course of and efficiency and selecting the correct mannequin allocation for shoppers’ danger tolerance and funding targets, you keep significant management over monies held in these accounts.

As well as, outsourcing will not be an all-or-nothing proposition. One frequent resolution is to take a hybrid strategy. For instance, you may proceed to self-manage nonqualified accounts and to outsource retirement accounts that qualify for tax benefits. The rationale for this strategy is to keep away from the potential for tax ramifications when shifting nonqualified belongings which have appreciated.

How Outsourcing Can Assist Increase the Worth Your Agency Delivers to Purchasers

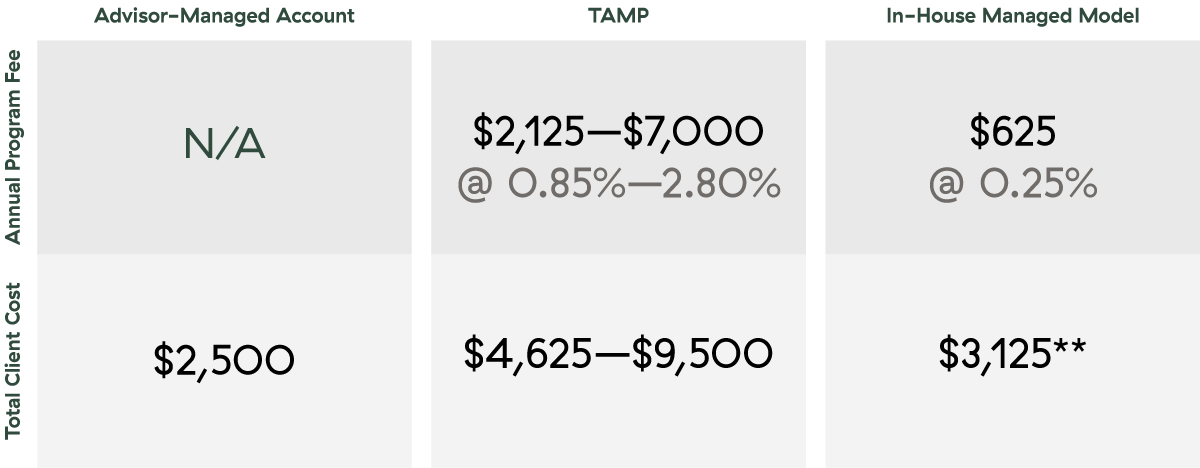

Outsourcing funding administration entails an extra shopper value, normally within the type of a program payment. The chart under compares common shopper prices for a hypothetical advisor-managed portfolio, a TAMP, and an in-house managed mannequin you may entry by way of your agency associate. This system charges for TAMPs can fluctuate extensively, with some reviews estimating the associated fee at 0.85 p.c to 2.8 p.c, relying on the complexity of this system chosen and the investments used.

Common Shopper Prices

Assumptions:

Supply: Commonwealth. This can be a hypothetical instance for illustrative functions solely.

*This quantity might differ primarily based in your agency’s payout coverage.

**Quantities primarily based on a conventional actively managed mannequin on Commonwealth’s Most well-liked Portfolio Companies® platform. Relying on the safety sort used throughout the mannequin, the general charges (along with the usual advisor payment) may rise to 0.65% ($1,625).

Relying on this system chosen, the additional charges to your shopper might be substantial. It is probably not of their finest curiosity, for instance, to outsource a $250,000 account to a TAMP charging a program payment of greater than 2 p.c. However for an additional 25 bps to 100 bps, many purchasers may think about the extra value acceptable given the potential advantages they’ll obtain.

Listed below are some causes outsourced investing options might help elevate the worth your agency delivers to shoppers:

-

Given the range of managed options accessible, you’ll be capable of choose the suitable mannequin portfolios and managers for every shopper, probably assembly their wants extra successfully.

-

Many managed merchandise can reveal a stable monitor document throughout mannequin sorts, thus providing shoppers a transparent, comprehensible story concerning funding suitability and efficiency.

-

Managed accounts can facilitate the diversification of shoppers’ product decisions by providing options that will fall exterior your areas of experience, reminiscent of options or choices methods.

-

Purchasers can evaluate a portfolio’s historic efficiency (topic to your agency’s compliance approval).

-

With another person managing the belongings, shoppers get extra time with you, so you possibly can each work on deepening your relationship.

The worth of those elements can’t be quantified, in fact. However when you talk about the truth of outsourcing along with your shoppers, you could discover that this system payment will not be an obstacle for them—or a purpose to cut back your charges.

How Outsourcing Saves Time and Drives Effectivity

Advisors who select to construct and handle shopper portfolios spend a considerable period of time (or workers assets) on asset analysis, due diligence, funding reporting, buying and selling and rebalancing, and different managerial duties.

By outsourcing the most important raise concerned with these duties, you possibly can achieve again that point, which you’ll be able to then dedicate to client-facing planning work and different revenue-generating actions. Take a latest 2020–2021 examine performed by Commonwealth in partnership with Cerulli Associates. It discovered that Commonwealth advisors spend 29 p.c much less time on buying and selling and rebalancing and 22 p.c much less time on analysis, due diligence, and portfolio monitoring than different advisors, reminiscent of these at wirehouses. That speaks to the robust adoption fee of Commonwealth’s outsourcing options, in addition to to the expertise instruments and analysis steering provided to its affiliated advisors.

Outsourcing can even mitigate the enterprise dangers of funding workers leaving your agency. If you handle your personal portfolios and a key workers member leaves, your agency’s operations might be disrupted, leaving you shorthanded within the interim.

Briefly, outsourcing may drastically enhance the dimensions and effectivity of your agency.

Making the Proper Transfer

Managed portfolio options aren’t proper for each advisor or shopper. To assist information your resolution, ask your self the next questions:

-

Is your ardour speaking to shoppers or selecting investments?

-

The place do your skills lie? Are you able to construct stable portfolios, or are you higher at monetary planning?

-

Are you seeking to develop the agency or obtain a greater work-life stability?

-

What selection is in your shoppers’ finest curiosity?

In case you determine that outsourcing funding administration is the correct transfer, it’s vital to conduct due diligence so that you absolutely perceive the philosophy, historic efficiency, and prices of a platform’s choices. Ideally, your agency associate may have the assets that will help you navigate potential options and develop your attain to incorporate extra holistic wealth administration.