The Solo 401(ok) auto-contribution tax credit score can earn you $1,500 over three years by simply enabling automated contributions to your solo 401(ok) plan.

Solo 401(ok) plans are a sort of retirement plan that permit solo enterprise homeowners to save lots of on taxes whereas placing away funds for retirement.

Whereas most individuals affiliate 401(ok) plans with bigger companies, even the smallest companies with a single worker can create a 401(ok) plan for his or her enterprise.

The Solo 401(ok) auto-contribution credit score laws are fairly advanced, so we’re sharing what you might want to know to obtain as much as $1,500 in tax credit. In partnership with My Solo 401k Monetary, we break down what the auto-contribution tax credit score is, and how one can make the most of it together with your Solo 401k plan.

What’s A Solo 401(ok) Plan?

A Solo 401(ok) will also be known as a Self-Employed 401(Okay), Particular person 401(ok), or one other title. What’s most vital to know is that it’s a 401(ok) however designed for only one particular person.

Should you’re new to the idea, Solo 401(ok) plans are the very same as 401(ok) plans supplied by massive employers, however with solely a single member. You may open and run a Solo 401(ok) at no cost at main brokerages like Schwab and Constancy, nevertheless, specialty suppliers like My Solo 401k Monetary make opening and operating a Solo 401(ok) simpler in lots of circumstances, for a price.

Most free solo 401k plans don’t supply all of the options that you would have if you happen to open your personal solo 401k. For instance, some don’t permit Roth contributions or after-tax contributions. And at present, no free plan supplier has the auto-contribution function to allow the tax credit score.

Should you open your personal plan with an organization like My Solo 401k Monetary, you’ll be able to nonetheless maintain your shares and exchange-traded funds (ETFs) at Constancy or Schwab.

Understanding the Solo 401k Auto Contribution Tax Credit score

As a part of SECURE Act 2.0, Congress handed a regulation encouraging companies to supply 401(ok) plans with automated contributions. Companies can earn $1,500 in tax credit, damaged right down to $500 per yr for 3 years.

Freelancers and different enterprise homeowners with no staff should not excluded from the credit score. Whereas different elements of the 401(ok) credit score program are a bit extra doubtful, the final consensus is that Solo 401(ok) plans are eligible for the $1,500 automated contribution credit score.

For instance, if you happen to begin a brand new Solo 401(ok) plan in 2024, you would earn the next tax credit:

Keep in mind, tax credit should not the identical as deductions. Whereas a tax deduction lowers your taxable revenue, credit straight scale back your taxes. That makes this program value basically $1,500 in free cash for solo entrepreneurs who select to take benefit.

To get the credit score, you’ll be able to create a brand new Solo 401(ok) plan with automated contributions or replace your present Solo 401(ok) plan to incorporate automated contributions. On a private be aware, after researching what’s doable, that’s precisely what I’m going to do.

It’s additionally vital to do not forget that simply because your plan has automated contributions doesn’t imply it’s a function that you just personally need to allow. You may opt-out of your personal plan’s auto contribution function and nonetheless obtain the tax credit score.

Suppliers like My Solo 401k Monetary will enable you each guarantee your plan has the suitable auto contribution setup, and make sure that you opt-out if you happen to so want.

Eligibility Necessities

Figuring out which companies are eligible for the 401(ok) automated contribution credit score is a bit sophisticated. After I first requested my accountant, he indicated that I may not be eligible. However after a bit back-and-forth, we determined that my enterprise, the place I’m the one worker, is eligible. I verified this with a number of sources.

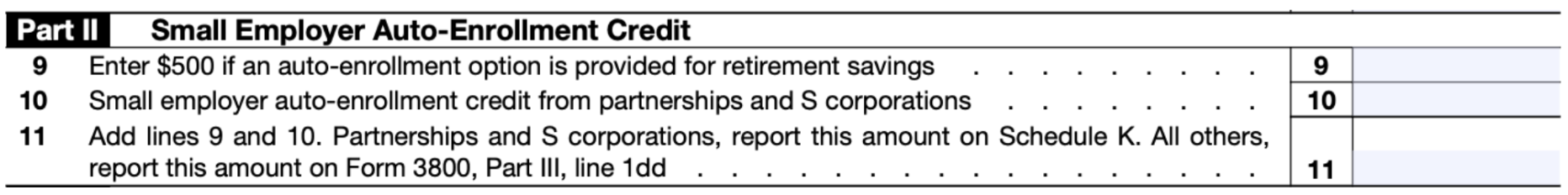

The directions for Kind 8881, the shape you could use to get the credit score, mentions a number of varieties of retirement plan credit. Not all solo companies can get all credit included on this kind, however Solo 401(ok) plans qualify for Part II, which is devoted to the automated contribution credit score.

If you have already got a 401(ok) plan with automated contributions enabled, you might not qualify. If you’re new to automated contributions, you most likely do qualify. Should you’re uncertain, seek the advice of with a trusted tax skilled.

Your Solo 401(ok) will need to have particular language stating that new staff are robotically enrolled for auto contributions to qualify for the credit score.

Advantages Of Computerized Contributions

Many staff in massive corporations do not take part in 401(ok) plans. A current survey discovered that about 40% of staff aren’t arrange. However with automated signup for contributions, practically 100% of staff take part.

Social Safety alone is usually not sufficient to take care of the identical lifestyle throughout retirement. Most consultants recommend that Individuals save a minimum of 15% of their revenue for retirement to take care of their lifestyle. With automated enrollment and auto contributions to a 401(ok) plan, they’re extra prone to keep on monitor for retirement.

Setting an automated 3% contribution is considerably of an business customary. After your enrollment, you’ll be able to enhance or lower your contribution degree at any time.

Claiming The Tax Credit score

To assert the tax credit score, you’ll want to finish and submit Kind 8881. It’s a easy, one-page type that you just or your accountant can full in only a few minutes.

The Small Employer Auto-Enrollment Credit score is calculated in Half II of the shape. You will enter the $500 credit score quantity in Field 9.

In accordance with IRS tips, “An eligible employer that provides an auto-enrollment function to their plan can declare a tax credit score of $500 per yr for a 3-year taxable interval starting with the primary taxable yr the employer consists of the auto-enrollment function.”

Once more, when you have any doubts or questions, it’s finest to seek the advice of with a licensed tax skilled.

Is The Auto-Enrollment Credit score For Solo 401(ok) Plans Price It?

Should you don’t have already got an automated enrollment function in a Solo 401(ok) plan, the credit score is totally definitely worth the effort. Whereas it takes a while to finish the kinds, there’s so much to realize and little to lose by organising this plan function and receiving the credit score.

In some ways, it’s like the federal government is subsidizing you $1,500 to make tax-advantaged contributions on your personal retirement. That’s an enormous win on your funds if you happen to’re self-employed.

Firms like My Solo 401k Monetary may help you with this. Whether or not you’re open an new Solo 401k for the primary time, or you may have an present plan you might want to replace (known as recharacterization), they may help.