(Bloomberg) — Optimism is constructing {that a} game-changing fund design that may assist asset managers shrink purchasers’ tax payments and develop their ETF companies will quickly be permitted by the US securities regulator.

This week, no less than seven corporations together with JPMorgan and Pacific Funding Administration Co. filed amendments to their purposes to create funds which have each ETF and mutual fund share lessons. The filings replace preliminary purposes — a few of which sat idle for months — with extra particulars concerning the fund construction, and recommend the US Securities and Change Fee has engaged in constructive discussions with a rising variety of candidates, based on business attorneys.

“The SEC signaling is evident. These amendments actually represent the SEC prioritizing ETF share class aid,” stated Aisha Hunt, a principal at Kelley Hunt regulation agency, which is working with F/m Investments on its software.

The newest spherical of filings, which additionally embody Charles Schwab and T. Rowe Worth, are serving as one more signal that the SEC is fast-tracking its choice course of on multi-share class funds, after F/m Investments and Dimensional Fund Advisors filed amendments earlier in April.

Brian Murphy, a companion at Stradley Ronon and lawyer on DFA’s submitting, stated different fund managers are receiving suggestions and amending purposes.

“We perceive that the SEC employees is telling different asset managers to comply with the DFA mannequin as nicely,” stated Murphy, who can be a former Vanguard lawyer and SEC counsel.

At stake is a novel fund mannequin the place one share class of a mutual fund could be exchange-traded. It was patented by Vanguard over 20 years in the past, and helped the cash supervisor save its purchasers billions on taxes. The blueprint ports the tax benefits of the ETF onto the mutual fund, and is a tantalizing prospect for asset managers which can be seeing outflows and trying to break into the rising ETF business.

After Vanguard’s patent on the design expired in 2023, over 50 different asset managers requested the SEC for so-called “exemptive aid” to make use of the fund design. However it wasn’t till earlier this yr, when SEC appearing chair Mark Uyeda stated the regulator ought to prioritize the purposes, that it was clear the SEC could be taken with permitting different fund corporations to make use of the mannequin.

In accordance with Hunt, the regulator has signaled that it’ll first approve a small subset of the candidates.

‘Work to be Finished’

To make sure, an approval doesn’t imply that an issuer will have the ability to instantly start utilizing the fund blueprint. As a result of ETFs commerce throughout market hours, they require totally different infrastructure than mutual funds, so corporations that at present solely have the latter construction might want to rent employees and kind relationships with ETF market makers earlier than they implement the dual-share class mannequin.

“Dimensional has type of set the template for what that language seems to be like within the context of those filings. And by extension cleared the best way for approval, which feels imminent now,” stated Morningstar Inc.’s Ben Johnson. “However then as soon as we arrive at approval, there’s nonetheless going to be work to be completed.”

Mutual fund corporations might want to put together for shareholders who need to convert, tax-free, into the ETF share class, which might require some “plumbing” and structural modifications, stated Johnson.

One other level to think about is that mutual funds which have important outflows is probably not ripe for ETF share lessons, as that would end in a tax hit, based on analysis from Bloomberg Intelligence. In 2009, a Vanguard multi-share class fund was hit with a 14% capital-gains distribution after a large shareholder redeemed its shares within the fund. Fund outflows can convey a couple of tax occasion when a mutual fund has to promote underlying holdings to fulfill redemptions.

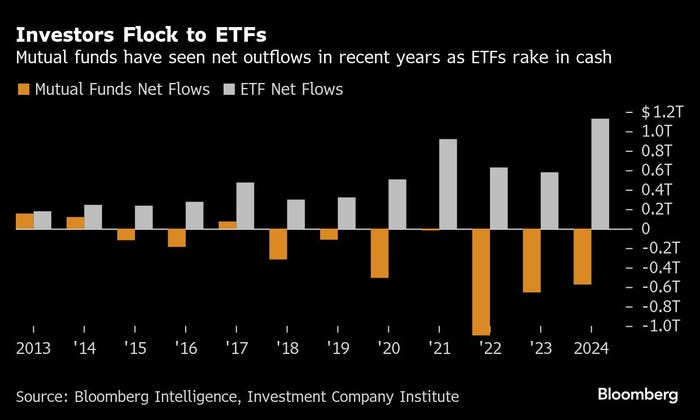

Mutual funds have largely bled property in recent times as ETFs have grown in recognition. Consequently, legacy asset managers have discovered themselves battling for a slice of the more and more saturated ETF market, which now boasts over 4,000 US-listed ETFs. SEC approval of the dual-share design might open the floodgates to hundreds extra funds.