“What do you need to do?”

“I need to work in a cool job with cool folks.”

“OK…doing what precisely?”

“um…properly…I imply…”

This was a dialog that occurred in my senior 12 months of school with the steerage counselor.

I knew I needed to work in finance in some capability as a result of I preferred numbers, however past that, I had no plan.

Discovering a job after faculty was tough as a result of I didn’t know what I needed to do with my life. There have been a great deal of interviews in banking, however they needed me to be in gross sales. That wasn’t going to work.

Finally, I landed a job as an analyst with a small funding consulting agency. My boss began out managing cash for one of many greatest hospital programs in Detroit. He was so good at it that a number of different hospitals approached him to handle their cash.

I nonetheless keep in mind my first day on the job having to search for what bond credit score scores had been as a result of I had no thought how they labored. I had lots to study.

There are usually two varieties of jobs whenever you’re first beginning out — studying jobs and incomes jobs. This was a studying job as a result of I definitely wasn’t incomes that a lot.

I used to be courting my now spouse on the time however she was going again to high school on the opposite aspect of the state. So each evening I might get dwelling from the workplace, go to the gymnasium, eat some dinner after which learn for 2-3 hours an evening.

I learn each funding ebook I might get my fingers on. I highlighted and underlined. I took notes.1

My boss taught me about asset allocation, funding coverage statements, threat profiles, and the best way to talk successfully with shoppers.

I used to be nonetheless so inexperienced I didn’t understand these early years had been setting a baseline of funding data I might use for years to come back.

Then we obtained married. I moved again throughout the state to work for the funding workplace at a nonprofit with a billion-dollar endowment fund.

I joined in July 2007, proper because the monetary system was on the point of imploding. These first 3-4 years on the job, dwelling via the Nice Monetary Disaster and its aftermath, had been formative for me as an investor.

I realized lots about the best way to survive a four-alarm disaster, profession threat and persistence.

I used to be at that job for a decade, getting the chance to work with each asset class and funding technique possible — shares, bonds, commodities, hedge funds, personal fairness, enterprise capital, infrastructure, structured merchandise and extra. Extra studying.

I labored with clever individuals who had been good at what they did however I used to be itching to do one thing else. Nevertheless, identical to faculty, I didn’t actually know what that one thing else was.

After getting my CFA designation, I went again to high school at evening to get an MBA. One in all my classmates had a weblog and confirmed me the best way to construct a web site. Popping out of the monetary disaster I had a variety of ideas racing via my thoughts so it seemed like a very good outlet.

On a whim, I began A Wealth of Frequent Sense.

Within the first six months or so, nobody learn it moreover family and friends, however I found my love for writing. I used to be capable of manage every thing I had realized to grasp what I truly considered investing. It was illuminating.

Josh Brown and Barry Ritholtz had been enormous inspirations for the weblog. I used to be late discovering them in 2012-ish, so I went again via and skim all of their hottest posts. I grew to become a day by day shopper of their content material.

After he wrote a bit about hedge funds, I summoned the nerve to e-mail Josh about my expertise within the institutional funding business. I defined how I most well-liked simplicity over complexity and the way that was missing within the area.

Josh instructed me if I actually felt that strongly about it, I ought to write a weblog publish and ship it to him. That’s what I did. I labored actually arduous on it. Josh preferred it a lot that he posted it on his weblog (anonymously).

He gave me some good suggestions and stated I ought to contemplate writing extra usually. I shared with him a hyperlink to my weblog that nobody was studying.

Josh grew to become a reader and supporter of my work. He shared it on The Reformed Dealer and social media. Finally, Tadas at Irregular Returns picked it up as properly. My viewers grew. Then got here a ebook deal.

It was all so surprising. I wasn’t attempting to construct a model or an viewers or promote something. I simply loved writing about markets and investor conduct.

Josh and Barry began Ritholtz Wealth in 2013. I obtained to know them on work journeys to New York Metropolis and met Michael too.

On a telephone name with Josh, as I used to be complaining about my profession trajectory, he stopped me and requested what I needed to do with my life.

I lastly had a solution.

I instructed him I needed to work with shoppers of all sizes and shapes, proceed producing content material, and make the most of that content material in my on a regular basis job. I additionally needed to work with individuals who shared my philosophy on the varieties of shoppers and portfolios we ought to be working with.

I needed to get pleasure from finance extra.

Josh stated, “OK come try this with us.”

The remainder is historical past.

I’ve been with Ritholtz Wealth for nearly a decade, and the enterprise has grown significantly in that point. After I joined because the seventh member of the workforce, we had been a start-up RIA managing round $140 million.

Right this moment our workforce is 60+ (and rising) and we handle greater than $5 billion for greater than 1,000 households and organizations.

I get to work in a cool job with cool folks, identical to my 22-year-old self needed.

I put in a variety of arduous work but in addition obtained fortunate.

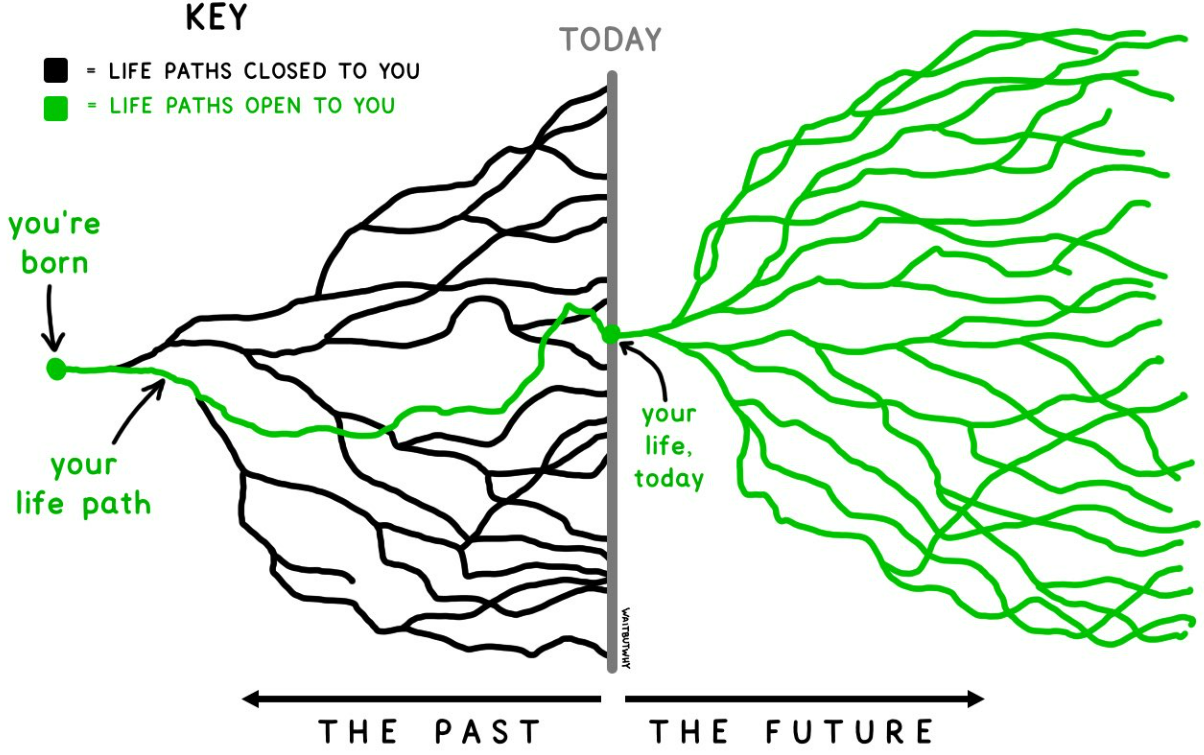

Tim City created this glorious visible that that exhibits the potential paths your life can take:

I take into consideration this type of factor lots.

One fork within the highway right here or there and my profession might have turned out vastly totally different. All the roles I didn’t get. Dangers that didn’t pan out. Dangers I might have taken.

Giving younger folks profession recommendation is at all times tough as a result of a lot of your path is set by some mixture of arduous work, circumstances and dumb luck.

If there’s something to take from my story it’s this:

All the time be studying. Typically you study what works. Different instances you study what doesn’t work. Typically data helps within the second. Different instances it takes years for the precise classes to sink in.

Being a lifelong learner has been an incredible profit to my profession.

Put your self on the market. Somebody as soon as instructed me running a blog is gross sales for introverts. That checks out for yours actually but it surely was nonetheless nerve-wracking placing myself on the market.

The Web may be an unforgiving place. You want thick pores and skin.

Many individuals in my life checked out me like I used to be loopy for pursuing a profession primarily based on a weblog and relationships that had been cast on the net.

You’re leaving a billionaire household to work with some guys you met on the Web?!

It was a threat that by no means felt dangerous to me as a result of it was precisely what I needed to do with my profession.

Typically you simply need to take the leap and see what occurs.

You by no means know when somebody will take an opportunity on you.

Michael and I had been stay from Huntington Seaside at Future Proof this week speaking about our non-traditional profession paths and extra:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Some Issues I Don’t Need After I Develop Up

Now right here’s what I’ve been studying recently:

Books:

1I nonetheless have a few of these outdated notebooks in my workplace.