As a species, human beings like to compete with each other. I see this aggressive nature on show every single day with my six-year-old James and nine-year-old Max. Who can stand up the steps first? Who can end their dinner first? Who will get to cuddle with daddy first? (Okay, full disclosure right here, it’s normally a battle over who can cuddle with mommy!) Successful, doing higher than another person, and outperforming are in our blood. In some ways, this idea additionally applies to analyzing your portfolio’s funding efficiency. However to precisely decide outperformance, it’s essential to check your outcomes towards the right commonplace or benchmark.

What Is Successful?

The opposite day after Max’s baseball sport, James (stuffed with liquid braveness from ingesting his blue slushy) challenged me to a race across the bases. Not being from the “participation trophy period” of as we speak, I went full out and handily beat him. Now, my buddies usually joke that my legs are so skinny that folks may chalk them up if I handed a pool corridor. Nonetheless, it was not a “truthful” race, as my legs are for much longer and my physique is extra developed than my son’s. (I be previous!) In fact, if James had been to run towards youngsters who had been nearer to his age, it might present a a lot better litmus take a look at of how briskly he actually is.

The identical concept holds true for evaluating the efficiency of your portfolio. Usually, advisors request that I take a second take a look at a portfolio when shoppers ask about their returns in contrast with “the market.” For many traders, the market refers back to the S&P 500. For essentially the most half, this index consists of large-cap U.S. fairness. So, until you personal a equally constructed portfolio, it’s not a good comparability.

As an alternative, a extra applicable benchmark is a blended index that features the Russell 3000 (home fairness), the MSCI World ex-U.S. (worldwide fairness), and the Bloomberg Barclays U.S. Mixture Bond (bonds) indices, in addition to money. As well as, the share in every index ought to mirror a consumer’s precise allocation to home equities, worldwide equities, bonds, and money. To “win,” shoppers ought to consider whether or not their investments beat this blended benchmark.

Everyone Wish to Rule the World

The above references a track from 1985 by Tears for Fears. It falls outdoors my high 1,000 favourite songs; nonetheless, it does converse to how the common investor needs to make as a lot because the market, so long as the market is up. Additionally it is completely regular to have a short-term reminiscence and neglect that the S&P 500 was down 37 p.c in 2008. Advisors work with shoppers to find out their threat tolerance and, in flip, the asset allocation that aligns with it. The extra threat that you’re keen to tackle, the higher the likelihood that your return might be greater due to it. Conversely, with greater threat comes a better probability of extra lack of principal when the market falls.

What Goes Round, Comes Round

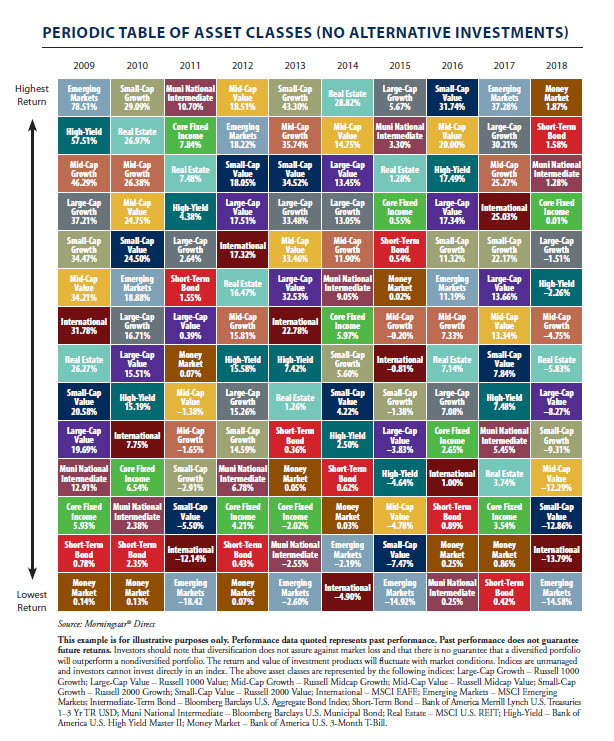

This brings us to the idea of diversification. With hindsight, it’s not uncommon for an investor to suppose, “why didn’t my advisor simply put all my cash into Amazon and Apple?!” Cue the reference to the dot-com bubble of 2000 that I witnessed firsthand as a inventory dealer. Now, I’m not saying that as we speak’s tech giants are analogous to people who crashed like Pets.com. However Newton’s regulation of gravity of what goes up should come down applies right here. How a lot they go down is one other story. The purpose is one thing that has been consistently emphasised with all traders: diversification is important to long-term efficiency. Just like the circle of life (the brand new Lion King now enjoying in a theater close to you!), an asset class can do nice one yr and horrible the following. For example, rising markets fairness was up 37.28 p.c in 2017 and down 14.58 p.c in 2018. The Callan chart under illustrates this idea greatest.

A Marathon . . . Not a Dash

Again in 2000, I made a decision to run the Boston Marathon although I had by no means run greater than 5 miles at a time in my life. Formed extra like a rhombus than a runner, I spotted that the one manner that I might run 26.2 miles could be to run comparatively gradual and regularly construct up my endurance. Within the brief run (pun meant!), my tortoise-like tempo saved me behind the pack. In the long term? I used to be in a position to endure and end the race, whereas others that had been as soon as forward of me fell by the wayside. I had achieved my aim.

Investing could be checked out in the identical mild. It’s about conducting your aim, whether or not that is proudly owning a house, placing your youngsters by school, or retiring at a sure age. You’ll be able to solely dash for therefore lengthy. The previous adage of gradual and regular wins the race applies right here.

The Backside Line

I train my boys that it’s okay to be aggressive however that additionally it is okay to lose. Each, in the long term, will make them stronger and assist them obtain their objectives in life. They need to measure their relative success or failure towards applicable benchmarks. Traders would do properly to do the identical.

Editor’s Notice: The authentic model of this text appeared on the Unbiased Market Observer.