My retirement planning for the previous two years since retiring has centered on the Bucket Method to have the appropriate funds in the appropriate funding buckets to have high-risk adjusted returns whereas minimizing taxes over my lifetime. This text focuses on forty of the highest performing ETFs that I imagine can kind a great basis for the approaching decade. I wrote Investing in 2025 And the Coming Decade describing why I feel bonds will outperform shares on a risk-adjusted foundation as a result of rates of interest should keep larger for longer to finance the nationwide debt and beginning fairness valuations are so excessive. Federal Reserve Chairman Jerome Powell principally mentioned as a lot this previous Wednesday and the S&P 500 dropped 3%.

I rated over 5 hundred ETFs that I observe in over 100 Lipper Classes, utilizing the MFO Danger and Ranking Composites, Ferguson Mega Ratio which “measures consistency, threat, and expense adjusted outperformance”, Return After-Tax Publish Three 12 months Ranking, and the Martin Ratio (risk-adjusted efficiency) to pick the highest fund for every Lipper Class. I then subjectively adjusted the funds to favor the Nice Owls and for my very own preferences of Fund Households. I eradicated the Lipper Classes the place the ultimate fund had a excessive price-to-earnings ratio and fell additional than the S&P 500 following Mr. Powell’s announcement. I used the Factset Ranking System to get rid of a number of funds. I eradicated virtually twenty funds to maintain the ultimate checklist of funds to maintain the choice diversified and easy.

What Will the Investing Surroundings Usher in The Subsequent Decade?

The approaching decade will deliver uncertainty as a result of:

- Nationwide debt as a proportion of gross home product (GDP) has not been this excessive since World Conflict II.

- Federal Debt as a proportion of (GDP) is rising at six p.c including to the nationwide debt.

- Inhabitants development which drives financial development has slowed for many years.

- Tax cuts are coming and are prone to scale back Federal income with advantages favoring the rich and including to the nationwide debt.

- Tariffs elevate the price of inflation favoring retaining charges larger for longer.

- Inventory valuations are excessive implying under common long-term returns.

- Rates of interest will doubtless be elevated in comparison with historic averages with a purpose to finance the nationwide debt and comprise inflation.

- Geopolitical threat has risen.

- Political brinkmanship has risen.

For concepts about find out how to put together for extra risky markets, I refer you to David Snowball’s article final month, “Constructing a chaos-resistant portfolio”, in addition to mine, “Envisioning the Chaos Protected Portfolio”. The number of ETFs on this article displays a few of these concepts from the MFO December e-newsletter.

Bucket Method

The Bucket Method is a straightforward idea of segregating funds into three classes to fulfill short-, intermediate-, and long-term spending wants. It may be extra difficult in a dual-income family with separate account possession, and completely different tax traits. For these in larger tax brackets, asset location to handle taxes is essential.

For instance, if an investor owns each Conventional and Roth IRAs, then funds with decrease development and fewer tax effectivity ought to be put into the Conventional IRAs. Roth IRAs are perfect for larger development funds which can be much less tax-efficient. After-Tax accounts held for the long run are finest fitted to tax-efficient “purchase and maintain” funds with low dividends and better capital beneficial properties.

These are the ideas included within the following buckets. Traders want to pick what is acceptable for his or her particular person circumstances. Some funds can match comfortably into a number of buckets or accounts with completely different tax traits.

I organize my accounts so as of which of them I’ll withdraw cash from first. The primary ones are probably the most conservative and the final ones are probably the most aggressive. I desire to contemplate these being in Funding Buckets. On the day that the S&P 500 fell 3%, my accounts that may fund the subsequent ten years of dwelling bills fell 0.35% whereas producing earnings.

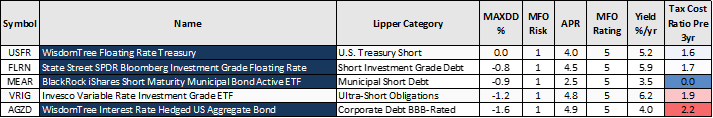

Bucket #1 – Security and Dwelling Bills for Three Years

The checklist of funds in Bucket #1 is brief as a result of I used fund efficiency in 2022 and the COVID recession to push funds with excessive drawdowns into Bucket #2. Cash market funds, certificates of deposit, and bond ladders ought to be thought of a staple of a conservative bucket for emergencies and dwelling bills. The Tax Value Ratio displays the portion of the returns that can be misplaced as a consequence of taxes. The upper one’s tax brackets, the extra relevant it turns into to spend money on municipal bonds. For an investor wanting to attenuate taxes, BlackRock iShares Brief Maturity Municipal Bond Lively ETF (MEAR) could also be an ideal selection.

The blue shaded cells signify a Nice Owl Fund which has “delivered prime quintile risk-adjusted returns, primarily based on Martin Ratio, in its class for analysis durations of three, 5, 10, and 20 years, as relevant.”

Bucket #1 – Security and Dwelling Bills for Three Years

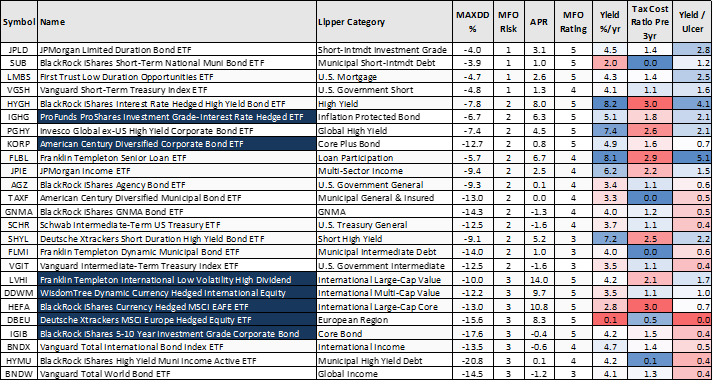

Bucket #2 – Intermediate (three to 10 years) Spending Wants

There’s a essential distinction between MFO Danger and MFO Ranking. MFO Danger relies on threat as measured by the Ulcer Index which is a measure of the depth and length of a drawdown. MFO Danger applies to all funds. MFO Ranking is the quintile score of risk-adjusted efficiency as measured by the Martin Ratio for funds with the identical Lipper Class.

I lately modified my funding technique for Bucket #2 from Whole Return to Earnings as a result of rates of interest are traditionally excessive. Within the desk under, I calculate the Yield to Ulcer ratio to see how a lot threat I could be taking for that earnings. The danger over the previous three years has come from rising charges and the anticipation of a recession which can have remodeled right into a tender touchdown. I anticipate rates of interest to stay comparatively excessive for longer however regularly fall. I favor bonds with intermediate durations.

Bond portfolios ought to be top quality, however riskier bond funds might be added to diversify for larger earnings or complete return. Excessive Yield, Mortgage Participation, and Multi-Sector Earnings funds carry extra threat than high quality bond funds however are sometimes much less dangerous than fairness funds.

A number of Worldwide Fairness Funds make it into Bucket #2 as a result of the valuations are decrease and so they have decrease volatility. Franklin Templeton Worldwide Low Volatility Excessive Dividend Index ETF (LVHI) stands out for having a excessive yield and Yield/Ulcer ratio together with excessive returns, however it’s not significantly tax-efficient.

Bucket #2 is the place I see probably the most alternative over the subsequent 5 to 10 years due to excessive beginning rates of interest. I can be monitoring higher-risk bond funds and income-producing funds to doubtlessly add.

Bucket #2 – Intermediate (three to 10 years) Spending Wants

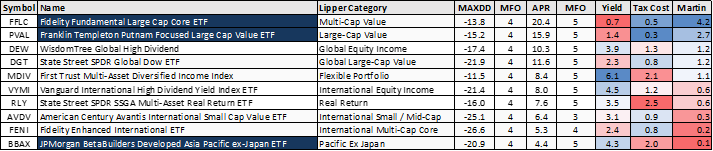

Bucket #3 – Passing Alongside Inheritance, Longevity, Progress

My considerations about Bucket #3 are principally excessive valuations. The theme in Bucket #3 is development at an affordable value. Fairness funds might do nicely in 2025 and 2026 due to tax cuts. I provide fewer funds to contemplate in Bucket #3 as a result of I excluded these with excessive valuations and excessive current volatility.

I used to be considering of shopping for Berkshire Hathaway subsequent yr, however now favor Constancy Basic Massive Cap Core ETF (FFLC) as an alternative.

Bucket #3 – Passing Alongside Inheritance, Longevity, Progress

Closing

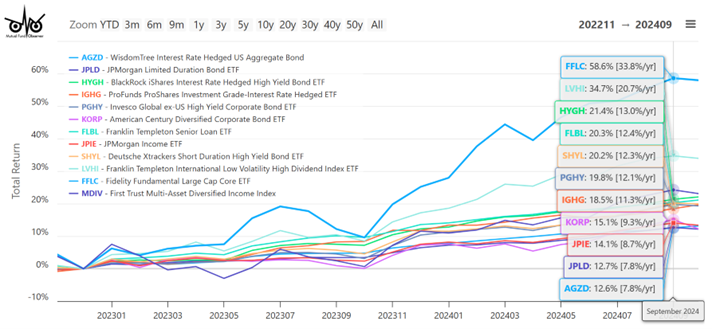

I’ve delayed making some small modifications to my portfolio till subsequent yr with a purpose to maintain taxes decrease in 2024. I plan to make regular withdrawals from riskier investments to decrease my stock-to-bond ratio. Beneath is a chart of Whole Return of a number of the funds that I’m monitoring with probably the most curiosity.

Determine #1: Chosen Creator’s ETF Picks for 2025

I want everybody and productive and nice new yr.