As variable-rate mortgage holders eagerly anticipate the Financial institution of Canada’s first price minimize, fastened charges are heading within the different course: up.

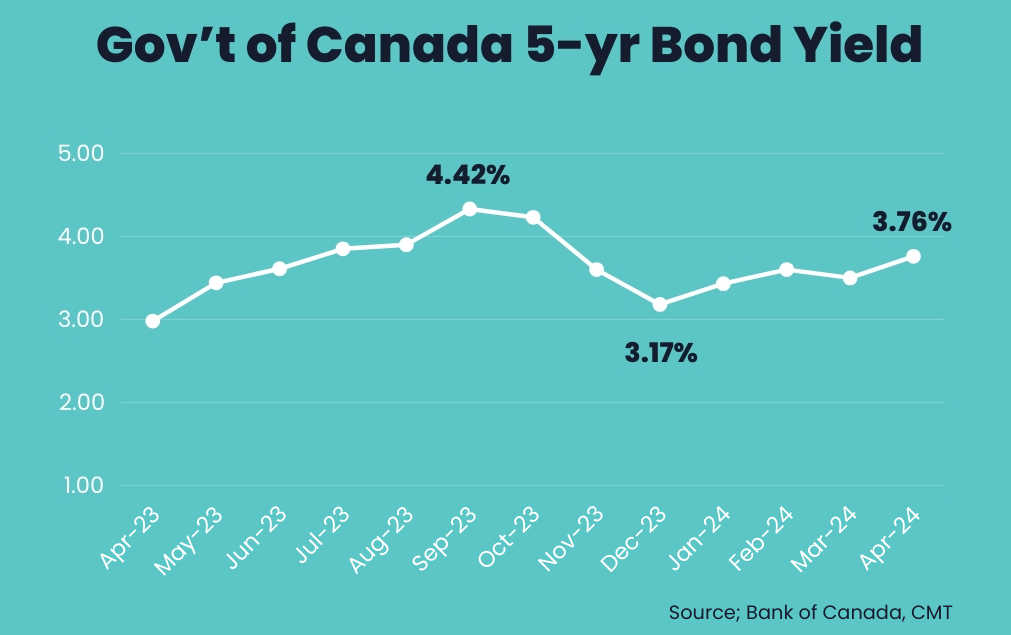

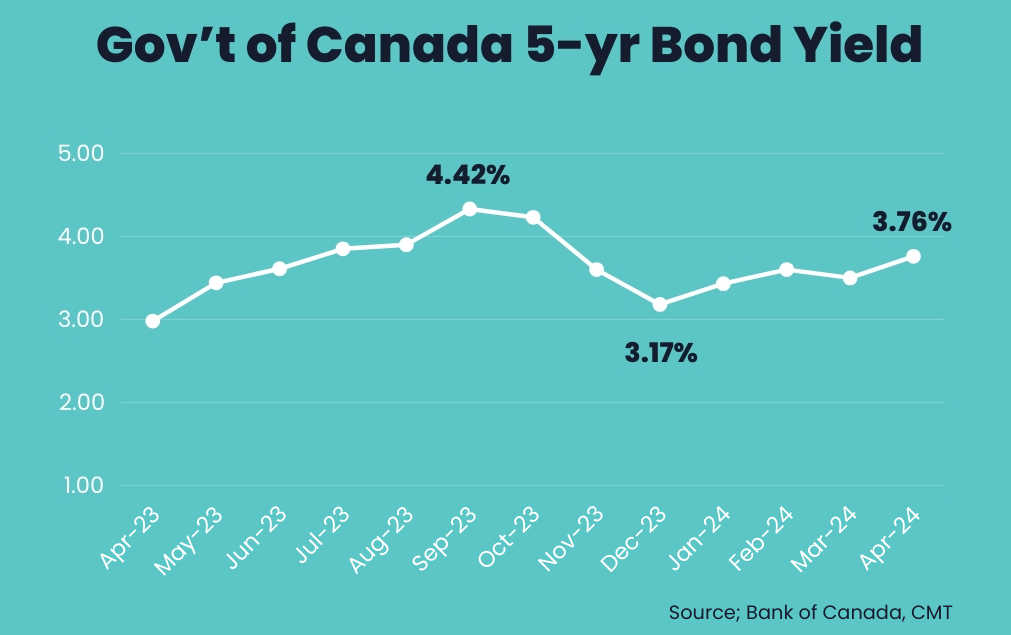

After peaking in early October, Authorities of Canada bond yields—which lead fastened mortgage charges—plummeted by 125 foundation factors, or 1.25 proportion factors, by early January.

Since reaching that low, they’ve rebounded by roughly 60 bps, with round 25-bps value of these positive aspects seen up to now three weeks. Because of this, fastened mortgage charges are being taken alongside for the trip.

Sturdy financial knowledge responsible

Price knowledgeable Ron Butler of Butler Mortgage says 2- to 5-year fastened mortgage charges are up throughout numerous lenders by wherever from 15 to 30 bps in latest weeks.

Butler says the positive aspects are being pushed primarily by latest U.S. knowledge, together with sturdy employment, GDP and inflation figures.

As we reported earlier this month, U.S. CPI inflation in March was up 0.4% month-over-month and three.5% on an annualized foundation. That triggered some economists to invest that U.S. price cuts might get pushed out to later this yr, or probably even till subsequent yr.

On Wednesday, U.S. Federal Reserve Chair Jerome Powell appeared to verify these calls when he mentioned a “lack of additional progress” on the inflation entrance might result in rates of interest staying greater “for so long as wanted.”

In Canada, the place GDP development and employment have held up higher than anticipated, markets nonetheless see the primary Financial institution of Canada price minimize being delivered at both its June or July price conferences, although that may all the time change.

The place might fastened charges go from right here?

Price knowledgeable and mortgage dealer Ryan Sims, who predicted the rise in charges in a CMT column printed earlier this month, thinks fastened charges nonetheless have some room to rise.

“I nonetheless see mortgage charges going up, though I might assume one other 20 to 30 bps would do it,” he informed CMT. “The hole between fastened and variable is an excessive amount of, and the bond market had priced in quite a lot of cuts that I don’t assume will occur for lots longer than folks thought.”

The typical deep-discount 5-year fastened price accessible for insured mortgages (these with a down cost of lower than 20%) is at present round 4.79%. “I believe we see it get to five.29%,” Sims mentioned.

Whereas fastened charges are broadly anticipated to renew their decline as soon as Financial institution of Canada price cuts are imminent, Sims says there’s a wildcard that ought to be thought-about: that fastened charges proceed to rise even because the BoC’s benchmark price falls.

“Canada’s fiscal coverage is in unhealthy form, and I believe you can see authorities bonds, and by default mortgage charges, choose up—no matter [BoC Governor] Tiff Macklem dropping in a single day charges,” he mentioned. Price cuts which can be delivered too quickly might be seen as a “panic transfer” by worldwide markets and assist drive yields greater, he notes.

“Folks overlook that rates of interest are about perceived threat, and after [this week’s] finances, threat in Canada, no less than from an investing perspective, went up,” Sims added. “I might simply see one other 20 to 30 bps into Canada authorities yields over the subsequent 12 to 18 months simply on threat—no matter what in a single day charges really do.”