In the course of the current webinar, Unmasking Fraud in Not-for-Income: 5 Key Schemes and 5 Preventive Steps, we engaged with a whole lot of accounting and finance professionals from not-for-profit entities throughout the nation. People shared their ideas and views on the fraudulent exercise they’re seeing of their organizations and strategies to mitigate threat.

Under are the highest 4 fraud classes that emerged—phishing schemes, bank card fraud, verify fraud and money theft—together with key insights to assist shield your group.

Risk #1: Phishing Scams and Electronic mail Fraud

In lots of phishing schemes, hackers both impersonate an e-mail account or take over a trusted e-mail account, utilizing a number of strategies to steal funds from organizations. The commonest ways embrace:

- Reward Card Scams: These scams sometimes contain social engineering, whereby a fraudster poses as a senior chief and makes an attempt to trick your crew into handing over delicate info with out having to crack your safety techniques. The hacker requests somebody to buy present playing cards for purchasers or colleagues after which asks for the numbers on the again of the playing cards, together with the PINs. As soon as they’ve this info, they shortly use the present playing cards on-line, leaving the group with the bills.

- Pretend Vendor Invoices: The hacker impersonates a vendor and sends a fraudulent bill for cost or makes an attempt to reroute common automated clearing home (ACH) funds. They use a rip-off approach known as typosquatting, the place they register domains that look much like reliable ones however comprise slight variations, equivalent to bankofarnerica.com (utilizing “rn” as an alternative of “m”), to deceive workers.

- Rerouting of Buyer Proceeds: After getting access to a corporation’s e-mail account, often somebody within the accounting division, the hacker sends invoices to prospects. These invoices seem reliable however embrace altered cost directions directing funds to the hacker’s checking account.

How you can Shield Your Group from Phishing Scams

Listed here are just a few methods you may assist your group keep away from falling for phishing scams.

- Implement safety consciousness coaching to assist workers acknowledge phishing makes an attempt and tried fraud.

- Use IT safety measures like Area-based Message Authentication, Reporting and Conformance (DMARC) and DomainKeys Recognized Mail (DKIM) e-mail authentication processes or e-mail filtering. Require multi-factor authentication on all accounts.

- Rent a cybersecurity specialist to conduct penetration testing, also referred to as moral hacking. The specialist will try to hack into a corporation’s system to establish weaknesses in safety protocols.

- Prohibit private e-mail entry on firm units to scale back publicity to malware and phishing assaults.

- Encourage workers to pause and confirm pressing monetary requests—scammers create urgency to control victims.

Risk #2: Credit score Card Fraud

Bank cards are a frequent concern for not-for-profits. The commonest sorts of fraud embrace:

- Unauthorized private purchases: A licensed worker makes use of a company-issued bank card for private objects, both by chance or deliberately.

- Compromised accounts: Hackers acquire an organization bank card’s info and use it for unauthorized purchases on-line or in individual with a cloned bank card.

How you can Shield Your Group from Credit score Card Fraud

Listed here are just a few methods to guard your group from unintended or fraudulent bank card use.

- Restrict the variety of firm bank cards and situation them solely to workers who want them for his or her jobs. Following a regular expense reimbursement coverage could also be a safer course of.

- Set inside insurance policies limiting the quantity workers can spend on a bank card with out prior approval from a superior. Work together with your monetary establishment to set spending limits and service provider restrictions.

- Overview bank card statements month-to-month and require workers to submit receipts or invoices for all purchases. Statements alone could not present sufficient element to tell apart enterprise from private bills.

- Set up clear bank card utilization insurance policies and revoke playing cards from workers who violate them. Small violations can escalate into fraud.

Risk #3: Verify Fraud and Theft

Regardless that paper checks are reducing in recognition, verify theft and fraud stay a risk to organizations. Nevertheless, your group can take steps to scale back the danger.

How you can Shield Your Group from Verify Fraud

With just a few modifications to your processes, you may lower the probabilities of your group experiencing verify fraud.

- Use Constructive Pay: This function, provided by most banks, matches issued checks with these checks being introduced for cost. If particulars don’t match, the financial institution rejects the verify. Seek the advice of together with your financial institution to find out which verify traits they’ll confirm (e.g., payee, quantity, date) and the precise course of they use.

- Cut back reliance on bodily checks and contemplate ACH or an automated cost system that hides account particulars from distributors.

- Carry out well timed financial institution reconciliations to detect fraud early. Assign an worker with out check-signing authority to deal with financial institution reconciliations.

- Require twin signatures on checks above a specific amount. Whereas banks could not implement this requirement, it will increase each actual and perceived fraud detection.

- Observe U.S. Postal Inspector suggestions for mailing checks.

- Drop checks off on the put up workplace.

- Hand envelopes containing checks on to a mail provider.

- Drop checks in a blue United States Postal Service (USPS) assortment field earlier than the final pickup of the day to stop in a single day theft.

- Use gel ink pens, that are extra immune to verify washing.

- Cancel and reissue stale checks. When required, escheat uncashed checks to the state.

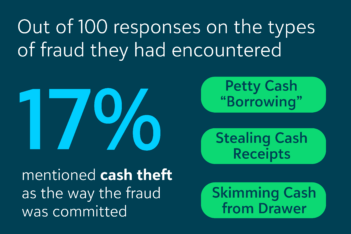

Risk #4: Money Theft

With in-person occasions and volunteers, theft of petty money or donations and register skimming are widespread points for not-for-profits.

How you can Shield Your Group from Money Theft

Listed here are just a few straightforward steps your group can take to restrict the alternatives for money theft.

- Decrease the variety of money assortment containers and places.

- Guarantee money containers are safe and, if potential, inside view of safety cameras. This can help in investigating any theft allegations and reduce the danger of theft by growing the notion of detection.

- Conduct frequent money counts and reconcile to money register listings to detect discrepancies early.

- Be sure that when gathering money donations, there may be all the time multiple worker current.

Key Takeaways

Whereas not-for-profits function with a mission-driven focus, they aren’t resistant to fraud dangers. Being proactive is one of the best protection and there are easy steps organizations can take in the present day. In response to the Affiliation of Licensed Fraud Examiner’s Report back to the Nations, the longer the fraud goes undetected, the better the monetary loss. If stopping fraud is just not potential, detecting it early is essential. By implementing these safeguards, your group can cut back vulnerabilities and make sure that monetary sources stay devoted to your mission.