Worldwide diversification has been an anchor across the necks of balanced buyers for a while now:

Outperformance between America and the remainder of the world has traditionally been cyclical. The most recent cycle has lasted for much longer than any of the earlier iterations.

Simply have a look at how dominant the US has been by way of grabbing market share:

Right here’s what I wrote again in December:

In 20 years of managing cash I’ve by no means witnessed extra dismal sentiment for worldwide shares, worth shares and actually valuations generally.

Buyers I come into contact with have all however given up on these things. I do know you possibly can have stated the identical factor the previous 5-7 years or so but it surely feels just like the dam actually broke this 12 months. Buyers are dropping by the wayside.

Right here’s the factor — worldwide shares have been cheaper than U.S. shares for a while now. There’s not a lot of a tech sector — particularly in Europe — both. So the large query has at all times been: What’s the catalyst? Valuations alone are usually not a catalyst.

I believe it’s doable we glance again on the 2025 insurance policies because the catalyst. President Trump has signaled the U.S. will in the reduction of on our protection presence within the EU. The European international locations are realizing they’re on their very own and wish to vary course.

Germany goes to embark on a large fiscal coverage reform to fill the void (through Bloomberg):

Germany plans to unleash lots of of billions of euros in debt-backed financing for protection and infrastructure investments in a historic shift to overtake its notoriously tight limits on authorities borrowing.

Friedrich Merz, who will probably be the following chancellor, introduced late Tuesday that Europe’s greatest financial system would amend the structure to exempt protection and safety outlays from limits on fiscal spending to do “no matter it takes” to defend the nation. It will permit Berlin to allot primarily limitless quantities of cash to bolster its army.Merz’s conservative bloc and the Social

Democrats of outgoing Chancellor Olaf Scholz — Germany’s essential middle events — additionally agreed to arrange a €500 billion ($528 billion) infrastructure fund for urgently-needed investments in areas together with transportation, vitality grids and housing.

This can be a large divergence from the austerity measures applied by Germany within the 2010s, one of many huge causes the EU has lagged so badly behind the U.S. financial system. Rates of interest are shifting greater. You might additionally see a falling greenback if there may be decrease international funding within the U.S. from new commerce offers and tariffs.

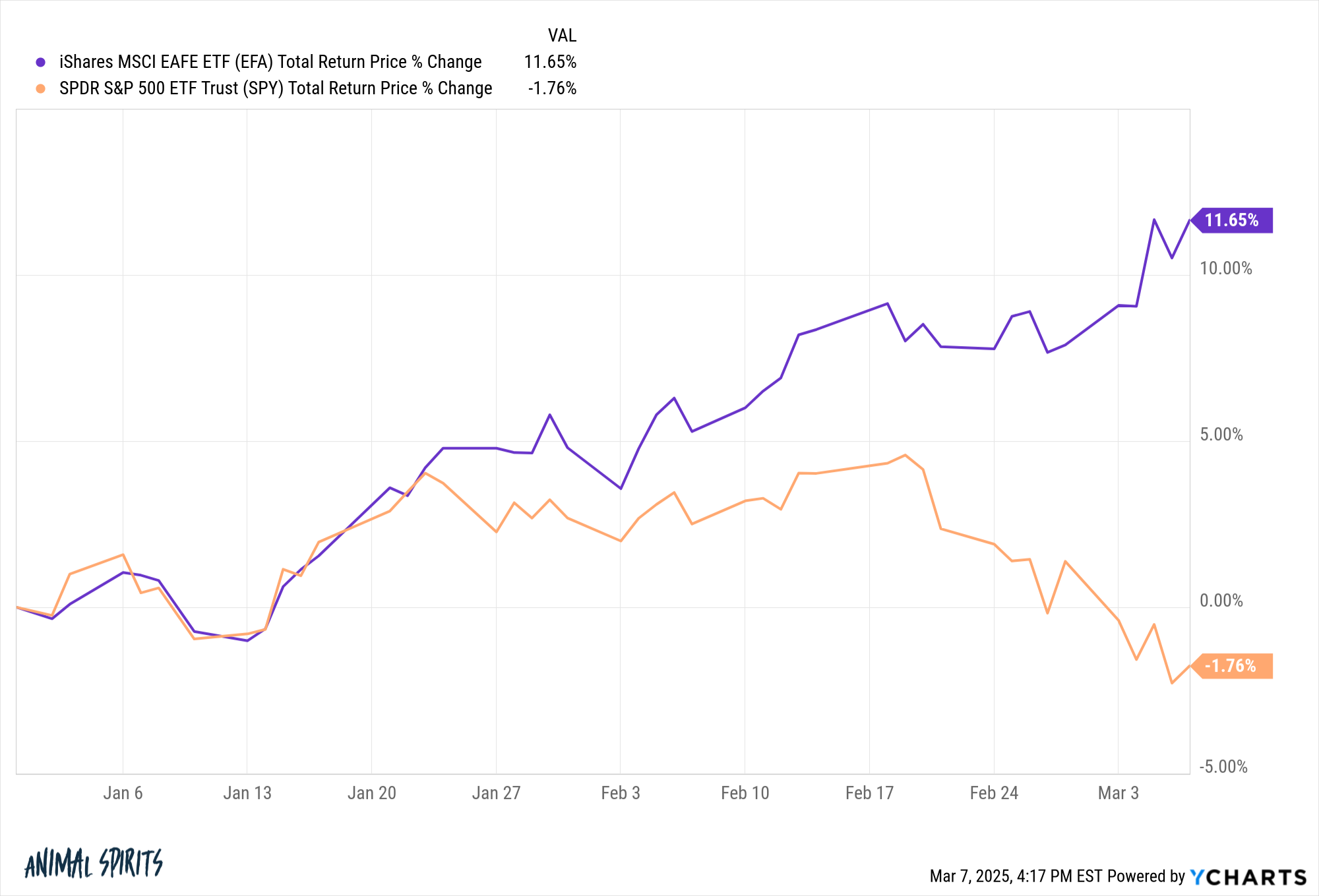

The inventory market is taking discover this 12 months as foreign-developed shares are outpacing the S&P 500 by a wholesome clip:

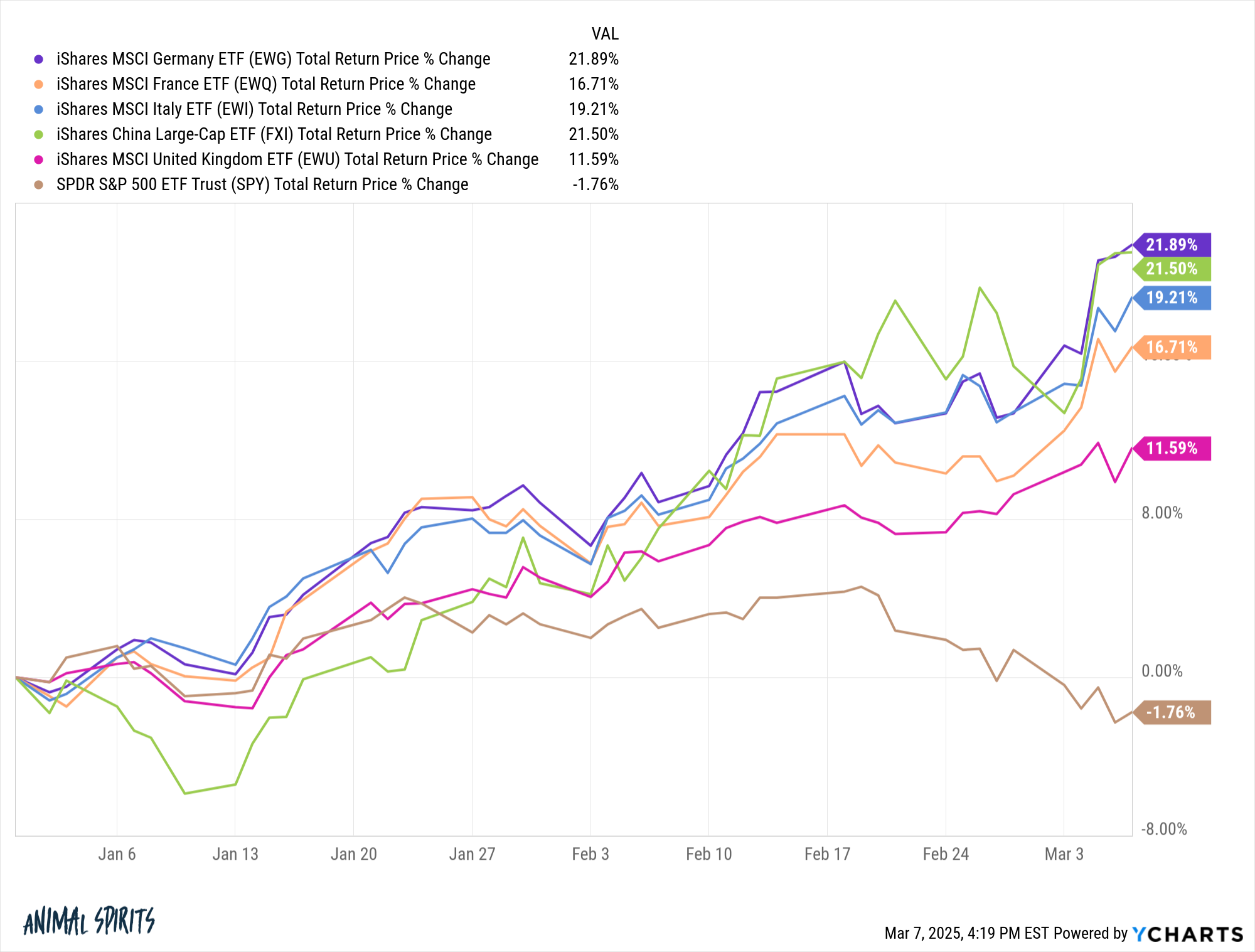

Once you break it down even additional by nation you’ll be able to see a possible breakout occurring right here in sure locations:

Germany goes nuts a bit greater than two months into the 12 months. So are Chinese language shares.

Clearly, that is simply two months of efficiency. Worldwide shares lagged badly final 12 months. Perhaps they’re simply enjoying catch-up now. This may very well be one other headfake in a sequence of headfakes through the years.

Perhaps all of this gained’t matter. Perhaps AI will stay the dominant theme for the remainder of this decade and past. Perhaps all the onerous guidelines and rules and lack of innovation in Europe will make it laborious to maintain the outperformance going ahead.

However there may be lastly a logical path ahead for worldwide shares. There’s a catalyst that truly is smart.

Perhaps I’ll eat these phrases however I’m getting an increasing number of bullish on diversification going ahead.

Michael and I talked about worldwide diversification and far more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Is Europe a Purchase Right here?

Now right here’s what I’ve been studying currently:

Books:

This content material, which comprises security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will likely be relevant for any explicit details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.