(Bloomberg Opinion) —

Now that the inventory market has momentarily stabilized from the shock of President Donald Trump’s “Liberation Day” tariffs, traders have a possibility to replicate on how their portfolio held up through the previous two turbulent weeks. If it sank greater than they anticipated, there could also be larger threat lurking there than they need or can tolerate.

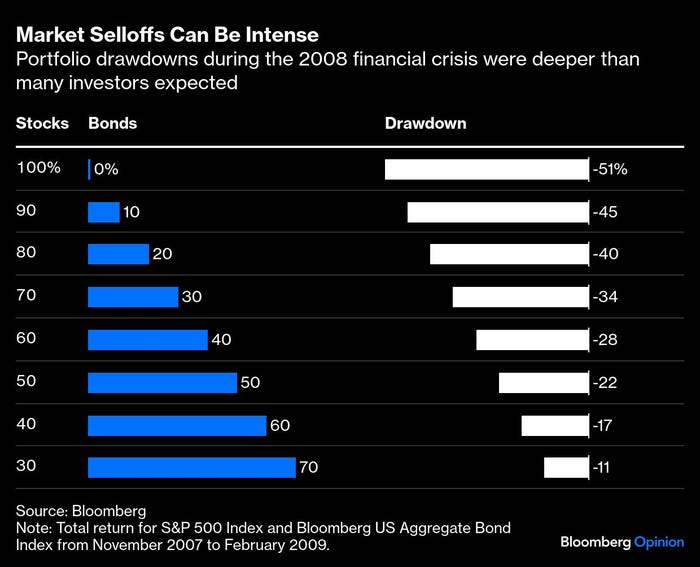

Folks don’t take into consideration threat a lot in a rising market. And after they do, they don’t focus sufficient on the important query: How a lot of my cash will evaporate in a disaster? The reply is greater than you most likely suppose, which explains why many traders had been shocked by the depth of the declines through the 2008 monetary disaster and the Covid pandemic — and even following Trump’s tariff announcement on April 2.

It’s not that traders don’t know that inventory costs transfer in two instructions, or that market selloffs, even extreme ones, are very seemingly momentary setbacks. Sadly, it’s straightforward to overlook when a portfolio is melting amid terrifying speak of an unprecedented, world-changing disaster — a soundtrack that all the time appears to accompany the worst market collapses.

The disaster chatter is so resonant as a result of it rings true. Sure, each disaster is completely different. However it has by no means been completely different within the a method that issues most to traders. Particularly, each disaster has ended with a market restoration, and often earlier than anybody expects.

Nonetheless, navigating a declining market can be simpler if traders had been higher ready for drawdowns. One purpose they’re not is that we discuss threat too abstractly. The dialog is commonly about volatility, which is useful for understanding how investments usually behave. However crises — or disruptions similar to sweeping tariffs which have the potential to set off a disaster — aren’t regular, and commonplace measures of volatility don’t convey forcefully sufficient what occurs in these moments.

The tough actuality is that an funding within the S&P 500 Index will get reduce in half a number of instances throughout an investing profession. There have already been two such episodes since 2000 across the dot-com bust and the monetary disaster. And the older you’re, the extra painful the drawdowns turn into as a result of extra {dollars} are often at stake.

Think about dutifully saving and investing for retirement for many years solely to get up someday to search out that half of your cash has vanished. Even when somebody had been to inform you all the fitting issues in that second — that the market will get well, and that even probably the most extreme selloffs are likely to final solely a 12 months or two — none of it’s prone to be a lot consolation in case your portfolio is down greater than you anticipate or can abdomen.

One more reason traders aren’t higher ready is that they take false consolation from aligning their portfolio with their age. Youthful traders are nudged to personal extra shares no matter their drawdown tolerance, risking that some will abandon the inventory market on the incorrect time if the declines are deeper than they will deal with. Older traders are inspired to allocate much less to shares, however their portfolio can nonetheless be down far more than they anticipate.

Take into account that through the monetary disaster, a portfolio allotted 60% to the S&P 500 and 40% to the Bloomberg US Mixture Bond Index would have been down 28% from November 2007 to February 2009, together with dividends. A extra conservatively postured 40/60 inventory/bond portfolio would have nonetheless been down 17%.

The answer is to construct portfolios with drawdowns particularly in thoughts. Right here’s a straightforward manner to do this: Multiply the primary variety of your proportion allocation to shares by 4 after which 5. The ensuing two numbers symbolize, in proportion phrases, the vary of seemingly decline in a extreme downturn. So, for instance, a 70/30 inventory/bond portfolio needs to be anticipated to say no someplace between 28% and 35% in a nasty storm earlier than it recovers. If that drawdown sounds too intense, cut back your inventory allocation and rerun the numbers till the anticipated drawdown is one you may dwell with.

Threat and return are associated: The decrease a portfolio’s inventory allocation, the decrease its anticipated return as a result of shares often outpace bonds. Buyers are prone to be finest off taking as a lot drawdown threat as they will deal with, however no extra. Those that overestimate their drawdown tolerance and find yourself dumping shares after they’re down would have most likely been higher off with a decrease allocation to shares to start with. I do know a number of traders who offered their shares through the monetary disaster as a result of they had been spooked by the deep declines. The world is collapsing, one warned me. The outdated playbook is out. Ready for a market restoration is a idiot’s sport, he mentioned. The market did get well starting in early 2009, and this investor finally purchased shares once more, however not till costs had been significantly greater than when he offered.

I additionally know traders who offered their shares through the pandemic. That selloff was milder however probably extra harmful as a result of it moved sooner. It took the S&P 500 simply over a month to hit backside in March 2020, and it recovered almost as rapidly. Those that offered because the market dropped had been virtually assured to purchase again at a lot greater costs.

I’ve a sneaking suspicion there are extra surprises forward for the market. The very best safety for traders in opposition to the inevitable bumps and potential crises: Know thyself.

Extra From Bloomberg Opinion:

Need extra Bloomberg Opinion? OPIN <GO>. Or you may subscribe to our day by day e-newsletter.

To contact the creator of this story:

Nir Kaissar at [email protected]