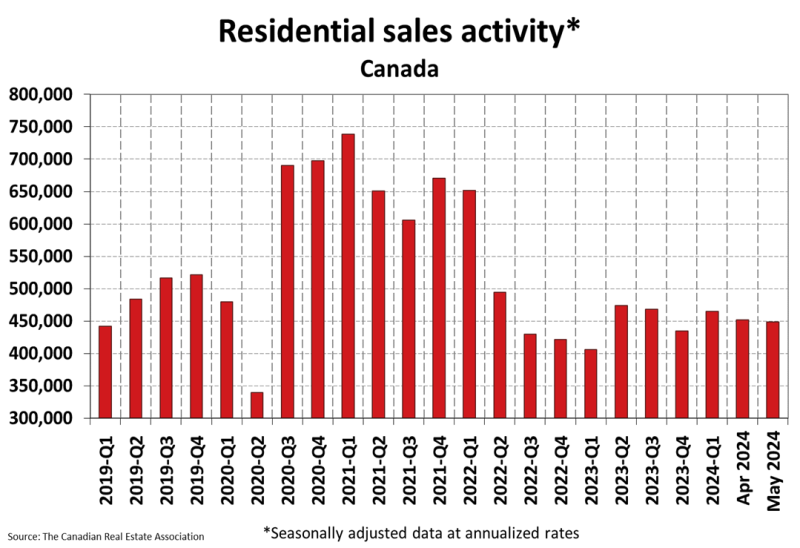

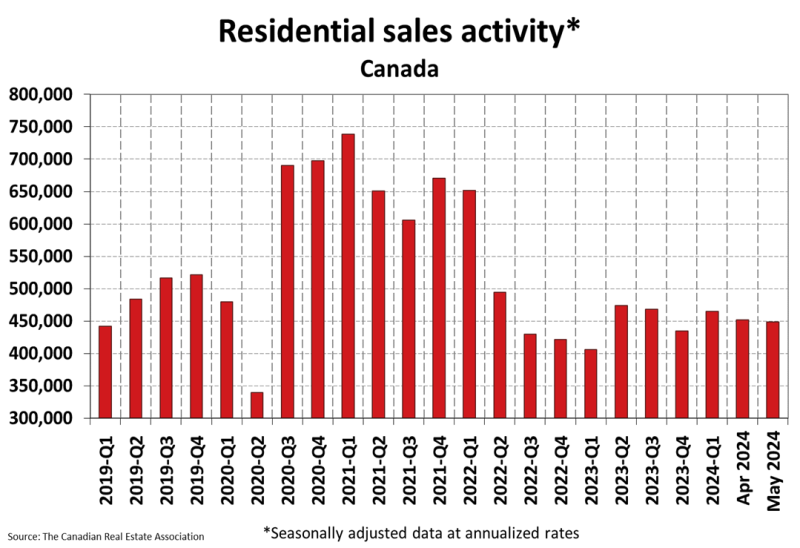

House gross sales slipped in Might and listings continued to construct as potential homebuyers largely remained on the sidelines.

Present residence gross sales within the month had been down 0.6% from April and are down 5.9% from year-ago ranges, in keeping with information from the Canadian Actual Property Affiliation. Gross sales of current properties at the moment are 13% beneath the 10-year common.

“Might’s tepid efficiency saved the narrative of a tender spring promoting season intact, as elevated borrowing prices and Financial institution of Canada uncertainty saved consumers on the sidelines,” famous Rishi Sondhi of TD Economics.

Regionally, weak point within the resale housing market was most pronounced in New Brunswick, the place gross sales posted a 9.4% month-to-month decline, adopted by Saskatchewan (-4.7%), Quebec (-2.4%) and Ontario (-2%).

Whereas consumers stay hesitant about leaping into the market, extra sellers are placing up the ‘on the market’ signal, which led to a 0.5% month-over-month enhance in new listings. This additionally triggered CREA’s months of stock measure to rise to 4.4 from 4.2 in April.

“For his or her half, sellers are behaving as if it’s the spring season, with Might’s modest acquire in listings marking the second straight month-to-month enhance,” Sondhi added.

Nationwide Financial institution Monetary’s Daren King recommended this could possibly be resulting from considered one of two causes.

“This latest rise in listings is likely to be defined by renewed confidence amongst sellers that they’ll have the ability to conclude a transaction in present market situations,” he wrote in a analysis report. “Nevertheless, it is also resulting from rising monetary misery amongst some homeowners, forcing them to place their property up on the market.”

He added that, “Whereas we imagine that this latter phenomenon stays marginal in the intervening time, it is going to be one to observe within the months forward, as we anticipate the deterioration within the Canadian financial system to proceed.”

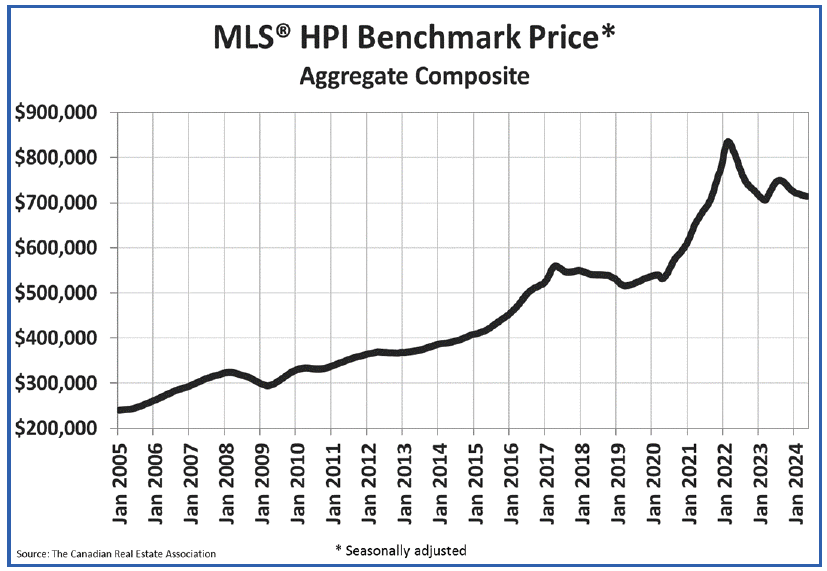

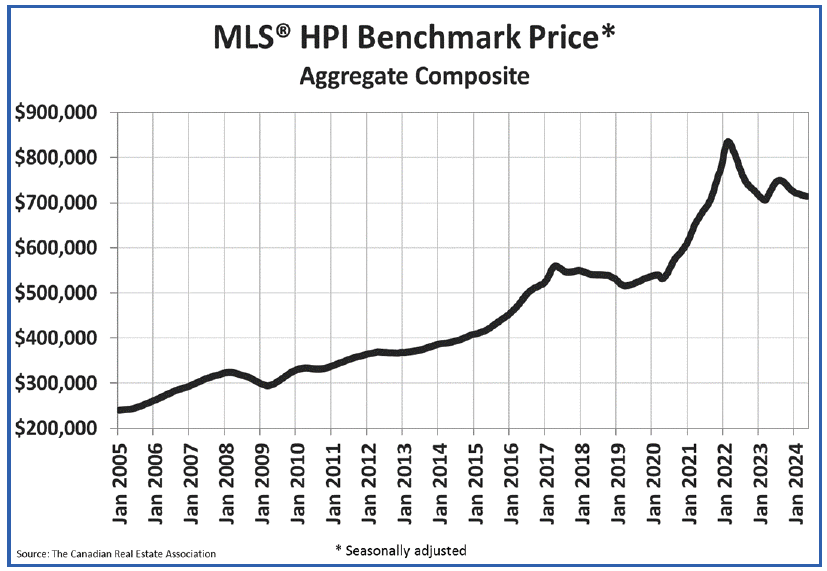

Downward stress on residence costs

The weakening sales-to-new-listings charges, which eased to 52.6% in Might from 53.3% in April, put some downward stress on common costs. The non-seasonally adjusted common nationwide residence value is down 4% year-over-year to $699,117.

The MLS House Worth Index (HPI), which adjusts for seasonality, slipped 0.2% month-over-month and is down 2.4% from a yr in the past.

Anticipate firmer exercise in June following BoC charge reduce

Analysts anticipate exercise to enhance in June with the Financial institution of Canada’s June charge cut probably to supply consumers with extra confidence that charges at the moment are able to fall.

“The Financial institution of Canada’s June 5 charge reduce could have solely been 25 foundation factors, however the psychological impact for a lot of who’ve been sitting on the sidelines was little doubt large,” wrote CREA senior economist Shaun Cathcart.

“We’re anticipating a firmer efficiency in June, amid a decline in bond yields, in step with the sign from the upper frequency information we observe,” added TD’s Sondhi. “Transferring ahead, additional charge aid is probably going within the playing cards [from the Bank of Canada], which ought to set the stage for a stronger second half of 2024.”

Cross-country roundup of residence costs

Right here’s a take a look at choose provincial and municipal common home costs as of Might.

| Might 2024 | Annual value change | |

|---|---|---|

| B.C. | $1,005,056 | -1.2% |

| Ontario | $890,634 | -3.7% |

| Quebec | $520,240 | +5.1% |

| Alberta | $502,625 | +8.3% |

| Manitoba | $371,224 | +3.6% |

| New Brunswick | $306,600 | +10.6% |

| Better Vancouver | $1,187,200 | +2.2% |

| Better Toronto | $1,117,400 | -3.5% |

| Victoria | $874,300 | +0.1% |

| Barrie & District | $807,300 | -1.8% |

| Ottawa | $651,300 | +1.2% |

| Calgary | $587,100 | +9.8% |

| Better Montreal | $534,300 | +3.8% |

| Halifax-Dartmouth | $539,200 | +1.5% |

| Saskatoon | $397,200 | +5.8% |

| Edmonton | $392,700 | +6.1% |

| Winnipeg | $358,300 | +3% |

| St. John’s | $340,900 | +5.8% |

*A few of the actions within the desk above could also be considerably deceptive since common costs merely take the whole greenback worth of gross sales in a month and divide it by the whole variety of items bought. The MLS House Worth Index, then again, accounts for variations in home kind and measurement and adjusts for seasonality.