Whereas non-bank mortgage channels have at all times coexisted with conventional banking, they have been traditionally small niches within the total economic system. That modified after the Nice Recession, when new laws restricted the power of banks to make conventional loans to U.S. center market companies (typically outlined as firms with EBITDA, or earnings earlier than curiosity, taxes, depreciation, and amortization, of between $10 million and $100 million and that are typically thought of too small to entry capital within the broadly syndicated market in a cost-efficient method). ‘Shadow banking’ emerged with unbiased asset managers funded by capital from institutional traders, changing banks as suppliers of secured, first-lien business loans.

The expansion in direct middle-market loans originated by asset managers is partly defined by the expansion in middle-market non-public fairness. These loans are known as ‘sponsor backed.’ Personal fairness sponsors usually want to borrow from asset managers relatively than conventional banks as a result of asset managers provide sooner pace, certainty of execution, and higher financing flexibility.

Efficiency Replace

Every quarter, Cliffwater offers an replace on the efficiency of personal loans in its “Report on U.S. Direct Lending.” Its evaluation depends on the Cliffwater Direct Lending Index (CDLI) an asset-weighted index of roughly 14,800 immediately originated center market loans totaling $315 billion as of December 31, 2023. The CDLI is used globally by institutional traders and asset managers because the index of selection for understanding the return and danger traits of U.S. center market debt. Launched in 2015, the CDLI was reconstructed again to 2004 utilizing publicly obtainable quarterly SEC filings required of enterprise growth firms whose major asset holdings are U.S. center market company loans. Importantly, SEC submitting and transparency necessities get rid of frequent biases of survivorship and self-selection present in different business universe and index benchmarks.

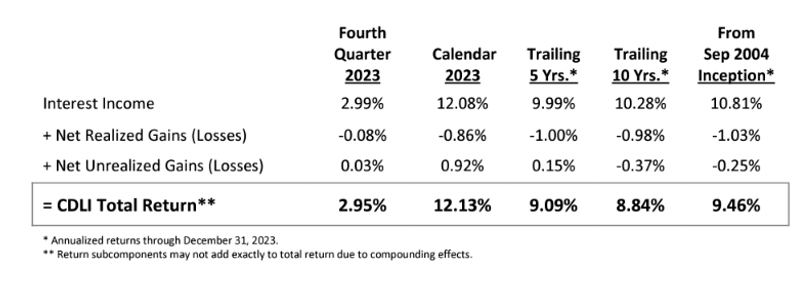

The next desk offers efficiency information for the fourth quarter of 2023 in addition to historic returns:

The CDLI produced a 2.95% whole return within the fourth quarter, bringing the trailing four-quarter whole return to 12.13%. Curiosity earnings rose to 2.99%, which was considerably offset by 0.08% in realized losses for the quarter. Unrealized features equaled 0.03% for the quarter, representing the conversion of prior unrealized losses to realized losses and a reversal of unfold widening. For the trailing 5 and 10 years, the overall return was 9.09% and eight.84%, respectively. Since its September 30, 2004, inception, the CDLI has produced an annualized 9.46% return, unlevered and gross of charges.

Yield to Maturity/Present Yield

Whereas most direct loans within the CDLI have a five- to seven-year said maturity, refinancing and company actions scale back their common life to roughly three years. The CDLI three-year takeout yield fell barely from 12.29% on September 30, 2023, to 12.20% at yr’s finish, primarily as a consequence of a small tightening of spreads. Over the identical interval, the yield to maturity on the Morningstar LSTA US Leveraged Mortgage 100 Index declined barely from 9.68% to 9.63%, and the yield to maturity on the Bloomberg Excessive-Yield Bond Index rose from 8.50% to eight.88%.

Diversification

CDLI Trade Weights as of Dec 2023

The CDLI is very diversified by business group with weights not dissimilar from market capitalization weights for the Russell 2000 Fairness Index however for the absence of a banking sector.

Credit score Threat

Fourth quarter losses diminished returns by 0.05%. For the yr, nevertheless, they added 0.06% to returns. For the trailing 5 years, 10 years, and since inception, the overall losses have been 0.85%, 1.35%, and 1.28%, respectively.

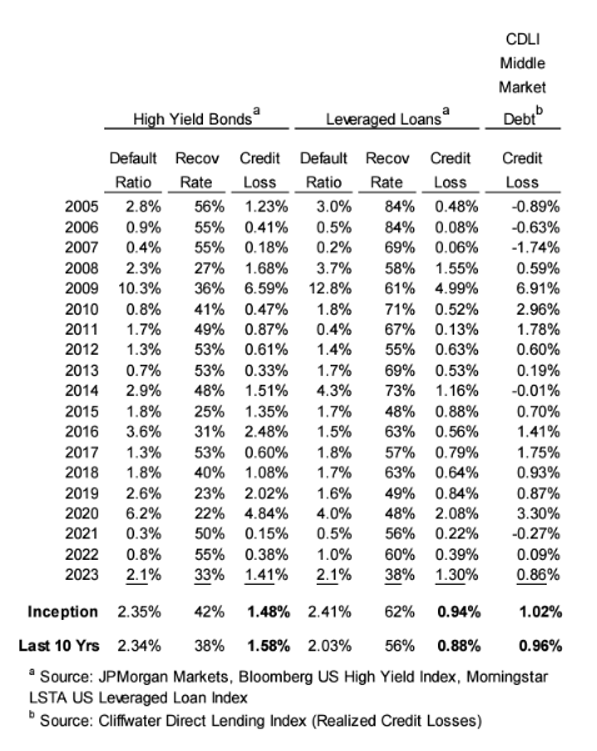

The next desk exhibits the 19-year (2005-2023) historical past of credit score losses for the CDLI in comparison with high-yield bonds and leveraged loans:

The exhibit exhibits that common annual realized credit score losses for center market loans (1.02%), represented by the CDLI, have been barely larger in comparison with leveraged loans (0.94%) however properly beneath credit score losses for high-yield bonds (1.48%) for the complete 19-year interval.

Valuations

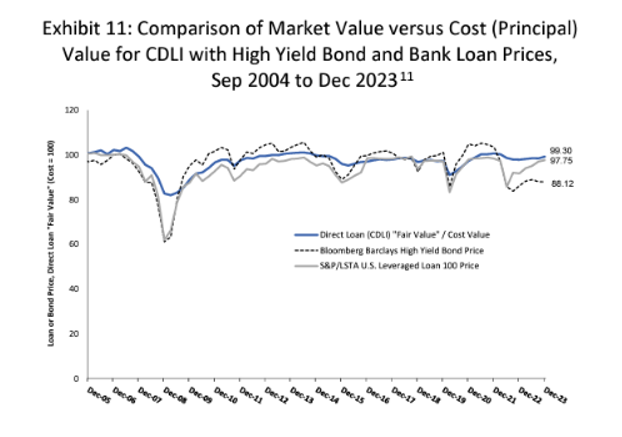

The direct loans within the CDLI are valued quarterly utilizing ‘honest worth’ accounting guidelines, whereas high-yield bonds and financial institution mortgage costs are market decided. Regardless of differing sources for worth, the exhibit beneath exhibits that direct mortgage valuation follows the high-yield bond and financial institution mortgage markets, although with considerably much less volatility.

Historic Returns to the CDLI

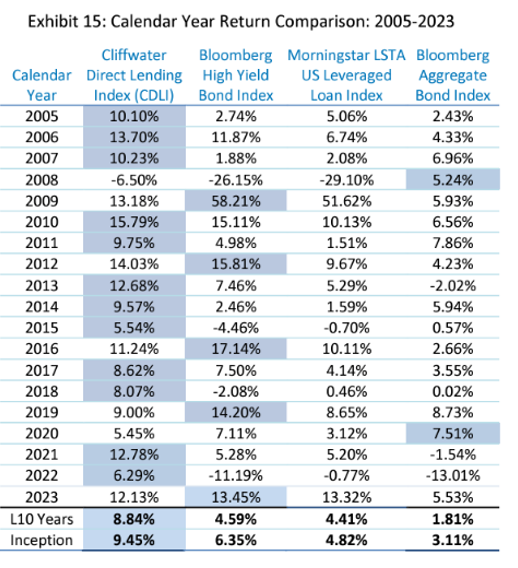

The next exhibit compares CDLI calendar-year returns to high-yield bonds, syndicated loans, and investment-grade bonds. The asset class with the best calendar yr return is highlighted.

Senior-Solely Direct Loans (CDLI-S)

The CDLI-S is comprised of solely senior loans inside the CDLI. It was created in 2017 to handle the comparative efficiency of senior center market loans and the complete universe of center market loans represented by CDLI. CDLI-S follows the identical building methodology as CDLI however consists of solely loans held by managers of enterprise growth firms which have an funding type Cliffwater has decided clearly focuses on senior secured loans. Cliffwater generates the identical quarterly efficiency and portfolio information for CDLI-S that’s obtainable for CDLI besides that the start date is September 30, 2010, for CDLI-S in comparison with September 30, 2004, for CDLI. The shorter historic sequence for CDLI-S is attributable to the post-2008 introduction of most senior-only direct lending methods. As with the CDLI, CDLI-S mustn’t undergo from biases (backfill and survivorship) present in different databases as a result of all supply information comes from required SEC filings.

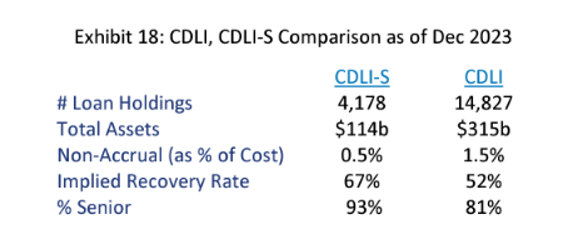

As seen within the desk beneath, loans within the CDLI-S are typically represented by bigger, sponsored debtors with a observe document of decrease realized losses and a decrease price of nonaccrual standing.

The next tables evaluate the efficiency of the CDLI and CDLI-S from the inception of the CDLI-S in September 2010. As you’ll anticipate, whereas the CDLI-S offered enticing returns (8.23%) regardless of the a lot decrease credit score losses, its efficiency was beneath that of the CDLI (9.76%), as danger and the ex-post return have been associated.

Charges

In its 2023 payment survey for funding administration companies for center market company lending overlaying 58 of the biggest direct lending corporations managing $924 billion in direct lending property, Cliffwater discovered:

Administration charges and administrative bills for direct lending non-public funds averaged 3.94%, up from 3.56% of their 2022 research. The three.94% common of charges and bills was composed of 1.96% in administration charges, 1.50% in carried curiosity (efficiency payment), and 0.48% in administrative bills. The 0.38% year-over-year improve in the price of direct lending was principally as a consequence of an increase in reference rates of interest and wider credit score spreads, boosting carried curiosity costs. Administration charges and carried curiosity schedules remained comparatively unchanged year-over-year.

The 58-firm research group used 1.12x common leverage, held 87% first-lien loans, and loaned to debtors who have been 82% sponsor-backed, with a mean EBITDA of $74 million. Supervisor use of portfolio leverage and higher publicity to decrease middle-market or non-sponsor debtors have been related to larger charges, whereas higher publicity to first-lien sponsor-backed loans was related to decrease charges.

Charges (excluding administrative bills) as a share of web property assorted significantly throughout managers, starting from 2.64% (tenth percentile) to 4.32% (ninetieth percentile).

To entry the asset class, contemplate the Cliffwater Company Lending Fund (CCLFX) as a result of it compares favorably to the excessive business charges. Its bills are properly beneath these of the common fund, it costs on web (not gross) property, and it doesn’t cost any incentive charges. Different causes embody a robust due diligence course of in its supervisor choice, its excessive credit score requirements (specializing in senior secured loans backed by non-public fairness corporations), and broad diversification throughout managers with lengthy observe information in particular industries.

Up to date Efficiency of CCLFX Versus Day by day Liquid Funds

From July 2019 by December 2023, the fund returned 9.15% every year. By comparability, liquid loans, as represented by the SPDR Blackstone Senior Mortgage ETF (SRLN), the biggest fund of its type with AUM of $5.7 billion, returned 3.81% every year; the index fund specializing in senior secured floating price financial institution loans, Invesco Senior Mortgage ETF (BKLN) with $7.4 billion in AUM, returned 3.62%; and investment-grade bonds, as represented by the iShares Core U.S. Combination Bond ETF (AGG) with $104.2 billion in AUM, returned -0.13% every year.

For traders who don’t want liquidity for at the least some portion of their portfolio (which is true of most traders), this can be a worthwhile commerce—whereas not precisely a free lunch, it’s at the least a free cease on the dessert tray. For instance, contemplate the retiree who’s taking not more than their required minimal distribution (RMD) from their IRA account. Even at age 90, the RMD is just not even 10%, and interval funds are required to fulfill liquidity calls for of at the least 5% each quarter. For such an investor, the illiquidity premium is price contemplating.

Investor Takeaway

Traders who search larger yields and comparatively low danger, and who’re keen to sacrifice liquidity, will discover enticing alternatives in interval funds that spend money on senior secured, sponsored center market loans.

Larry Swedroe is head of economic and financial analysis for Buckingham Wealth Companions, collectively Buckingham Strategic Wealth, LLC and Buckingham Strategic Companions, LLC.

For informational and academic functions and shouldn’t be construed as particular funding, accounting, authorized, or tax recommendation. Sure data relies on third social gathering information and will turn into outdated or in any other case outdated with out discover. Third-party data is deemed dependable, however its accuracy and completeness can’t be assured. The opinions expressed listed below are their very own and will not precisely replicate these of Buckingham Strategic Wealth, LLC or Buckingham Strategic Companions, LLC, collectively Buckingham Wealth Companions. Neither the Securities and Trade Fee (SEC) nor every other federal or state company have permitted, decided the accuracy, or confirmed the adequacy of this text. LSR-23-617