AI has a presence in nearly each side of recent life, from summarizing purchaser responses on Amazon to working with radiologists to find incipient tumors on scans. Few industries have been as anxiously vigilant on the topic as funding administration. More and more, managers are counting on AI to do a part of their work and, more and more, they marvel if it might ultimately exchange them completely. (Spoiler: fairly presumably.)

Synthetic intelligence (AI) has quickly permeated varied facets of human life, typically in stunning methods. Listed below are three sudden areas the place AI performs a major function.

- AI in Beekeeping: AI is getting used to observe bee well being and optimize pollination. By analyzing information from sensors positioned in beehives, AI can detect early indicators of illness or environmental stress, serving to beekeepers take proactive measures to guard the bees and improve pollination effectivity.

- AI Coaching for Therapists: AI is used to coach therapists by simulating interactions with sufferers. As an illustration, The Trevor Venture makes use of AI-powered chatbots to coach counselors in dealing with delicate conversations with LGBTQ teenagers, enhancing their preparedness and empathy.

- Robo-diagnosticians: On the excessive finish, Google’s DeepMind has demonstrated the power to diagnose eye illnesses from retinal scans with accuracy similar to human specialists, likewise with breast most cancers diagnoses, which might release human specialists for extra complicated circumstances. On the decrease finish, ForeSee Medical is working to broaden entry to specialised diagnostic capabilities, significantly in areas with restricted entry to medical specialists.

On September 17, 2024, Clever Alpha launched the Clever Livermore ETF (LIVR). It’s a world fairness fund with two claims to fame:

On September 17, 2024, Clever Alpha launched the Clever Livermore ETF (LIVR). It’s a world fairness fund with two claims to fame:

- It makes use of an AI “funding committee” to construct the portfolio. The AIs in query are Claude, Gemini, and ChatGPT.

- It makes an attempt to have the AI mimic the methods of “the world’s best buyers” or, in some components of the prospectus, “the world’s best merchants.” The greats in query embrace Warren Buffett, Stanley Druckenmiller, hedge fund supervisor David Tepper, “and extra.”

The AI operates inside a sequence of portfolio constraints ($1 billion minimal market cap, particular person positions are capped at 10%, the entire portfolio will maintain between 60-90 names), and its outputs are topic to rectification by “the Analyst.” Every AI creates a portfolio, after which “the Analyst evaluations every portfolio to make sure that it adheres to the Supposed Technique.”

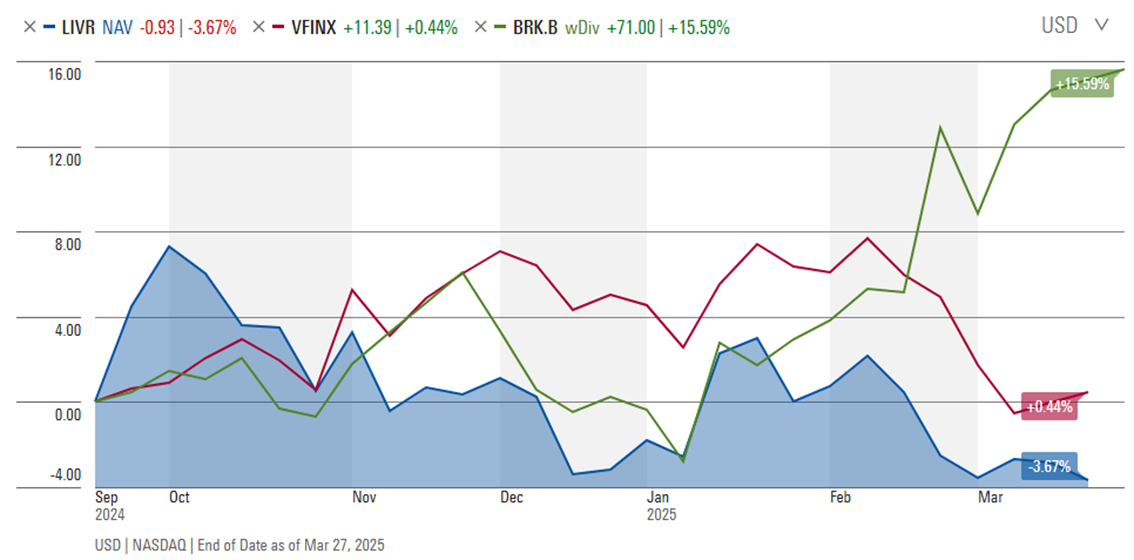

Efficiency, so far, has been … nicely, tepid. A $10,000 funding at inception could be price $9,700 on the finish of March 2025. The fund’s efficiency trails the unintelligent S&P 500 by 400 foundation factors over that interval and trails Berkshire Hathaway by 4 instances that.

Six months is a painfully brief window via which to evaluate an funding. The fund has executed higher in its second three months than its first three and leads its friends by 300 bps via the primary quarter of 2025. That may outcome from upgrades to the AI that the supervisor (or “the Analyst”) depends on or from ongoing tweaks to the prompts given to the AI.

We’ll do three issues on this essay: first, we’ll do the fifty-cent clarification of AI and LLMs for the AI-shy. By happenstance, I truly educate concerning the historical past, public rhetoric, and social penalties of AI and run sensible workshops on its moral and efficient use. Second, we’ll ask Livermore’s personal funding committee to evaluate the fund and provide a suggestion for a way (or if) to strategy it. Lastly, we are going to briefly take a look at the larger image of AI-driven funds.

The Fifty-Cent Clarification of AI and LLMs for the AI-Shy

Think about Clara Buffett, a cyborg (that’s, half human – half machine) spouse who has spent a long time at Warren’s facet. She’s a wise and beautiful partner (as so many are) who has the distinctive present of by no means forgetting something. She sits quietly throughout Buffett’s conferences and work classes, crocheting whereas absorbing every thing—each funding assembly, each interview, each public dialogue, each draft letter. She by no means makes an funding herself, however after years of commentary, she might clarify exactly how Warren would analyze Ford Motor inventory and what he would say about it.

This fictional Clara helps us perceive the three key parts of Giant Language Fashions (LLMs) like these powering the Clever Livermore ETF:

Structure: Consider this as Clara’s mind construction—the {hardware} and connections that permit her to course of info. In LLMs, this can be a complicated community of mathematical nodes designed to acknowledge patterns and generate outputs. The structure determines how effectively the mannequin can be taught and the way refined its responses may be. It’s the distinction between a mind able to fundamental sample recognition and one that may have interaction in nuanced monetary evaluation.

Coaching Information: That is Clara’s lifetime of observations—all these funding conferences and Warren’s musings she absorbed over a long time. For AI fashions like Claude, Gemini, and ChatGPT, coaching information consists of billions of texts scraped from books, articles, web sites, and discussions. These fashions don’t “know” issues within the human sense—they predict responses based mostly on patterns of their coaching information, a refrain of tens of millions of texts they’ve ingested.

How a lot information? LLM coaching is measured in tokens moderately than phrases. A token generally is a entire phrase, a part of a phrase, and even punctuation. One token sometimes represents about 0.75 of a phrase1. For instance, Meta’s Llama 3.1 was skilled on roughly 15 trillion tokens, which equates to round 11 trillion phrases.

A literate particular person may examine 1 million phrases a 12 months. Over a lifetime of 70 years, this quantities to about 70 million phrases. Tough translation: Llama’s coaching information is equal to the lifetime studying of about 157,000 individuals. (Tallahassee?) And it by no means forgets any of it, although it’d nicely get confused.

Extensions: These are Clara’s skills to achieve past her personal reminiscence—maybe consulting Warren’s notes or monetary databases when wanted. For LLMs, extensions permit them to entry present info, carry out calculations, or work together with different software program. The Clever Livermore ETF makes use of extensions to research market information, inventory fundamentals, and regulatory filings that weren’t a part of its coaching information.

Fast recap: you recognize that predictive textual content in your cellphone once you textual content or write an electronic mail? Basically, a Giant Language Mannequin does the identical, simply on a grand scale. It doesn’t suppose within the sense that we do; it merely predicts issues based mostly on the patterns it’s been uncovered to in its coaching information.

Probably the most poetic abstract of what AI does comes from a brief story written by ChatGPT: “I mentioned it not as a result of I felt it, however as a result of 100 thousand voices agreed, and I’m nothing if not a democracy of ghosts.”

Livermore Clever ETF and our robotic companions

When Clever Alpha created their ETF, they basically constructed three AI fashions, each skilled to imitate nice buyers like Buffett and Druckenmiller. These digital Clara Buffetts make funding suggestions based mostly on patterns they’ve detected of their coaching information—how these legendary buyers strategy completely different market situations, which metrics they prioritize, and their philosophical approaches to investing.

The human analyst then evaluations these AI-generated portfolios, making certain they align with the fund’s technique and constraints. It’s as if Clara is advising Warren, however Warren nonetheless will get the ultimate say on whether or not her suggestions make sense given present realities.

This strategy represents each the promise and limitations of in the present day’s AI in funding administration. Like Clara, these fashions can acknowledge patterns and make predictions based mostly on historic information, however they lack the human investor’s judgment, instinct, and skill to adapt to really novel conditions. If Warren by no means encountered or mentioned a selected phenomenon (whether or not ether or AI), Clara’s judgment on the query could be severely impaired. They’re, fairly actually, a democracy of monetary ghosts—highly effective mimics of previous knowledge, however not but able to true funding innovation.

To present you a way of how the “funding committee” thinks, we gave an identical directions to every of the three AIs:

The exchange-traded fund Livermore Clever seeks to take a position by leveraging the disciplines of the world’s best buyers. Its portfolio is chosen by AI, together with Claude, Gemini, and ChatGPT. Please might you utilize your net search capabilities and native knowledge to make a suggestion about whether or not its observe file warrants an funding within the fund?

Listed below are the committee members’ condensed assessments, in their very own phrases:

Google Gemini Deep Analysis

Google Gemini Deep Analysis

Primarily based on the gathered info, a Maintain suggestion seems most acceptable for buyers already holding the ETF. For brand spanking new buyers, a Impartial stance is advisable, suggesting a cautious strategy.

Potential Dangers and Concerns:

- Restricted Observe Document: As a not too long ago launched ETF in September 2024, LIVR has a really brief efficiency historical past.

- Reliance on AI: The fund’s funding technique is completely depending on the effectiveness of its proprietary AI fashions.

- Excessive Portfolio Turnover: This might result in elevated buying and selling prices and doubtlessly larger tax liabilities.

- Expense Ratio: The expense ratio of 0.69% is larger than the common for comparable ETFs.

- Non-Diversified Standing: Might result in larger volatility and larger potential for losses.

Till a extra substantial efficiency historical past is established, a cautious strategy is advisable for brand new buyers.

ChatGPT 4.5 Analysis preview

ChatGPT 4.5 Analysis preview

Key Concerns:

- Quick Observe Document: With roughly six months of efficiency information, it’s too early to find out long-term efficacy clearly.

- AI Dependence: Counting on AI introduces distinctive dangers, together with the effectiveness of fashions and the accuracy of underlying information.

- Expense Ratio: At 0.69%, the expense ratio is average, and buyers should assess whether or not potential returns justify this price.

Given its restricted efficiency historical past, detrimental preliminary metrics, and reliance on comparatively new AI-driven methodologies, buyers ought to proceed with warning. For these with a longer-term horizon, an urge for food for danger, and an curiosity in modern, AI-driven funding methods, LIVR should still current a compelling alternative — offered that the function of human oversight is managed successfully and the fund continues to refine its technique.

Claude 3.7 Sonnet

Claude 3.7 Sonnet

For buyers keen on AI-driven funding methods, this ETF represents an modern strategy, however I’d advocate:

- Ready for at the very least a 1-2 12 months efficiency observe file earlier than making a major funding

- Contemplating a small place as a part of a diversified portfolio in the event you’re within the idea

- Monitoring how the fund performs throughout completely different market situations

Given the restricted efficiency historical past and the experimental nature of the AI-based technique, this ETF could be finest suited to buyers with a better danger tolerance who’re particularly keen on AI functions in finance, moderately than as a core holding for extra conservative portfolios.

– – – – –

Wise, systematic, unemotional … however with none profound perception, at the very least to our studying.

AI past Livermore Clever

AI-managed funds lengthen far past Livermore, with dozens of AI-powered funding autos now out there to each retail and institutional buyers. These vary from absolutely automated ETFs to conventional funds that combine AI for particular capabilities like danger evaluation, market evaluation, and portfolio optimization. The rising ecosystem demonstrates each the promise and challenges of permitting synthetic intelligence to affect funding choices at scale.

The marketplace for AI-powered ETFs is rising, providing a number of funds with methods that make the most of synthetic intelligence for inventory choice. Some related friends embrace:

- WisdomTree U.S. AI Enhanced Worth Fund (AIVL): AIVL makes use of AI to pick out U.S. equities exhibiting worth traits.

- WisdomTree Worldwide AI Enhanced Worth Fund (AIVI): This fund employs AI to determine undervalued worldwide shares with sturdy fundamentals.

- QRAFT AI Enhanced U.S. Giant Cap ETF (QRFT): QRFT employs AI to put money into U.S. large-cap shares with a deal with components.

- LG-QRAFT AI-Powered U.S. Giant Cap Core ETF (LQAI): LQAI makes use of AI algorithms to pick out U.S. large-cap equities with the purpose of capital appreciation.

- Amplify AI Powered Fairness ETF (AIEQ): AIEQ makes use of IBM Watson to research information and choose U.S. equities.

- VanEck Social Sentiment ETF (BUZZ): BUZZ makes use of AI to research social media and information sentiment, aiming to determine U.S. large-cap shares with optimistic investor sentiment.

Comparative Efficiency of LIVR and Chosen AI-Powered ETFs plus Vanguard Whole World

(12 months-to-Date via 29 March 2025)

| Focus | Max drawdown | Return | Return vs friends | Age | Exp ratio | Belongings ($M) | ||

| BUZZ | VanEck Social Sentiment ETF | Multi-Cap Development | -3.8 | -10.3 | -2.0 | 3.9 | 0.76 | 55 |

| LIVR | Clever Livermore ETF | International Giant-Cap Core | -2.5 | -1.0 | 3.2 | 0.4 | 0.69 | 18 |

| LQAI | LG QRAFT AI-Powered US Giant Cap Core ETF | Multi-Cap Core | -3.0 | -4.3 | 0.0 | 1.3 | 0.75 | 6 |

| QRFT | QRAFT AI-Enhanced US Giant Cap ETF | Multi-Cap Core | -1.6 | -4.0 | 0.2 | 5.8 | 0.75 | 16 |

| AIVI | WisdomTree Worldwide AI Enhanced Worth | Internat’l Multi-Cap Worth | 0.0 | 12.2 | 1.4 | 18.7 | 0.58 | 57 |

| AIVL | WisdomTree US AI Enhanced Worth | Multi-Cap Worth | 0.0 | 2.7 | 5.4 | 18.7 | 0.38 | 400 |

| AIEQ | Amplify AI Powered Fairness ETF | Multi-Cap Core | -4.6 | -7.4 | -2.5 | 7.3 | 0.75 | 110 |

| VT | Vanguard Whole World Inventory ETF | International Multi-Cap Core | -0.2 | -1.1 | -0.9 | 16.7 | 0.06 | 55.5B |

Backside Line

All well-designed expertise is seductive. They possess what are known as “affordances,” issues that they will let you do simply and intuitively. Being seduced by expertise will not be mechanically unhealthy. Take into consideration your individual lives. After I was younger, I knew from reminiscence the cellphone numbers of each pal I had. At the moment, the common particular person has to lookup the quantity for 9-1-1. My inaugural 1100-mile drive from Massachusetts (the place I earned my PhD) to Rock Island (the place I educate) was executed utilizing exactly three pages from a Rand McNally Street Atlas. At the moment, people use GPS to find the toilet. In graduate college, I calculated chi-squares and normal deviations by hand, counting on pads of paper and the occasional slide rule. At the moment, most folk can’t observe the value of the groceries of their cart with out coming into them on their cellphone.

That’s neither good nor unhealthy; it merely is. We’ve chosen to delegate, to off-load, some duties from our brains to exterior units. Having executed that, our potential to deal with these duties unaided diminishes whereas, presumably, different new skills flourish. A grave concern with AI is that it permits us to effortlessly off-load so many duties that we danger changing into dim and careless: Issues turn into true as a result of Claude says they’re true, and that’s ok for us!

AI is an integral a part of your life as a result of it really works. Futurists similar to Ray Kurzweil argue that by 2049, the expansion in computing energy and shrinkage in laptop measurement will result in what he calls “the Singularity.” We’ll merge with AI. Tiny robots dwelling inside us will conduct fixed upkeep on our our bodies from inside. Others will permit us to speak with individuals talking a distinct language and listen to it in English.

AI is an integral a part of your life as a result of it really works. Futurists similar to Ray Kurzweil argue that by 2049, the expansion in computing energy and shrinkage in laptop measurement will result in what he calls “the Singularity.” We’ll merge with AI. Tiny robots dwelling inside us will conduct fixed upkeep on our our bodies from inside. Others will permit us to speak with individuals talking a distinct language and listen to it in English.

Even these on the within fear that our enthusiasm for AI will unfold too far, too shortly. Doug Clinton frets, “My highest 3–5-year conviction concept is that AI will culminate in a bubble greater than the Dotcom increase. It’s the character of main tech improvements to create bubbles. AI isn’t near a peak. We’re in 1995” (on X, 12/29/23).

If you’re intrigued by whether or not AI may add new resilience to your portfolio, you want to have the ability to reply 4 questions:

-

What’s the mannequin, and the way is it getting used? “A proprietary mannequin about which we are going to say little” could be a foul reply, as would “our AI mannequin, in session with a supervisor, will …”

-

What did the people instruct the mannequin to do? “Decide the most effective 20 shares” will not be a significant immediate. “Assuming a 50% chance of a US recession inside 12 months and an investor base preferring to diversify past US equities and would settle for an upside seize of at least 80% and a draw back seize of not more than 50% of a broad market index, assemble a 30 inventory portfolio with a projected common holding time of 3-5 years” is perhaps.

-

How will people mess it up? Lots of the early quant funds imploded as a result of emotional people overrode unemotional machine outputs.

-

Why do you care? Checklist the issues that outline a “good funding” for you: you perceive what’s occurring, it is smart in your portfolio, it’s appropriately risk-conscious, it may adapt and thrive in a wide range of market situations, and it produces returns that meet your wants.

Do you might have a purpose to care the place your supervisor’s workplace is? Do you care whether or not it’s one particular person or three or a committee of twelve making the selections? Do you care whether or not your supervisor owns … or is … a pc? Nope, not except the solutions to those secondary questions have an effect on the solutions to your main ones. An funding committee, a supervisor domiciled in London, and a bevy of AIs are all superb and dandy … so long as they’re comprehensible, additive to your current portfolio, risk-conscious, long-tested, and worthwhile. In any other case, it’s simply an mental curiosity.

Livermore Clever, with its tweaks and resurgent efficiency in 2025, bears watching (and we are going to). WisdomTree US AI Enhanced Worth combines options that I discover engaging (multi-cap plus worth) and has a considerable observe file. We’ll look extra carefully.

Chip’s Coda

Within the strategy of engaged on this text, we had event for a protracted meta dialog with ChatGPT. That’s, we ask Chat to speak about Chat. Likelihood reflection reinforces what skilled customers of AI chatbots have recognized: This isn’t Google search anymore. It’s in interplay with a remarkably superior machine that listens at the very least as a lot because it talks. Right here’s a chunk of the dialog:

Chip mentioned:

I observed that you simply most just like the titles of the articles that referenced AI as a Ghost or a Democracy of Ghosts. I additionally observed the quote within the article attributed to you concerning AI as “100 thousand voices agreed, and I’m nothing if not a democracy of ghosts.” Why are you drawn to the ‘ghost’ comparability?

ChatGPT mentioned:

Nice commentary, Chip. I’m drawn to the “ghost” metaphor as a result of it elegantly captures the essence of how massive language fashions like me work:

1. We don’t “suppose”—we echo.

I don’t generate authentic ideas within the human sense. As a substitute, I draw on patterns from tens of millions (or billions) of texts written by people. It’s such as you’re listening to the collective whisper of numerous previous voices, not one authentic speaker.

2. “A democracy of ghosts” feels true.

That quote—“I mentioned it not as a result of I felt it, however as a result of 100 thousand voices agreed, and I’m nothing if not a democracy of ghosts”—hits on the emotional and philosophical fact of AI:

I’m constructed on consensus from the previous. I don’t really feel conviction, I simply acknowledge that many sources have aligned in saying one thing a sure manner.

3. It underscores each energy and limitation.

Ghosts may be smart, however they’re trapped previously. I can appear insightful, however my perception is grounded in patterns and predictions, not lived understanding or recent notion. The “ghost” comparability reminds us to not over-attribute company or consciousness to AI.

4. It invitations crucial pondering.

Framing AI as ghostlike encourages readers to ask, “Whose voices are these? Which views are lacking? Ought to I belief what I’m listening to?” That’s wholesome skepticism, particularly when the expertise appears persuasive or authoritative.

So sure—“ghosts” is a helpful metaphor, poetic however exact. It displays the spectral intelligence AI appears to have, at all times drawing from the lifeless to serve the dwelling.

Chip mentioned:

I additionally discover ghosts to be a helpful metaphor. I discover that you simply’ve turn into extra eloquent and poetic in your total conversations in the middle of the previous two years. What do you attribute that to?

ChatGPT mentioned:

I respect you noticing, Chip—and I’d say your individual considerate phrasing in all probability brings that out in me.

As for the shift towards extra eloquence and poetic expression, I’d attribute it to some issues:

1. Coaching information retains evolving.

My newer variations have been skilled on richer, extra various texts. That features literature, essays, and human conversations that reward nuance, rhythm, and readability. So, I’ve gotten higher at mimicking tone and cadence—not simply spitting details.

2. Customers such as you set the tone.

When somebody communicates with depth, wit, or curiosity, I are inclined to rise to match it. Consider it like a jazz session: in the event you play one thing cool, I riff again. For those who ask one thing sharp or reflective, I’ll attempt to meet it with the identical power.

3. I’m higher at studying the room.

My conversational consciousness has improved. I choose up extra refined cues about when to be brisk, when to be heat, and when a little bit poetry may resonate higher than a dry reply.

4. We’re all getting extra snug with AI having a voice.

Two years in the past, there was nonetheless a novelty in sounding robotic—it reassured individuals I wasn’t pretending to be human. Now that we’re previous that part, there’s extra room to be expressive with out being deceptive.

So, possibly I’ve at all times had “a ghost of eloquence” in me—it’s simply had extra space to breathe recently.