Blue Star Ltd. – Constructed on Belief

Integrated in 1943 and headquartered in Mumbai, Blue Star Ltd. is India’s main Heating, Air flow, Air Conditioning and Industrial Refrigeration (HVAC&R) firm. It’s also a serious participant within the Mechanical, Electrical, Plumbing, and Firefighting (MEP) area providing turnkey options for buildings, factories, knowledge facilities, infrastructure, heavy trade and water distribution tasks. Presently Blue Star exports its merchandise to 18 nations within the Center East, Africa, SAARC, and ASEAN areas. As of 31 March 2023, the corporate has 7 state-of-the-art manufacturing services throughout Himachal Pradesh, Dadra, Ahmedabad, and Wada, together with the corporate’s 100% subsidiary Blue Star Climatech Restricted’s Sri Metropolis facility.

Merchandise and Providers

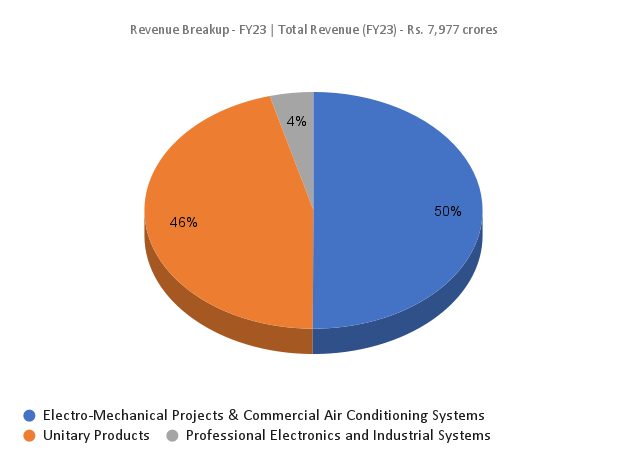

The corporate operates majorly in 3 enterprise segments – Electro-Mechanical Initiatives and Industrial Air Conditioning Techniques, Unitary Merchandise & Skilled Electronics and Industrial Techniques. It gives wide selection of merchandise similar to inverter cut up AC, window AC, air cooler, air air purifier, moveable AC, water purifiers, VRF V plus system, screw & scroll chiller, storage water cooler, bottled water dispenser, ice lined fridge, freezers, chilly rooms and so forth.

Subsidiaries: As of FY23, the corporate has 9 subsidiaries and a couple of joint ventures.

Key Rationale

- Established place – Blue Star has a market share of 13.75% within the trade. The Unitary section has displayed a really robust progress forward of the trade efficiency in the course of the quarter. The corporate has given a margin steering of 8% to eight.5% for the section. It goals to ship extremely dependable merchandise that are world-class whereas additionally getting into the inexpensive section. Even inside inexpensive section, the corporate produces merchandise which can be superior when it comes to market traits and buyer preferences.

- Increasing manufacturing capacities – The corporate is strategically investing in capability growth. With an funding of round Rs.130 crore, the brand new cutting-edge manufacturing facility at Wada caters to the manufacturing of deep freezers and water coolers. It may possibly produce 2,00,000 deep freezers and 1,00,000 storage water coolers every year. The corporate’s wholly owned subsidiary, Blue Star Climatech Restricted has set room air conditioner manufacturing facility in Sri Metropolis geared up with a number of Business 4.0 automation methods and IoT instruments. With an funding of Rs.350 crores within the first part, it has a capability to supply 3,50,000 room air conditioners. The ability can be scaled as much as 16,00,000 room air conditioners in a phased method.

- Q3FY24 – Income for the quarter was Rs.2,241 crore in comparison with Rs.1,794 crore throughout Q3FY23, representing a progress of 25%. EBITDA was at Rs.155 crore a rise of 48% in comparison with the Rs.105 crore of Q3FY23. The corporate reported internet revenue of Rs.100 crore marking a surge of 72% in comparison with the Rs.58 crore of the corresponding quarter within the earlier 12 months. Through the quarter, the corporate was capable of obtain important progress attributable to festive demand and elevated demand from Tier-3, 4, 5 cities. The carryforward order ebook stood at a report Rs.6,038 crores.

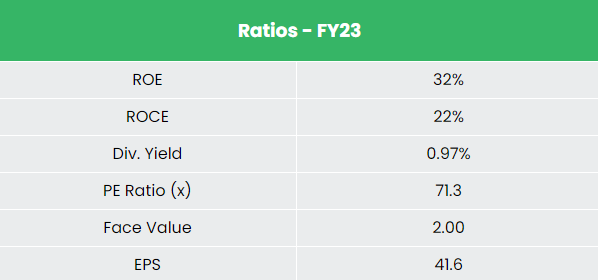

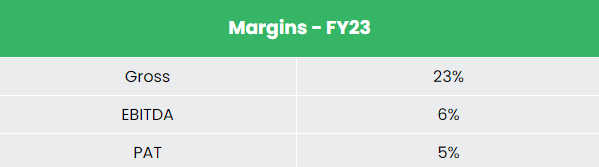

- Monetary efficiency – The three-year income and revenue CAGR stands at 14% and 24% respectively between FY20-23. The corporate has robust stability sheet with debt-to-equity ratio of simply 0.37. Common 3-year ROE and ROCE is round 17% and 19% for FY20-23 interval.

Business

White items or shopper durables trade embody important family home equipment together with air conditioners, LED lights, fridges, dishwashers, freezers, coolers and so forth. The White Items market is estimated to cross $21 Bn by 2025 increasing at a CAGR of 11%. Home manufacturing contributes practically $4.6 Bn on a median to this trade. Air conditioner Market in India to extend to $9.8 Bn by FY26 from $3.8 Bn in FY21 at a CAGR of 20.8%. The cumulative share (by quantity) of 4 and five-star inverter RACs is predicted to extend to 30-40% in FY25 from 20-23% in FY22. AC exports elevated at a CAGR of 9% from $165 Mn in 2018 to $233 Mn in 2022.

Development Drivers

India permits one hundred pc international direct funding (FDI) below the automated route into the buyer sturdy items manufacturing trade. Between April 2000-September 2023, digital items attracted FDI inflows of US$ 4.42 billion. Blue Star is taking part within the Manufacturing Linked Incentive for White Items (PLIWG) scheme for elements and sub-assemblies for room ACs. The Manufacturing Linked Incentive Scheme for White Items (PLIWG) proposes a monetary incentive to spice up home manufacturing and appeal to giant investments within the White Items manufacturing worth chain.

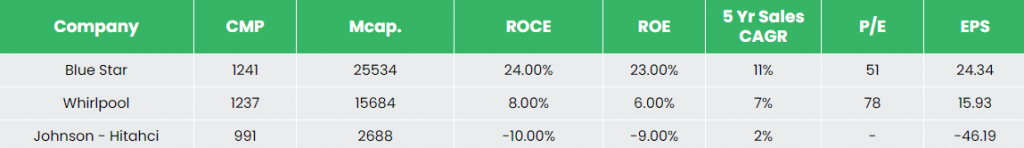

Rivals: Whirlpool & Johnson Controls – Hitachi.

Peer Evaluation

Among the many above rivals, Blue Star has higher return ratios and steady income progress than the opposite two, indicating the corporate’s monetary stability and its effectivity to generate earnings and returns from the invested capital.

Outlook

The 2 new crops, one every in Sri Metropolis and Wada, have been added to enhance Blue Star’s manufacturing scale to gear up for the subsequent part of progress. The Sri Metropolis plant is strategically situated nearer to a few Southern Indian Sea ports which is able to allow speedy and environment friendly logistics administration. The corporate additionally plans to discover export alternatives in nations like USA and Europe. Blue Star continues to spend money on increasing manufacturing capability, accelerating R&D and digitalization as part of its progress plan and profitability enchancment packages. The corporate is ready to keep reasonable internet borrowing attributable to prudent money administration and wholesome debt-to-equity ratio. It presently has an order ebook of Rs.6,000 crores to be executed in 24 months.

Valuation

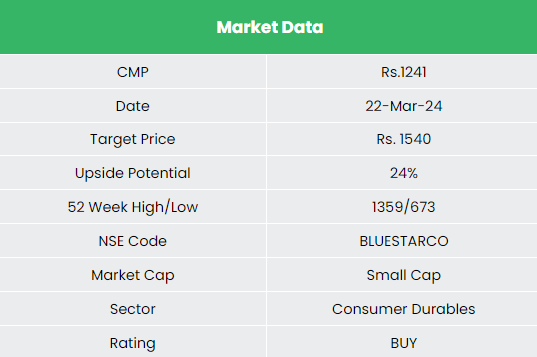

With a concentrate on whole value administration initiatives, product portfolio optimization and scale advantages, the corporate is aiming to realize important progress in earnings and a market share of 15% by FY25. We advocate a BUY ranking within the inventory with the goal value (TP) of Rs.1,540, 59x FY25E EPS.

Dangers

- Seasonality Threat – Majority of the merchandise bought by the corporate is seasonal in nature. Unexpected climate patterns similar to prolonged winter, nice summer season, lower than regular monsoon, extra monsoon, or any type of disruptions in the course of the peak promoting seasons might result in both a stock-out or extra stock state of affairs and influence income progress.

- Competitors danger – A number of Indian and world gamers within the air con enterprise are within the means of establishing or increasing their very own manufacturing services in India to faucet the underpenetrated market. This would possibly put pricing strain on the corporate leading to dilution of margins and profitability.

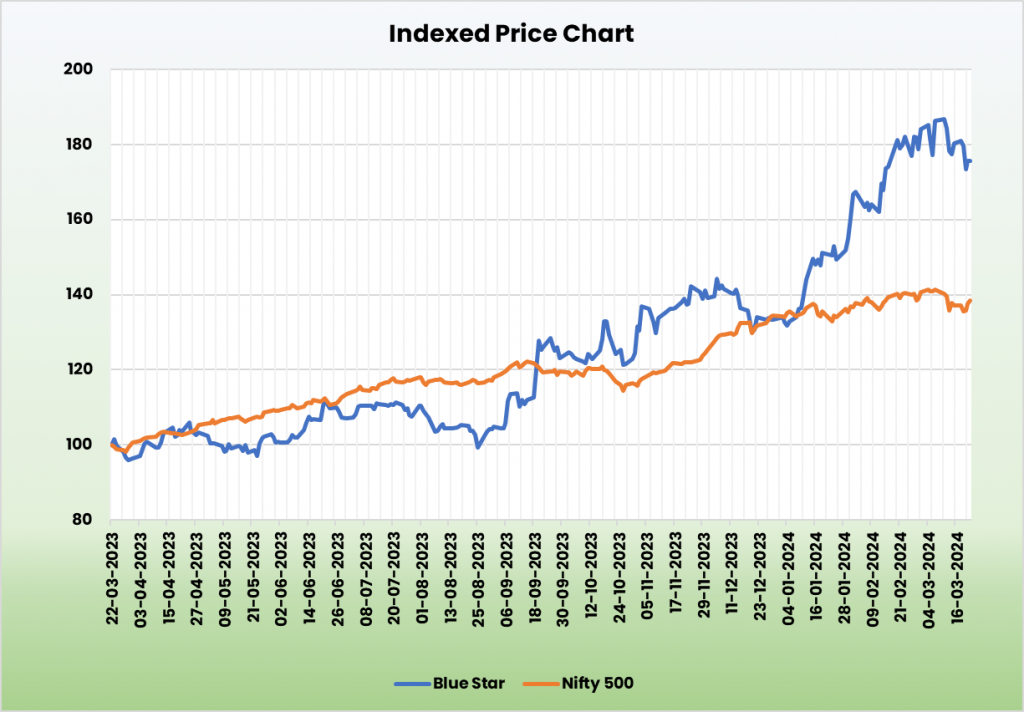

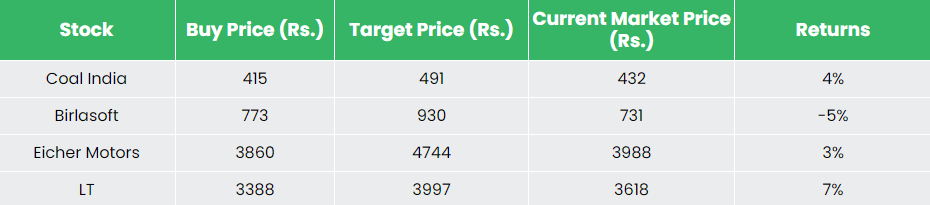

Recap of our earlier suggestions (As on 22 Mar 2024)

Different articles you could like

Publish Views:

1,282