Advisor optimism within the inventory market and the economic system each took notable downturns in February.

In accordance with Wealthmanagement.com’s WMIQ Advisor Sentiment Index, a month-to-month survey of registered funding advisors, monetary advisors’ outlook on the economic system and the fairness markets took notable dives, every falling near a 12-month low.

Advisor optimism within the markets fell nearly 10% over the month to an index studying of 114. Whereas that’s nonetheless in constructive territory (a studying of 100 displays a impartial view), it’s a whisp away from its 12-month low reached in April 2024.

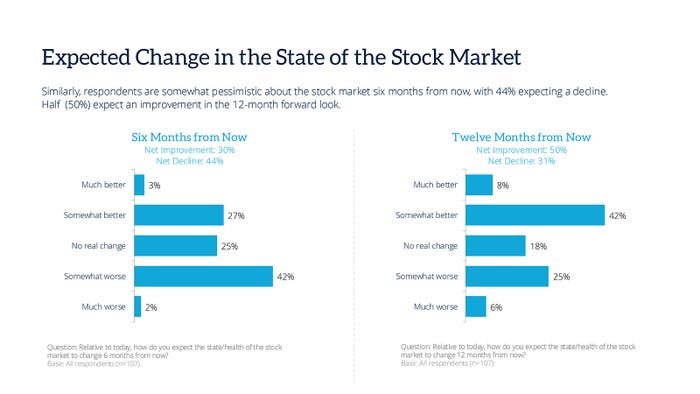

And their expectations flip much more pessimistic over the following a number of months: Solely 31% of advisors anticipate the market to be increased in six months, whereas 44% see additional deterioration. That sentiment flips when advisors look out 12 months; 31% see a decline, whereas half see enhancements.

The short-term decline in market sentiment bucks the constructive development sparked months in the past when the much-noted “Trump bump” noticed markets go increased primarily based on the anticipation of decrease rules, taxes and pro-business insurance policies.

Extra not too long ago, Trump’s tariff stance, inflation fears and unpredictable geopolitical conditions have weighed on markets, down nearly 4% year-to-date and eight% from its 52-week excessive reached final month, as mirrored within the S&P 500 index.

In fact, many advisors say fairness valuations had been frothy to start with and want a pullback to make clear correct pricing and valuations. Half of advisors (51%) anticipate market sentiment to show constructive over the following 12 months.

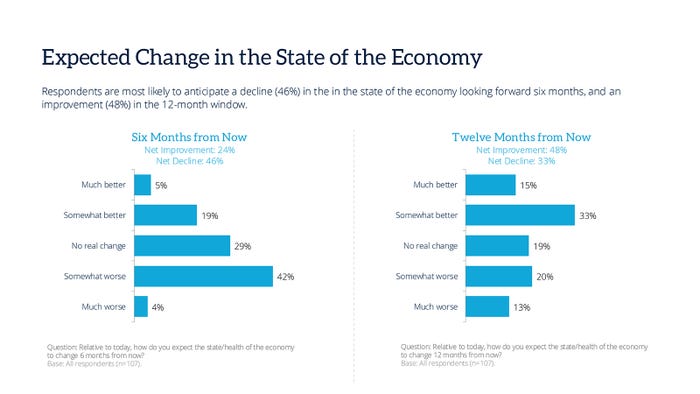

In the meantime, lower than half of advisors (44%) really feel optimistic concerning the present state of the economic system. When requested concerning the economic system over the following six months, nearly half (47%) anticipate additional erosion in sentiment. Advisors proceed to brace for extra financial ache.

Many advisors stated inflation stays stubbornly excessive, and a few concern it can persist as a result of tariffs, authorities spending, and financial coverage.

“I believe the president is doing issues that may assist the inventory market in the long run, however there seems to be cracks within the economic system,” wrote a survey respondent. “As soon as there’s further readability concerning the Trump administration’s financial, regulatory and tax insurance policies, it needs to be constructive for the … economic system and capital markets.”

Methodology, information assortment and evaluation by WealthManagement.com and Informa Interact. Methodology conforms to accepted advertising and marketing analysis strategies, practices and procedures. Starting in January 2024, WealthManagement.com started selling a quick month-to-month survey to energetic customers. Information might be collected inside the ultimate 10 days of every month going ahead, with a objective of no less than 100 monetary advisor respondents per 30 days. Respondents are requested for his or her view on the economic system and the inventory markets each at present, in six months and in a single yr. Responses are weighted and used to create an index tied to a impartial worth of 100. Over time, the ASI will present directional sentiment of retail-facing monetary advisors.