Bounce to winners | Bounce to methodology

Service first

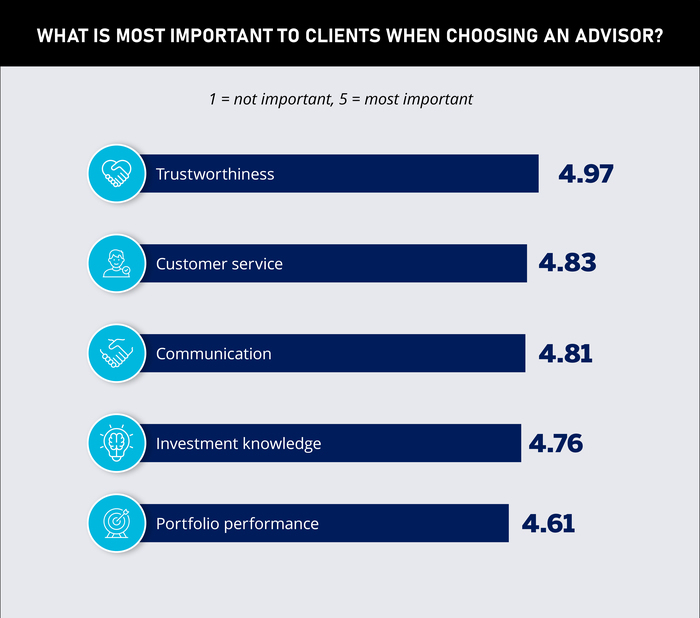

What issues most to Canadians in the case of their funds is receiving personalised consideration and having their needs listened to.

Wealth Skilled celebrates Ontario’s greatest monetary advisors who refuse to compromise of their pursuit of addressing and actioning purchasers’ needs. An often-overlooked means to do that is for an advisor to develop in depth data and experience in a distinct segment sector that pertains to the basics of a consumer’s monetary plan.

Two of WP’s 5-Star Advisors of 2024 present how being specialised fingers them a big benefit to ship superior service ranges.

David Little

Blue Oceans Personal Wealth

Location: Burlington

It’s no imply feat to clock up 40 years in such a aggressive trade, however the standout issue is how Little has achieved it on his personal phrases.

He remembers how in his first job in Toronto, he obtained a blunt demand to search out 10 new purchasers in two weeks or be fired – a close to unattainable activity. Nonetheless, with a will-to-win perspective, he did what was required, after which give up two weeks later on account of a refusal to function in such an surroundings.

“What it taught me was that on this trade, success comes from surviving and meaning you set purchasers’ pursuits forward of yours,” says Little. “I’ve labored with tons of of individuals on this enterprise who by no means made it, that had been far smarter than I used to be, extra educated, however didn’t perceive that it wasn’t at all times about them and the way a lot cash they had been going to make.”

That why Little’s agency, Blue Oceans Personal Wealth, operates underneath managed circumstances:

“I’ve by no means had a consumer run out of life earlier than they ran out of cash, and it’s as a result of we’ve a system that works”

David LittleBlue Oceans Personal Wealth

“This workplace is constructed to guarantee that no matter we are able to do for a consumer, it doesn’t matter what it’s, we are going to go to the nth diploma to ensure after they go to mattress at evening, they don’t have to fret in regards to the one factor I take care of for them – their funds,” he explains.

Little has honed his experience to deal with his purchasers’ de-accumulation in retirement, the alternative of how most advisors go about their work.

“Definitely, there’s a a lot greater deal with accumulating belongings as a result of meaning firms are accumulating income,” he says. “When individuals are spending it, it’s a deep accumulation of belongings, the de-accumulation of income, they usually’re not interested by that.”

The agency’s repute rests on Little and his workforce’s constant skill to ship over the a long time.

He provides, “My largest drawback is I don’t have a large enough megaphone to inform a broad group of people who there’s a bunch of us on this trade which can be right here to assist at this part of their lives, essentially the most crucial part. I do know what’s lacking and the way do I do know? All of my enterprise comes from any person else.”

Shoppers, usually dissatisfied with the dearth of personalised consideration to their retirement planning, migrate to Little from bigger companies and main banks.

Little recounts the instance of a consumer who joined after studying a print interview he had executed.

The consumer famous the factors he highlighted and requested a earlier advisor about them.

“The consumer informed me that [the previous advisor] couldn’t reply them, in order that they needed to see me. They’ve been a consumer now for most likely eight years.”

In retirement planning, typical components on somebody’s de-accumulation of belongings embrace:

-

promoting a household dwelling and investing the proceeds

-

arranging their energy of legal professional and dealing with designated kinfolk

-

wrapping up the property of a deceased individual with no will

Finest monetary advisor loses ego

Little was additionally an early adopter of flat charge funding portfolios, eradicating the inducement to make extra if a consumer invested a bigger sum.

“I did that to ship a sign to my purchasers that I’m on this for them, not for me. I don’t need them to suppose I’m investing in one thing or altering an funding as a result of I get compensated,” he feedback. “I might have gone to a financial institution and possibly made much more cash for myself, however I don’t need anyone telling me how a lot I’ve to promote or how a lot income I must generate.”

These singular calls for to ignore ego and private remuneration imply that not everyone seems to be lower out to work at Blue Oceans.

Little provides, “We’ve had many individuals who’ve come right here desirous to work with me that didn’t survive as a result of they didn’t perceive that. As soon as once more, it was about them and the way a lot cash they had been going to make.”

One factor Little stresses is that whereas it’s his identify on the award, none of his recognition or repute can be doable with out the workforce that gives him with a platform to showcase his experience.

That and consumer appreciation are the keys to his success. “I used to be informed by an expensive buddy who’s not with us anymore, ‘The higher you take care of your purchasers, the higher they may take care of you.’ I’ve lived a life-style that’s accredited to my purchasers – they’re those that permit me to do what I do.”

Tina Tehranchian

Assante Capital Administration Ltd.

Location: Toronto

Philanthropy is an underexposed space wherein a few of Ontario’s greatest monetary advisors function. It’s additionally the place Tehranchian completely blends her expertise, abilities, and fervour.

“With philanthropic tax planning, I may give again to the group and it offers me big satisfaction to assist donors go away a number of instances what they must the totally different charities that I work with,” she says.

To spotlight what may be executed, Tehranchian hosts public displays and knowledge periods.

She explains, “Many individuals who come have by no means considered leaving a bequest to a charity. It’s an eye-opener.”

“If I come throughout a consumer the place I could make an enormous distinction of their life, however they don’t have a big quantity of belongings, I prefer to tackle that problem”

Tina TehranchianAssante Capital Administration Ltd.

Requested to pinpoint why philanthropy isn’t an even bigger focus within the trade, Tehranchian says, “One of many issues is many advisors by no means carry up the charitable dialog with purchasers as they might not have the experience or data to assist alongside these strains.”

Nonetheless, an even bigger challenge is that some advisors don’t broach the topic as they concern it would result in a lower in belongings underneath administration.

“I don’t suppose alongside these strains. I’ve helped my purchasers give away tens of millions of {dollars} to charities and it has undoubtedly strengthened my bond with them as a result of we share the identical values,” feedback Tehranchian. “You lose some belongings after they give cash to charity, however you’ll acquire belongings as a result of they’ve extra belief in you and are more likely to make investments sooner or later.”

As a consequence of her prowess within the philanthropy area of interest, Tehranchian has labored with purchasers and charities nationwide. Alongside working her agency, she additionally does fundraising and has sat on charitable boards.

“Charity work has been an enormous part of my very own life. That’s why I perceive people who find themselves philanthropic and who need to make the world a greater place, even when it’s in small increments. I can use my data and experience to assist them multiply the impression of their philanthropy,” she says.

Finest monetary advisors demand excellence

Tehranchian’s purchasers vary from high-net-worth people, right down to these with extra modest incomes. She prides herself on providing methods which can be sensible and straightforward for the typical individual to implement.

Noticeably, lots of her purchasers are of an identical age to Techranchian they usually’ve moved by means of life collectively throughout her over three a long time within the trade.

She says, “We had been all younger individuals once we met. It’s a pleasure to have been with them by means of the whole cycle and see them retire comfortably and obtain all of the targets that we labored on.”

Tehranchian has recruited a proficient workforce, enabling her to dedicate her consideration to particular tasks. The technique is about maximizing her talent set.

“I’m lowering the variety of purchasers that I service, however they’ve extra complicated conditions and want extra time – it’s all about rightsizing. It’s been a seamless transition as a result of my affiliate advisor who’s youthful works on the less complicated conditions. It’s good for the purchasers as a result of they’re getting custom-made consideration.”

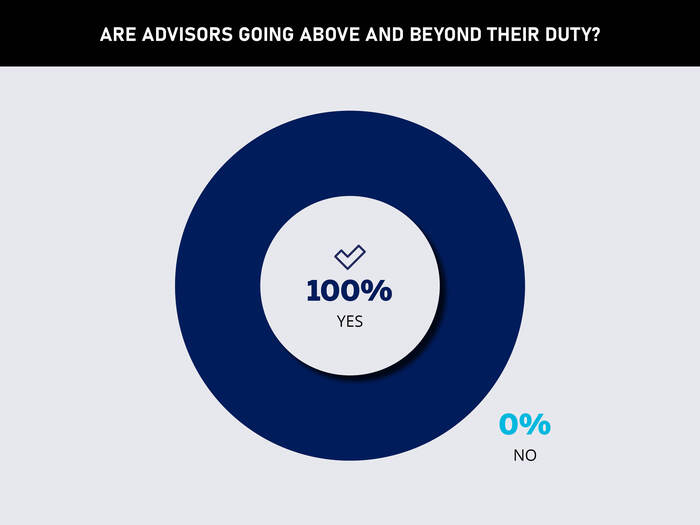

Regardless of having a trusted workforce, it’s Tehranchian’s identify above the door, so she insists on a service-first mindset. That is instilled amongst all staff and it’s what she regards as “the primary ingredient for a superb monetary advisory workforce”.

She explains, “I at all times inform them our aim shouldn’t be consumer satisfaction. I need my purchasers to be elated with the service we offer.”

The workforce’s synergy can be boosted by tech. They use video conferencing and distant connections to drive effectivity.

“Now 95 % of my purchasers need to communicate on video as a result of site visitors is so dangerous in Toronto and a few my assistants do business from home. I don’t power anyone to go to the workplace, so long as they get the work executed,” she says. “We’re utilizing expertise that was not out there even 5 or 10 years in the past, and it’s been a liberator because it saves me time that I can put again into working for purchasers.”

Constructing her enterprise, deciding on a specialization, and crafting a repute have all occurred as a result of Tehranchian has pushed excessive requirements alongside along with her experience.

“It’s important to set the bar excessive if you wish to be above the extraordinary, and that’s at all times been my aim.”

- Adam Watson

JMRD Watson Wealth Administration Group

Nationwide Financial institution Monetary - Adrian LeRoy

LeRoy Wealth Administration Group

IPC Securities Company - Adrian Van Hooydonk

Smart Wealth Advisory Group

iA Personal Wealth - Alynn Godfroy

Godfroy Monetary Group - Andrew Feindel

Richie Feindel Wealth Administration

Richardson Wealth - Brent Vandermeer

CrossPoint Monetary

iA Personal Wealth - Brian Kadey

Kadey Group

CG Wealth Administration - Christopher Dewdney

Dewdney&Co. - David Harris

Inexperienced Personal Wealth Counsel

Harbourfront Wealth Administration - Deven Lad

Mangrove Wealth Group

iA Personal Wealth - Dillon Garabedian

iA Personal Wealth - Fraser McKeown

Moneystrat Securities - Heather Holjevac

Holjevac Monetary Group - Jane Lapointe

Assante Capital Administration Ltd. - Jason De Thomasis

De Thomas Wealth Administration - Jason Periera

Woodgate Monetary

IPC Securities - John Kitcher

HighLifeWorth Wealth Administration

iA Personal Wealth - Kerry Rizzo

BlueRidge Personal Wealth

Harbourfront Wealth Administration - Kris Dureau

Inexperienced Personal Wealth

Harbourfront Wealth Administration - Kyle Richie

Richie Feindel Wealth Administration

Richardson Wealth - Laura Paradiso

Scotia Wealth Administration - Laurie Peterkin

Scotia Wealth Administration - Mark Samborski

Ironshield Monetary Planning

Pinnacle Wealth Dealer - Matthew Arthur

Arthur Wealth Administration - Matthew Langsford

Langsford Wealth Counsel

CG Wealth Administration - Mike Hennessey

Theodore Hennessey & Loy

IG Personal Wealth Administration - Reg Jackson

JMRD Watson Wealth Administration Group

Nationwide Financial institution Monetary - Rob McClelland

The McClelland Monetary Group

Assante Capital Administration Ltd. - Ron Haik

Nicola Wealth - Sadeki Simpson

Edward Jones