A reader asks:

I noticed the report this week that mentioned Social Safety will likely be bancrupt by 2035. As a card carrying millennial (I’m 35) I’m working beneath the belief that Social Safety received’t be there for me after I retire. Is {that a} truthful assumption contemplating the trillions of {dollars} we’ve added in authorities debt because the pandemic?

I noticed all the headlines too:

It sounds dire.

I do know lots of younger individuals who really feel the identical approach. There’s an excessive amount of authorities debt. Politicians received’t do something to repair the entitlement shortfalls. The boomers are going to go away the cabinets naked.

Insolvency sounds scary however the scenario is just not fairly as grim because the headlines would have you ever imagine. I went by means of the precise report. Right here’s what I discovered:

If Congress doesn’t act by 2035, the belief fund reserves are projected to be depleted. Nevertheless, the revenue from Social Safety taxes would cowl 83% of scheduled advantages.

Whereas it’s true that more cash will likely be going out than coming in, the shortfall is just 17 cents on the greenback. So it’s not like there will likely be no protection in any respect.

Now take a look at the chart they produced that takes issues out even additional:

By the yr 2098, after I will likely be turning 117, they undertaking the tax income will cowl 73% of the advantages. That’s an extended runway to shore issues up.

There are three potential eventualities when serious about these numbers:

(1) Individuals ought to get used to the thought of their Social Safety advantages getting slashed beginning within the 2030s.

(2) Politicians nonetheless have time to behave however taxes is perhaps going as much as keep away from any shortfall.

(3) The U.S. authorities likes to spend cash, we print our personal forex and we are going to merely go into extra debt to cowl the shortfall.

If I needed to guess, I’d assume some mixture of (2) and (3) is smart. No politician of their proper thoughts would slash Social Safety advantages for retirees. You don’t win votes that approach.

They might increase the tax limits for high-income earners or improve the submitting age for youthful folks. These fixes make sense to me.

Who am I kidding? We’ll in all probability simply kick the can down the street and improve authorities debt (or lower spending elsewhere). One of many classes from Covid is that if there’s a political will for extra spending, it’s going to occur. The one constraint you will have if you print your individual forex is inflation.

There are not any ensures on the subject of the actions of politicians, however Social Safety is a very powerful retirement plan ever enacted in America.

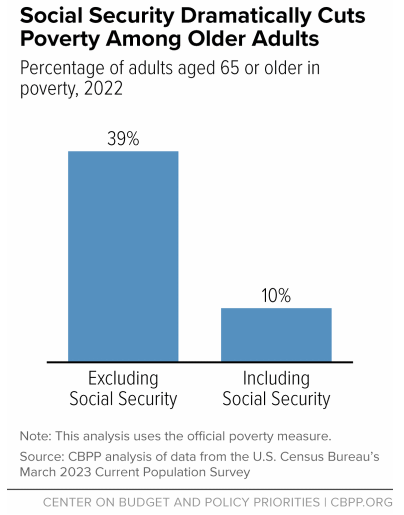

In accordance with the Middle on Funds and Coverage Priorities, almost 23 million adults and youngsters would fall beneath the poverty line within the U.S. with out Social Safety. That features almost 17 million folks 65 or older and nearly 1 million kids.

With out Social Safety, 4 out of each 10 senior residents could be in a lifetime of poverty:

As a substitute, the precise quantity is 1 out of 10.

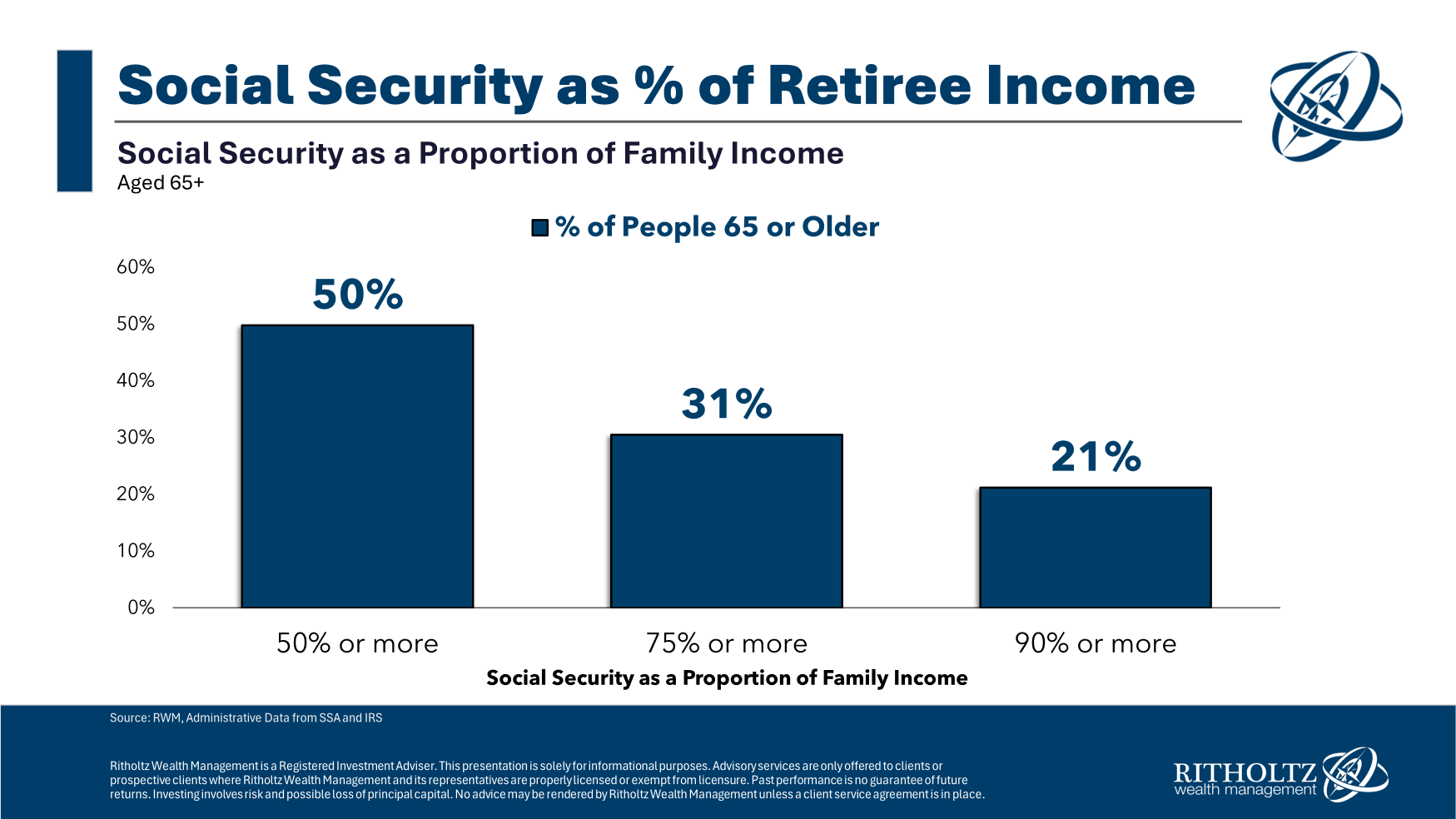

Social Safety additionally gives a big supply of revenue for a lot of retirees. One examine checked out Social Safety as a proportion of household revenue for these 65 and older:

Almost half of senior residents obtain 50% or extra of their revenue from Social Safety. One in 5 folks 65 or older will get 90% of their revenue from this system.

To some folks, Social Safety is a complement to different sources of revenue. To others, it’s one in every of their principal sources of revenue.

Social Safety is just not bankrupt. Issues will likely be high-quality so long as folks maintain paying Social Safety taxes. The federal government will determine one thing out or prioritize this plan.

In the event that they don’t, lots of people will battle to afford their retirement years.

We coated this query on the most recent episode of Ask the Compound:

Your favourite tax professional Invoice Candy joined me on the present once more this week to debate questions on downshifting your threat as you strategy retirement, essentially the most tax-efficient solution to pay for a medical process, when DIY buyers ought to think about an advisor, the Rule of 55 and the way to put together for taxes in retirement.

Additional Studying:

Can Younger Individuals Nonetheless Depend on Social Safety?

This content material, which accommodates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here will likely be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It’s best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or supply to supply funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.