Indira Puri, creator of the groundbreaking research “Simplicity and Threat,” printed within the April 2025 situation of the Journal of Finance, challenges conventional finance fashions by demonstrating that people aren’t simply risk-averse, they’re additionally complexity-averse (“simplicity is a singular element of selection”). This discovery reshapes our understanding of decision-making and portfolio design.

Puri examined whether or not folks worth simplicity when making dangerous selections, even when statistical outcomes (like imply or variance) are similar. Her exams introduced individuals with selections between lotteries of various complexity whereas conserving key statistical moments (like anticipated worth) fixed. Her key questions have been:

-

Do folks pay a “complexity premium” to keep away from convoluted threat eventualities?

-

Does complexity improve irrational selections (e.g., violating dominance guidelines)?

-

How does cognitive means affect complexity aversion?

Puri’s experiments in contrast conduct towards fashions like Anticipated Utility Idea (a decision-making mannequin the place rational selections are made by maximizing the anticipated “utility” of an end result, contemplating each goal and subjective possibilities, particularly in conditions involving uncertainty), Prospect Idea (a behavioral economics idea explaining how folks make selections underneath threat, highlighting that people worth positive factors and losses in another way, usually deviating from rational conduct) and rational inattention (the concept that financial decision-makers can not take up all obtainable data however can select which items of data to course of).

Here’s a abstract of Puri’s key findings:

Fashions that ignore complexity battle between threat aversion and complexity aversion. Behavioral fashions failed to elucidate complexity-driven threat premia—topics actively paid to keep away from complexity. They didn’t simply tune it out.

Unsurprisingly, complexity led to extra errors—topics objectively selected worse choices seven instances extra regularly in complicated setups versus easy ones. As such, complexity elevated threat premiums: Members demanded greater compensation for dangers introduced in complicated codecs, even when the statistical moments (like imply and variance) have been similar to less complicated alternate options.

Moreover, simplicity desire was predictable—selections systematically shifted towards less complicated frames when complexity elevated, aligning with a brand new “simplicity axiom” proposed within the paper.

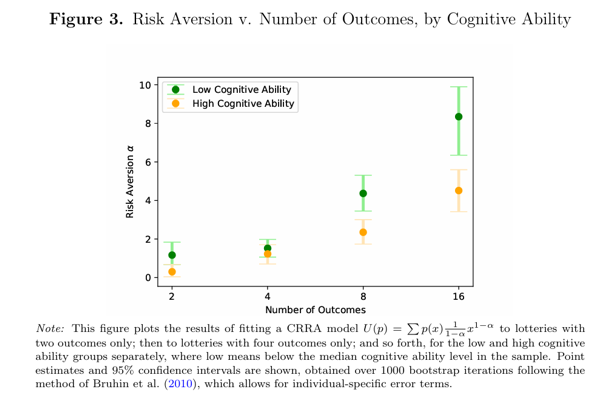

Lastly, cognitive means and complexity aversion are correlated—decrease cognitive means (measured through exams) correlated with stronger complexity aversion, suggesting less complicated portfolios could higher serve some traders. Prior analysis has proven that individuals with greater cognitive means are much less risk-averse.

Her findings led Puri to conclude that present monetary fashions are inadequate—not one of the conventional fashions, together with anticipated utility idea, cumulative prospect idea, prospect idea, rational inattention, salience idea (decision-makers’ consideration is directed to essentially the most salient payoffs of the lotteries obtainable for selection) or chance weighting (the tendency for people to over-weight low chance occasions, whereas additionally under-weighting excessive chance outcomes) totally captured the experimental findings associated to simplicity desire.

Takeaways

Puri’s findings problem conventional finance fashions and recommend that people are each risk-averse and complexity-averse, which has important implications for understanding decision-making in monetary markets and portfolio design. She confirmed that complexity is a hidden value, as traders systematically overpay to keep away from it, and conventional portfolio idea ignores this bias. By highlighting the cognitive facets of threat notion, she added a brand new dimension to portfolio diversification idea, suggesting that efficient diversification is not nearly statistical threat discount but additionally about creating portfolios that traders can perceive and follow over the long run.

My virtually 30 years of advising traders have taught me that whereas there may be an economically proper portfolio (one that’s hyper-diversified throughout as many distinctive sources of threat that meet your funding standards), there is no such thing as a single psychologically proper portfolio. Thus, the proper one for every consumer is the one which they’re more than likely to stay with. The reason being that behavioral errors akin to monitoring variance remorse (when a extra diversified portfolio underperforms a easy whole market portfolio) and recency bias can lead traders to desert even well-thought-out plans, resulting in poor efficiency. Puri confirmed that complexity aversion also can result in behavioral errors.

To adapt, monetary advisors can educate shoppers about complexity aversion to mitigate its results and keep away from the errors brought on by simplicity aversion (akin to much less diversified and, due to this fact, riskier portfolios, ones with extra tail threat). Nonetheless, Puri’s findings recommend that less complicated portfolio constructions could also be preferable, particularly for traders with decrease cognitive skills, difficult the idea that extra complicated, extremely optimized portfolios are all the time higher.

Implications for Advisors and Portfolio Development

Tailor Complexity to Cognitive Profiles. Establish shoppers susceptible to complexity aversion and supply them streamlined choices to forestall the error of overpaying for simplicity.

Simplify Consumer Decisions. Presenting portfolios in less complicated codecs (e.g., “60% shares/40% bonds” vs. multi-factor optimizations) could cut back perceived threat and enhance resolution high quality.

Keep away from Opaque Merchandise. Structured notes, leveraged ETFs, long-short issue methods, or multi-layer derivatives may set off hidden complexity premiums.