The only most requested query that I’ve heard since January 20th is:

“How will this new administration have an effect on my inventory, bond and actual property holdings?”

I preserve listening to variations of that query from purchasers, advisors, and the media. The overall query displays a priority in regards to the new Trump 2.0 administration’s flurry of actions, particularly DOGE, Elon Musk, layoffs, and different points.

My recommendation is to tune out the noise, flip off the TV, and keep away from the trolling, wild gesticulations, and chaos. As a substitute, focus on what is really occurring.

I admit the final demeanor feels bizarre as a result of there’s been an entire lot extra getting mentioned than executed; far fewer actions than the pronouncements (or said intentions to carry out actions) all of which can or could not occur.

How most of the 3 million federal civil service employees (not counting army or postal service workers) are actually going to be laid off? Does the chief department have the authority to cancel spending allotted by Congress? What can Elon Musk do?

I don’t know; I doubt a lot of the pundits you hear opining all day lengthy on TV know both. The result of those points won’t be litigated on tv; relatively, it will likely be litigated within the federal court docket system, the place it’s purported to occur.

***

It’s tough to recollect this when you find yourself overwhelmed by Steve Bannon’s “Flood the Zone ” technique. An ideal instance is the U.S. army exercise overseas. Is Canada about to develop into the 51st state? Will we retake the Panama Canal by power? Will Denmark knuckle underneath and promote us Greenland?

That was final week—it appears like months in the past. I don’t know if any of these territorial ambitions will come to fruition (coloration me uncertain). However I do see that the noise of those points has wholly overwhelmed any boots-on-the-ground exercise. My recommendation is that traders (largely) ignore these feedback.

Flood the Zone is superb at exhausting you politically, however don’t let it exhaust your self-discipline as an investor.

One other instance: 47 (the identical man as 45, however a special administration) introduced as we speak that he’s “canceling Manhattan’s congestion pricing.” The MTA yawned on the proclamation. Regardless of all of the sturm und drang, the MTA remains to be amassing congestion pricing and says it would proceed to take action till it’s ordered by a lawful court docket to cease.

What about all these Tariffs? Canada and Mexico? (Nothing executed)

Have there been mass layoffs? (No)

China Tariffs? (Nope)

Has Pentagon spending been lower but? (No)

Ukraine and Russia? (Nyet)

47 is a savvier government than 45; he’s skilled, has his personal folks in place, appears to have a thought-out plan, and his crew is executing that plan. However my focus is on what truly will get put into place and never the noise the media dutifully repeats as if it’s Gospel.

***

Recall the period of Trump 1.0, particularly the interval between election day and the inauguration. Throughout that interregnum, 45 started tweeting at firm executives, cajoling, threatening, and in any other case inflicting common mischief. For the primary few weeks, markets punished corporations that acquired 45’s ire. However quickly after, it grew to become clear this was largely bluster, with little or no actual-world penalties. Market (over)response pale.

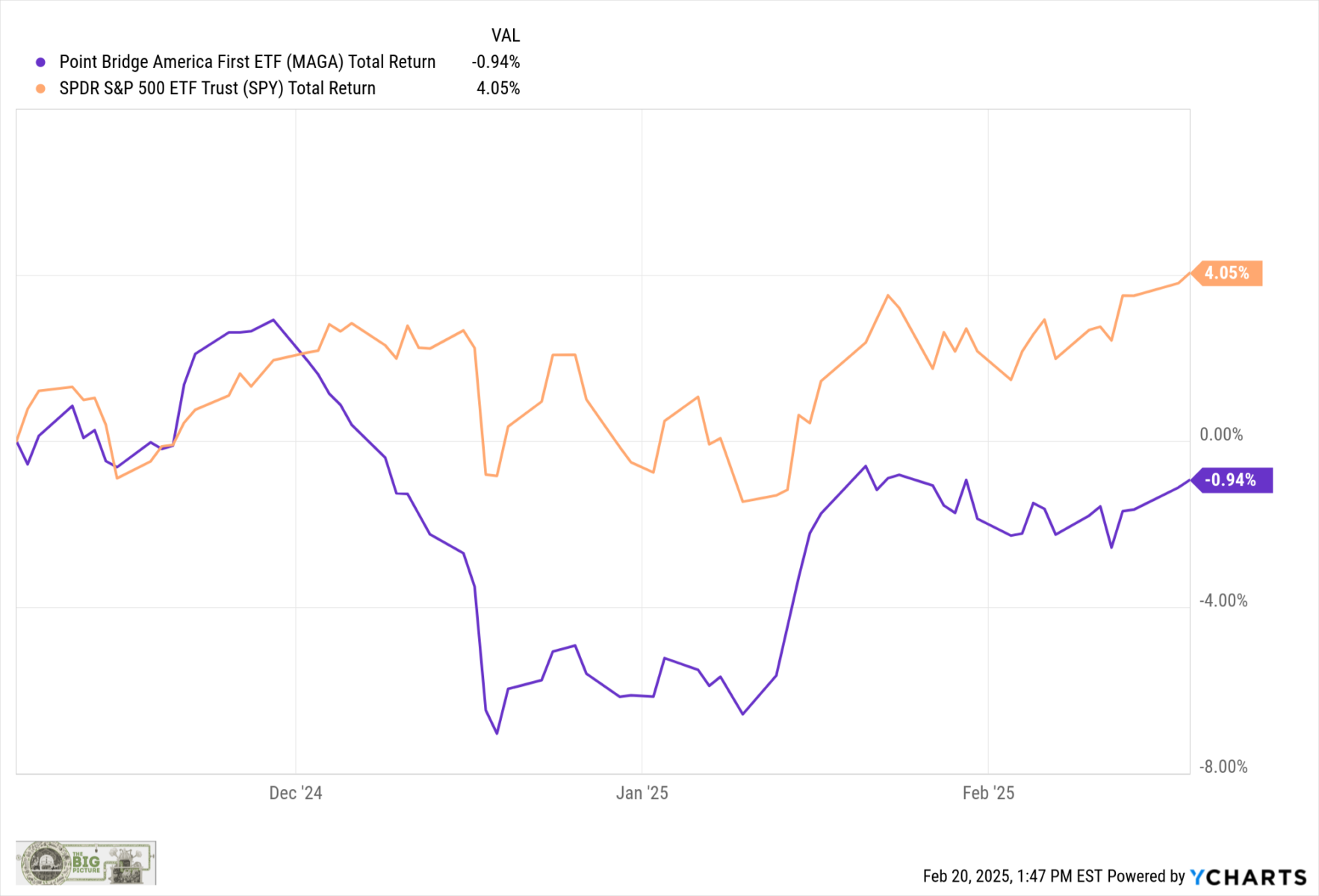

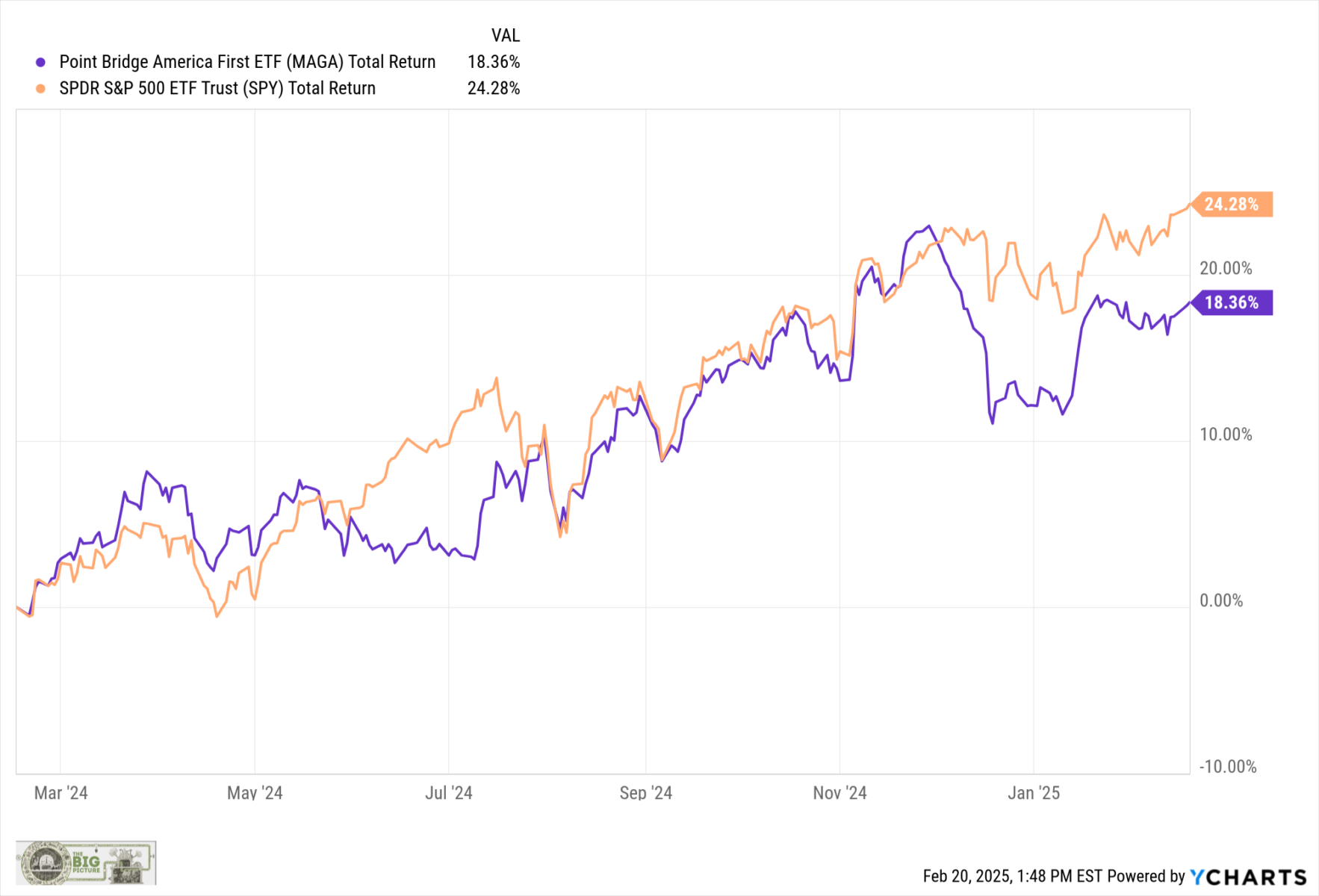

After November 5, 2024, the Russell 2000 Index gained on hopes that the said Trump coverage would profit smaller cap corporations. That has largely pale, and RUT is now roughly again to the place it was earlier than November 5th. Even the MAGA ETF (after a post-election pop) is once more lagging the S&P 500 (above since election; beneath, trailing 12 month chart).

To me, the political noise is simply that – a distraction. I recommend you ignore most of what will get mentioned, and concentrate on all of the issues that truly get achieved. These are more likely to embody giant tax cuts (TCJA gest prolonged 5+ years) and a a lot M&A-friendlier FTC…

***

Extra importantly, take note of the broader context of the place we’re as we speak. Again to again years of larger than 20% in equities strongly recommend we decrease expectations for the next 12-24 months.

Context issues far more than noise.

Beforehand:

Why Politics and Investing Don’t Combine (February 13, 2011)

How A lot is the Rule of Legislation Price to Markets? (August 2, 2021)

Archive: Politics & Investing

See additionally:

Governments are folks, my pal (Optimistic Callie, February 18, 2025)

Jobless Claims for the DC Space (Day by day Spark, February 18, 2025)