The primary asset allocation quilt I created for this web site lined the ten-year interval from 2005-2014.

These returns look nothing just like the final 10 years which is the entire level of this train.

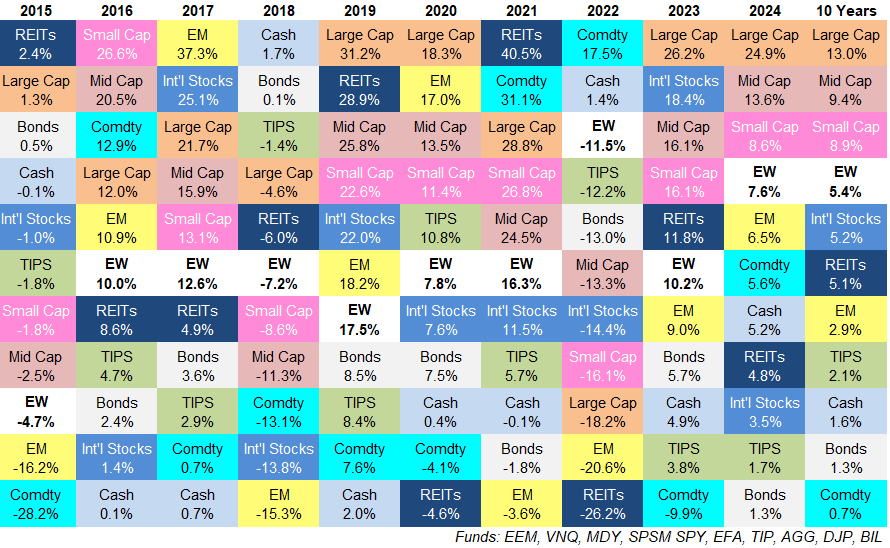

Right here’s the most recent quilt:

EW is an equal-weight portfolio of every asset class listed.

Some observations:

Inflation outperformed TIPS. The common inflation fee over the previous 10 years was round 2.9% yearly. Treasury-inflation protected securities had been up 2.1% yearly over the identical time-frame.

Wait…what?!

Sure you learn that proper. Inflation-protected bonds underperformed inflation.

There are two large causes for this.

One, the nominal charges on these bonds had been extraordinarily low. For the higher a part of three years or so traders in TIPS had been paying the U.S. authorities for the power to put money into these bonds (which means the nominal yields had been damaging).

Secondly, yields rose from nothing to one thing in an unprecedented method so TIPS acted extra like bonds than inflation-protection.

The excellent news is TIPS at the moment are yielding greater than 2% nominally, which means you get 2% plus no matter inflation goes ahead. The unhealthy information is you needed to endure a tricky interval of low yields and returns to get right here.

Money outperformed bonds. This one makes extra sense given the surroundings.

Money (T-bills) is likely one of the easiest hedges towards rising inflation and rates of interest. Plus, money yields have been larger than bond yields for a while now.

The three-month T-bill was above the 10-year Treasury fee from the autumn of 2022 via the top of final 12 months once they lastly flipped. And brief length fastened earnings is much much less inclined to a rising fee surroundings.

With larger beginning yields for bonds and the Fed decreasing short-term charges it’s arduous to see this persist.

We will see.

Commodities had a misplaced decade. It’s arduous to consider commodities had such a poor displaying contemplating we simply lived via the very best inflation spike in 40+ years.

There was a pleasant countertrend rally in 2021 and 2022 however that was not sufficient to make up for the poor displaying within the different years.

We basically had a misplaced decade on this basket of commodities.1

U.S. massive caps proceed to rule the day. The S&P 500 has been the highest performer of the group in 4 of the previous 6 years. The one 12 months when massive caps weren’t within the high half of those asset courses was 2022.

So it is smart U.S. massive cap shares have far and away the perfect 10 12 months annual outcomes.

It’s arduous to examine a state of affairs the place this doesn’t proceed. The tech behemoths are the perfect firms on the planet. They appear to get stronger by the 12 months. They usually’re not one-trick ponies both. All of them have a number of enterprise traces and are investing closely sooner or later. The largest corporations have gone all-in on AI.

If we get the AI nirvana the tech crowd envisions it’s tough to see that efficiency slowing down anytime quickly.

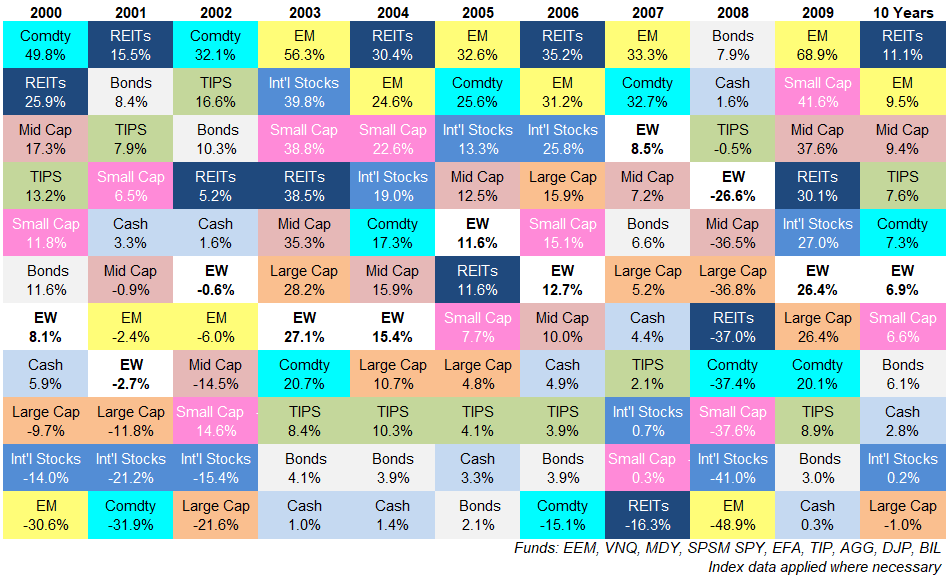

Nevertheless, I might be remiss if I didn’t level out that there’s seemingly a heavy dose of recency bias on this line of pondering. Check out the asset allocation quilt from 2000-2009:

The primary decade of the twenty first century regarded a lot completely different than the previous 10 years.

REITs had been the highest performers even after accounting for the actual property bust. Rising markets had a very good decade regardless of getting minimize in half in 2008. Commodities had been a very good hedge. So had been bonds, TIPS and mid caps.2

Giant cap shares completed useless final with a damaging return on the last decade.

There are alternative ways to view this knowledge.

Perhaps that misplaced decade was the outlier. Perhaps issues actually are completely different this time. We might be getting into a paradigm shift within the markets.

It’s additionally attainable that one of many causes massive cap development shares are doing so effectively over the previous 10+ years is as a result of they skilled a misplaced decade.3

Anytime you reside via a cycle like this it seems like it can final perpetually. Traders in Nifty Fifty shares within the Sixties and Nineteen Seventies, Japanese shares within the Eighties, dot-com shares within the Nineteen Nineties and power shares within the 2000s all felt like the nice occasions would final perpetually.

Perhaps U.S. massive cap shares will proceed their dominance within the subsequent 10 years. You may’t rule it out.

Market historical past exhibits the leaders and laggards are all the time altering from one cycle to the subsequent. Proper now that doesn’t appear remotely attainable.

My finest guess is the subsequent 10 years gained’t look very very like the final 10 years.

I’ll see you again right here in 2035 to check.

Additional Studying:

Updating My Favourite Efficiency Chart For 2023

1To be honest there are lots of alternative ways to place collectively a basket of commodities.

2It’s additionally attention-grabbing mid caps did 9.4% yearly in every of those 10 12 months home windows.

3And one of many causes they’d that misplaced decade is as a result of the Eighties and Nineteen Nineties had been so spectacular. These aren’t the one causes clearly. However you possibly can’t ignore these cycles of over- and underperformance both.