Payroll giving is an more and more common effort that permits staff to contribute on to charitable causes via automated deductions from their paychecks. For nonprofits, this presents a singular alternative to faucet into the philanthropic spirit of corporations’ staff.

All in favour of discovering how your personal nonprofit can accomplish that? We’ll cowl every thing you’ll want to learn about payroll giving right here.

This contains:

By leveraging worker help via payroll giving, organizations can drive significant change whereas concurrently enriching the office tradition. Learn on to learn the way.

What’s Payroll Giving?

Payroll giving is a charitable contribution technique that permits staff of taking part corporations to donate a portion of their wage on to nonprofit organizations via automated deductions from their paychecks regularly.

This technique simplifies the donation course of, making it straightforward for workers to help causes they care about without having to handle separate transactions or giving efforts. In the meantime, organizations obtain extra help and sources via the packages, permitting them to make a bigger influence of their respective missions.

Sometimes, corporations’ staff can select how a lot they wish to contribute and choose the meant recipient from an inventory of authorised charities or organizations. The donations are then collected by the employer and forwarded to the chosen nonprofits, usually based on a month-to-month or quarterly construction.

What Are the Advantages of Payroll Giving for Nonprofits?

In response to payroll giving statistics from Double the Donation, almost 6 million U.S. staff donate via payroll giving packages. That’s greater than $173 million every year, which is a giant chunk of funding that may make a major influence on nonprofits like yours.

Right here’s how:

1. Payroll Giving Creates a Dependable Supply of Revenue

Payroll giving supplies nonprofits with constant, recurring donations, enabling them to plan extra successfully and allocate sources effectively. This predictable earnings stream helps organizations maintain ongoing packages, fund new initiatives, and handle operational prices with larger stability.

With common contributions arriving all year long, nonprofits can fear much less about fluctuating funding and focus extra on reaching their mission.

2. Payroll Giving Encourages Lengthy-Time period Donor Relationships

Payroll giving fosters a tradition of sustained giving, as donors decide to contributing a portion of their wage regularly. This long-term dedication builds deeper connections between donors and the causes they help, leading to greater donor retention charges.

3. Payroll Giving Reduces Administrative Overhead

Since payroll donations are mechanically deducted from an worker’s paycheck, nonprofits usually face decrease administrative burdens in comparison with processing particular person one-time presents. These automated programs scale back the necessity for intensive follow-up, knowledge entry, or cost monitoring, permitting nonprofits to allocate extra sources to their packages and outreach efforts.

4. Payroll Giving Amplifies Donations By Matching Applications

Many employers supply matching present packages alongside payroll giving, doubling and even tripling the influence of staff’ contributions. For nonprofits, because of this each greenback donated via payroll giving has the potential to go even additional, maximizing the general influence of this system.

Selling these matching alternatives encourages extra staff to take part, making a win-win for donors, corporations, and nonprofits alike.

5. Payroll Giving Strengthens Company Partnerships

Payroll giving packages usually function a bridge between nonprofits and company companions, enhancing collaboration and fostering goodwill. By supporting these initiatives, corporations show their dedication to Company Social Duty (or CSR), whereas nonprofits acquire useful allies in spreading consciousness and growing their donor base.

These partnerships can result in extra help, similar to sponsorships, volunteer packages, or in-kind donations, too.

6. Payroll Giving Expands Donor Attain

Office giving packages introduce nonprofits to new audiences they won’t in any other case attain. Workers who take part in payroll giving could not have beforehand donated however are motivated by the comfort and encouragement of their employer’s program. Over time, these people may even turn into passionate supporters and advocates for the nonprofit’s mission.

7. Payroll Giving Offers a Aggressive Edge

For nonprofits looking for to face out within the crowded fundraising panorama, payroll giving affords a singular benefit. The streamlined, hassle-free nature of those packages makes them interesting to donors and provides nonprofits an edge in retaining long-term help. Moreover, providing payroll giving as an choice alerts that the group is revolutionary and aligned with trendy fundraising and company partnership practices.

How Does Payroll Giving Profit Firms + Workers?

Payroll giving packages additionally profit each corporations and staff in a number of significant methods, enhancing office tradition, worker satisfaction, and neighborhood influence.

Right here’s a breakdown of the advantages:

Advantages for Firms

- Enhanced Company Social Duty (CSR) Profile

Payroll giving demonstrates an organization’s dedication to supporting communities and aligns with CSR initiatives, bettering the corporate’s repute and enchantment to socially aware stakeholders. - Improved Worker Engagement and Retention

Workers worth alternatives to contribute to causes they care about, and payroll giving packages make it straightforward. This boosts morale, engagement, and loyalty, decreasing turnover charges. - Strengthened Group Ties

By enabling staff to help native or world causes, corporations foster stronger relationships with the neighborhood, creating goodwill and unleashing the potential for brand new partnerships.

Advantages for Workers

- Comfort in Giving

Payroll giving permits staff to donate instantly from their paycheck, making the method seamless and eliminating the necessity for separate transactions. - Elevated Giving Energy

Many corporations supply matching present packages that amplify worker donations, maximizing the influence of their contributions with out extra price to the worker. - Tax Effectivity

Payroll donations are sometimes pre-tax, decreasing the taxable earnings for workers whereas guaranteeing their chosen charity receives the total donation quantity. - Empowerment and Goal

Workers really feel extra linked to their firm and their chosen causes, fostering a way of delight and goal of their work.

All in all, payroll giving creates a win-win situation for corporations and staff, constructing a optimistic office surroundings whereas driving vital social influence. It enhances private achievement for workers and strengthens the corporate’s function as a neighborhood chief.

What Does the Payroll Giving Course of Look Like?

The payroll giving course of is designed to make charitable contributions easy, seamless, and impactful for each staff and employers.

Right here’s a step-by-step breakdown of the way it sometimes works:

1. Program Setup by Employer

If an organization is all in favour of growing a payroll giving program, step one is mostly to pick out a payroll giving supplier to facilitate and streamline the method. From there, it’s time to outline insurance policies and set up particular pointers for this system. This could embody worker and nonprofit eligibility, frequency of deductions, and whether or not they’ll supply matching presents or different incentives.

Then, the corporate begins selling this system and educating its workforce concerning the giving alternative via onboarding, inside communications, and numerous promotional campaigns to maximise participation.

2. Worker Enrollment

staff can then determine to enroll within the payroll giving program by choosing a charity they want to help, typically from an inventory of registered organizations. Workers determine how a lot they wish to contribute per paycheck, usually with the choice to set a hard and fast quantity or a share of their wage.

This a part of the method is often carried out by finishing a easy enrollment kind or on-line course of, authorizing the employer to mechanically deduct the authorised quantity instantly from the person’s paychecks going ahead.

3. Payroll Deductions

As soon as enrolled, the desired donation quantity is mechanically deducted from the worker’s paycheck, usually pre-tax (although this will rely on native pointers and laws).

Deductions are typically mirrored on staff’ pay stubs, offering a transparent document for transparency and tax functions.

4. Funds Distribution

Lastly, donors’ using corporations—or their giving platforms—consolidate all worker donations. From there, funds are distributed to the chosen nonprofits on an everyday schedule (e.g., month-to-month or quarterly), guaranteeing well timed supply.

8 Firms Providing Payroll Giving Applications

For the perfect outcomes, nonprofits needs to be conversant in corporations providing payroll giving packages. In spite of everything, these initiatives will enable organizations to considerably improve their fundraising methods, as they supply a dependable supply of funding via recurring, employer-sponsored donations.

Whereas we will’t listing all of them, we have now chosen a couple of examples of well-known corporations with payroll giving alternatives to highlight beneath. These embody:

On the lookout for much more examples of corporations with payroll giving packages—together with different giving alternatives? Think about investing in a office giving database like Double the Donation!

Ideas for Rising Help By Payroll Giving

Rising help via payroll giving requires strategic planning and efficient communication together with your viewers. Listed below are some finest practices to reinforce participation and engagement:

Pre-register for corporations’ giving portals.

To maximise the potential of payroll giving,nonprofits ought to guarantee their group is listed and up-to-date in corporations’ office giving portals. In spite of everything,many firms use platforms like Benevity or CyberGrants to handle worker giving packages. By pre-registering,nonprofits make it simpler for workers to pick out their group and begin donating.

- Finest Practices for Pre-registration:

- Confirm eligibility and full all required certifications.

- Present detailed,compelling descriptions of your mission and packages.

- Recurrently replace contact and cost particulars to keep away from disruptions.

Pre-registration reduces boundaries for donors and ensures that staff can simply discover and help your group. It additionally demonstrates professionalism and preparedness,enhancing your credibility with each corporations and their staff.

Concentrate on the advantages and influence of payroll giving.

Speaking the advantages and real-world influence of payroll giving is essential for partaking potential donors. Subsequently,it’s a good suggestion to spotlight how payroll giving simplifies contributions and amplifies their influence,particularly when paired with different packages,like matching presents.

Share tangible examples of how payroll giving has reworked your packages,supported your beneficiaries,or helped obtain particular objectives. Use metrics,pictures,or movies to make the influence relatable and actual. And don’t overlook the facility of a donor story or testimonial,both.

Present unique incentives for payroll giving donors.

Encouraging donors to decide to payroll giving will be simpler when unique perks are provided. A majority of these incentives make donors really feel valued and appreciated whereas fostering a way of neighborhood amongst supporters.

Listed below are a couple of concepts you would possibly think about:

- Early entry to occasion tickets or particular donor-only occasions.

- Customized thank-you messages or recognition in newsletters and annual stories.

- Branded merchandise,similar to tote luggage,T-shirts,or mugs,for payroll donors.

- Unique updates or behind-the-scenes content material about your packages.

Optimistic incentives create a optimistic suggestions loop,the place donors really feel rewarded for his or her generosity,growing their chance of staying dedicated to your group long-term. Plus,it may be simply what on-the-fence supporters have to make the primary soar and enroll in this system!

See it in Motion:Nonprofits Selling Payroll Giving Effectively

Many nonprofits have established efficient methods for selling payroll giving alternatives,showcasing revolutionary methods to have interaction staff and companies alike. Listed below are a couple of examples of organizations that are inclined to excel on this space:

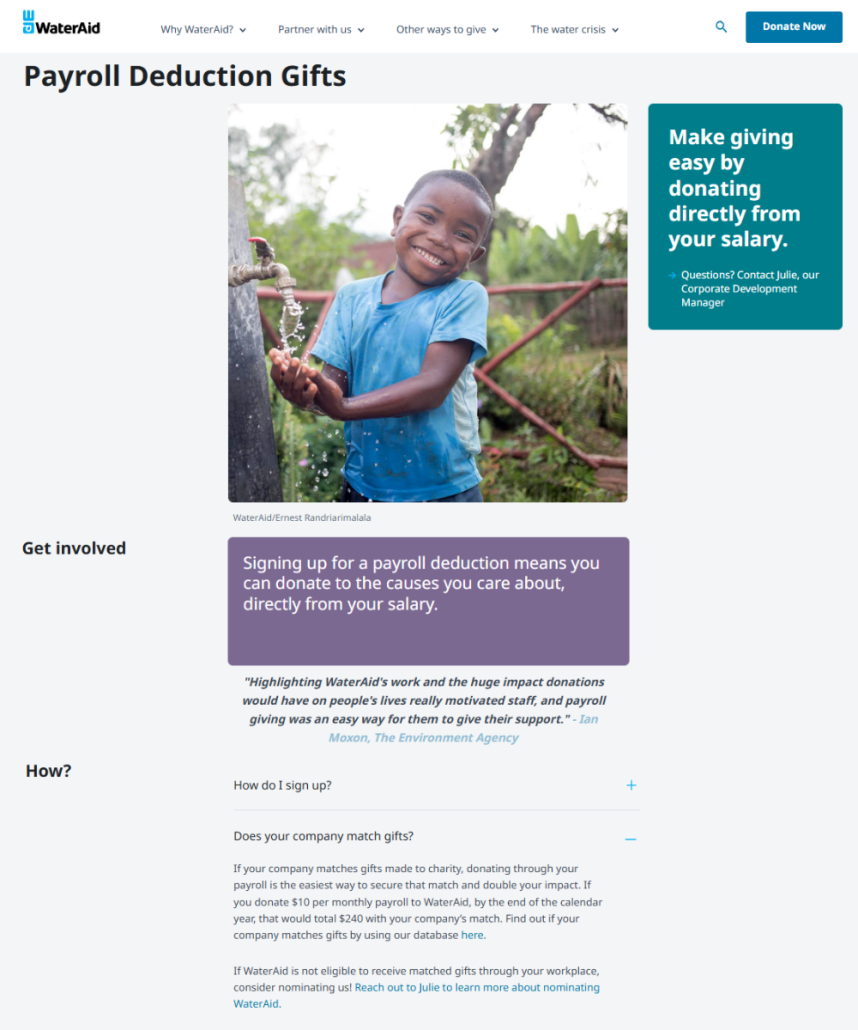

Water Support

WaterAid is a world group working to supply clear water,respectable bathrooms,and good hygiene in growing nations. The nonprofit highlights payroll deduction presents as a number one method for donors to make a distinction,and it does so particularly with the Payroll Giving touchdown web page beneath.

The group’s FAQ part additionally calls out one other type of office giving that always goes hand-in-hand with payroll giving:matching presents. It even hyperlinks to the nonprofit’s office giving database software for donors to simply uncover their eligibility for a match.

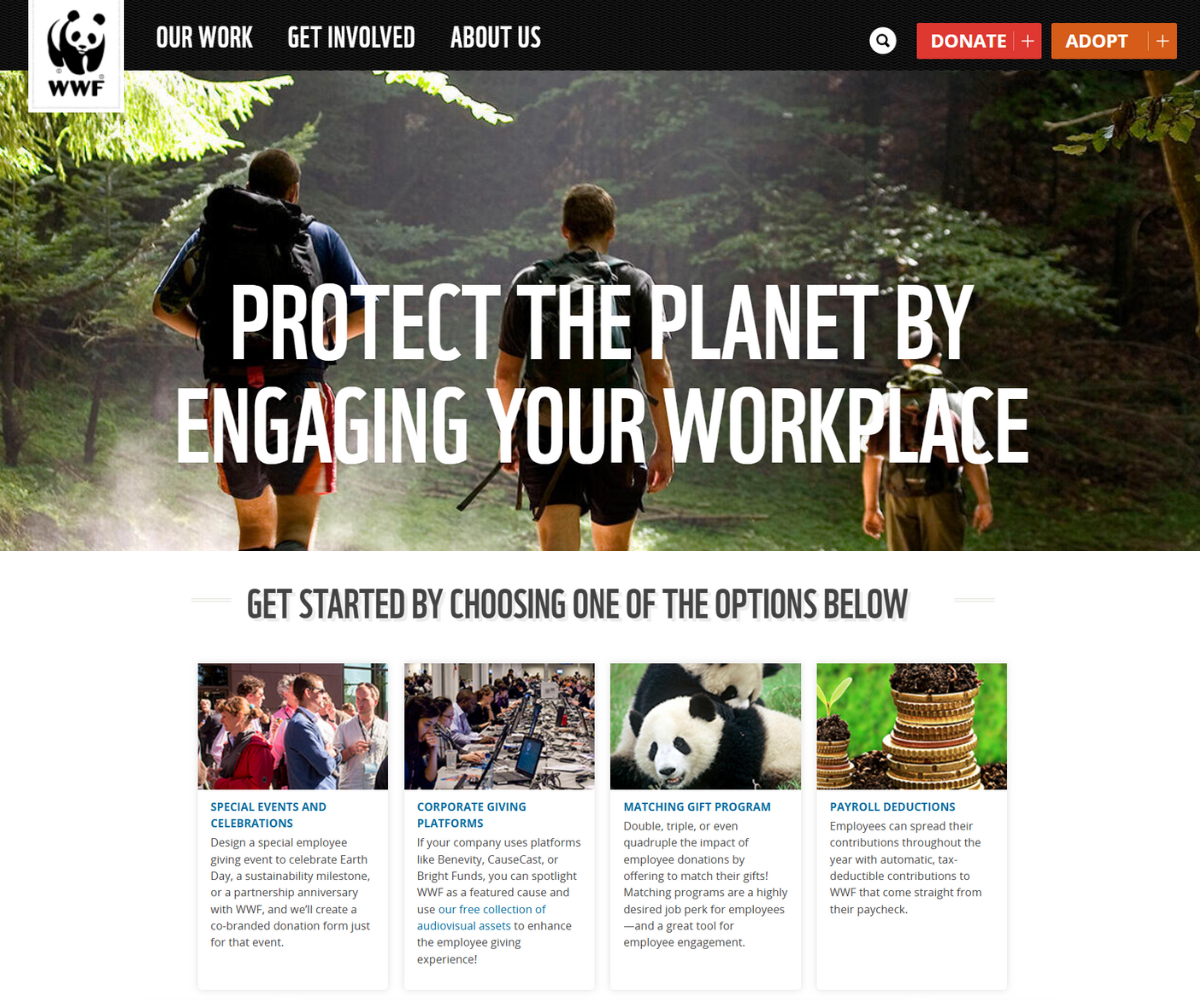

WWF

WWF,often known as the World Wildlife Fund,is a global conservation group targeted on preserving the world’s most susceptible species and ecosystems. To be able to drive help via payroll giving donations,WWF has established the next web page devoted to the packages:

The web page additionally hyperlinks to a video that additional explains the payroll giving alternative,empowering donors and firms alike to be taught extra and become involved with the packages. And so they actually concentrate on the tax advantages,too—driving the concept that a $5 month-to-month donation will price not more than $4!

Save the Youngsters

Save the Youngsters is a world nonprofit group devoted to bettering the lives of youngsters via training,healthcare,emergency response,and advocacy. The group is devoted to profiting from office giving packages for its trigger,which embody payroll giving,matching presents,and extra.

A method that it does so is with the next touchdown web page on its web site:

Kawartha Lakes Meals Supply

Kawartha Lakes Meals Supply (or KLFS) is a not-for-profit distribution heart supplying meals and private care gadgets to member organizations within the Metropolis of Kawartha Lakes. Because the group goals to boost extra via payroll giving packages,the group shared the next social media publish to boost consciousness:

This outlines the payroll giving alternative and encourages donors to get involved with their payroll departments to get arrange.

Wrapping Up &Extra Assets

Payroll giving stands out as a robust and environment friendly method for nonprofits to harness worker contributions and create a long-lasting influence on their causes. By facilitating easy donations instantly from supporters’ paychecks,organizations can construct a dependable funding stream that helps their missions and packages.

In the end,payroll giving represents a win-win situation. It permits staff to make significant contributions whereas empowering nonprofits to do greater than ever earlier than. By embracing this collaborative strategy,each events can work collectively to create optimistic change.

All in favour of studying extra about office giving alternatives and past? Take a look at these really helpful sources to maintain studying: