A reader asks:

If Invoice Candy’s favourite matter is Roth IRA’s/401K’s, I’d wager his second favourite is tax achieve harvesting (in a taxable account). For 2024, people with taxable earnings beneath $47,025 ($94,050 for married {couples}) pay 0% tax for long-term capital features (LTCG). In years once you’re beneath the brink you could possibly successfully lock in tax-free long-term features. The thought could be to appreciate simply sufficient LTCG to remain throughout the 0% tax bracket. I believe this matter could be useful to the listeners to remember as they head into the brand new 12 months with their tax planning. Perhaps Invoice might chime in and add a few of his insights/ideas on this matter.

Ask and also you shall obtain!

I’m not a tax particular person in order that’s why I outsource to knowledgeable. Invoice Candy is my private tax guru and the pinnacle of our tax crew at Ritholtz Wealth Administration. Invoice got here on Ask the Compound this week to reply this query for us.

This matter is particularly related for retirees taking withdrawals from their portfolios.

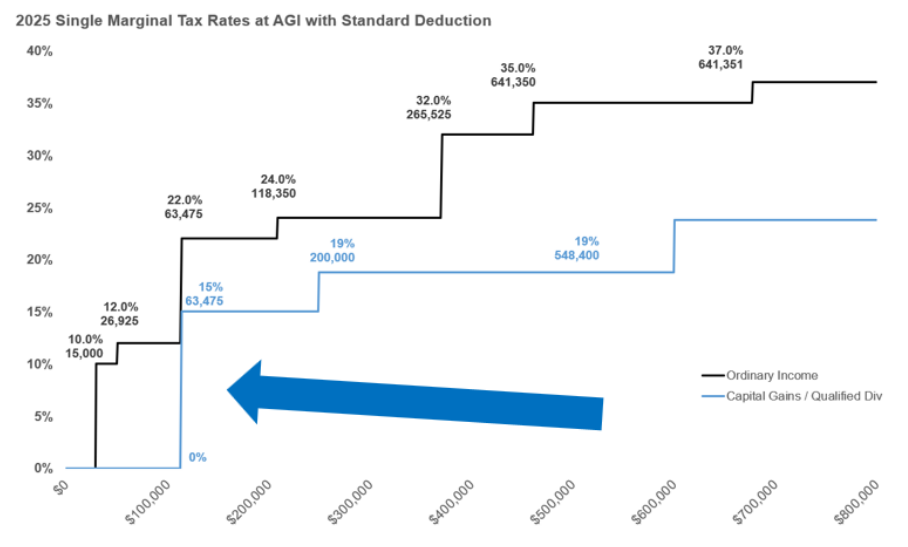

Our reader truly undersells the deal on long-term capital features right here. You additionally need to tack on the usual deduction which is $15,000 for people or $30,000 for a married couple.

Check out this useful chart Invoice made for me:

Meaning don’t need to pay federal earnings taxes in your long-term capital features till your earnings exceeds somewhat greater than $63,000. So you could possibly understand greater than $63,000 in capital features and dividends with out paying any federal earnings tax.1

Not unhealthy.

Revenue additionally included issues like Social Safety, pension earnings, part-time jobs, and so forth. However for the sake of conserving issues easy, let’s have a look at just a few examples to see how this is able to play out at varied ranges of spending from a portfolio.

Tax conditions are all the time circumstantial so I’m going to make use of spherical numbers so it’s not too sophisticated.

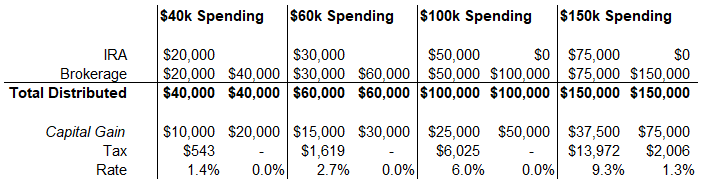

Let’s say you will have a $1 million portfolio and use the 4% rule to take $40k of spending in your first 12 months of retirement. And we are able to additional assume you are taking half of your distributions from a standard IRA ($20k) and half from a taxable account ($20k). For the brokerage account, we’ll additionally determine half of it’s capital features and the opposite half is the associated fee foundation.

On this state of affairs, you’re paying nothing in capital features. After your customary deduction you’d find yourself paying a small quantity (round $500) in taxes but it surely’s a price of lower than 1.5% in your $40k in spending.

Mr. Candy was form sufficient to draft another examples at varied spending ranges as effectively:

You may see these long-term capital achieve taxes didn’t kick in till the features had been $75k. And even then it was a negligible quantity.

The same old caveats apply right here — you could possibly change the place the cash comes from (we didn’t use any Roth belongings on this equation), change the forms of investments used, change the earnings profile, and so forth.2 However even when you use these numbers as ballpark figures, taxes will probably be much less of a burden in retirement than many individuals assume.

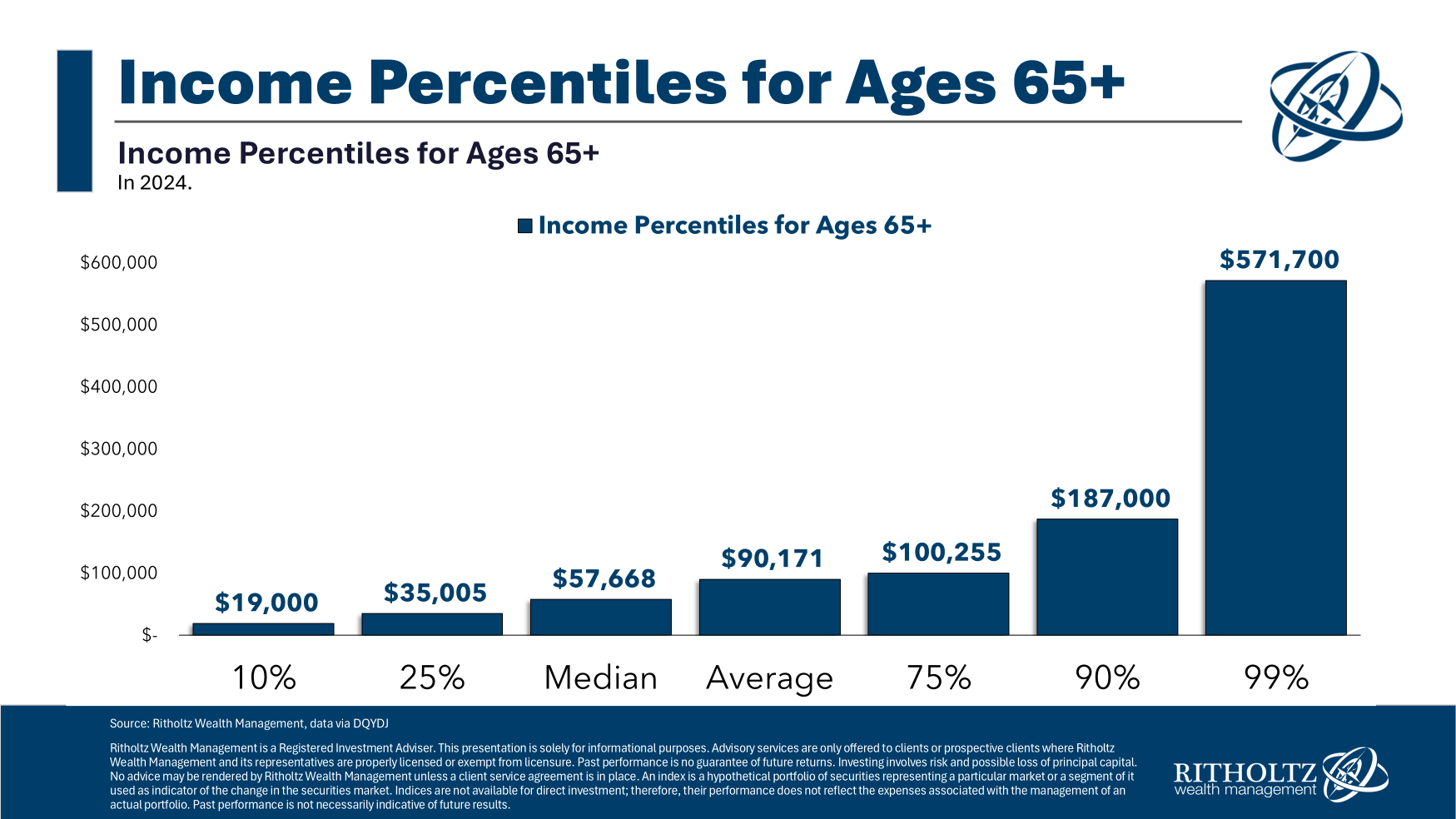

Some rich individuals who spend some huge cash would possibly have a look at these numbers and scoff however try the earnings percentiles for people who find themselves 65 and older:

Three-quarters of this cohort has an annual earnings of $100k or much less.

Taxes may not be as unhealthy as you assume in retirement.

Invoice joined me on Ask the Compound this week to sort out this one together with questions on when to promote a concentrated inventory place earlier than retirement, how direct indexing works, using margin to keep away from promoting appreciated securities and asset location on your enjoyable buying and selling account.

Additional Studying:

The Inheritance Battle

1State tax guidelines fluctuate by state in order that’s a consideration as effectively. These numbers are simply Federal taxes.

2That is why it’s so vital to make the most of a tax skilled when you can.

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here might be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency is just not indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.