Monetary fraud is an ever-evolving risk that you just, or somebody you already know, has probably been a sufferer of. This risk extends to banks and monetary establishments coping with clients’ monetary information. With AI, monetary frauds have gotten extremely subtle and sometimes exhausting to detect.

The Indian Cybercrime Coordination Centre (I4C) reported that during the last three years, digital monetary frauds have led to staggering losses price ₹1.25 lakh crore.

In 2023 alone, over 13,000 circumstances of monetary fraud have been recorded, almost half of which have been digital fee fraud (card/web). Based on information from the Nationwide Cybercrime Reporting Portal (NCRP), victims of digital monetary fraud reported to have misplaced no less than ₹10,319 crore.

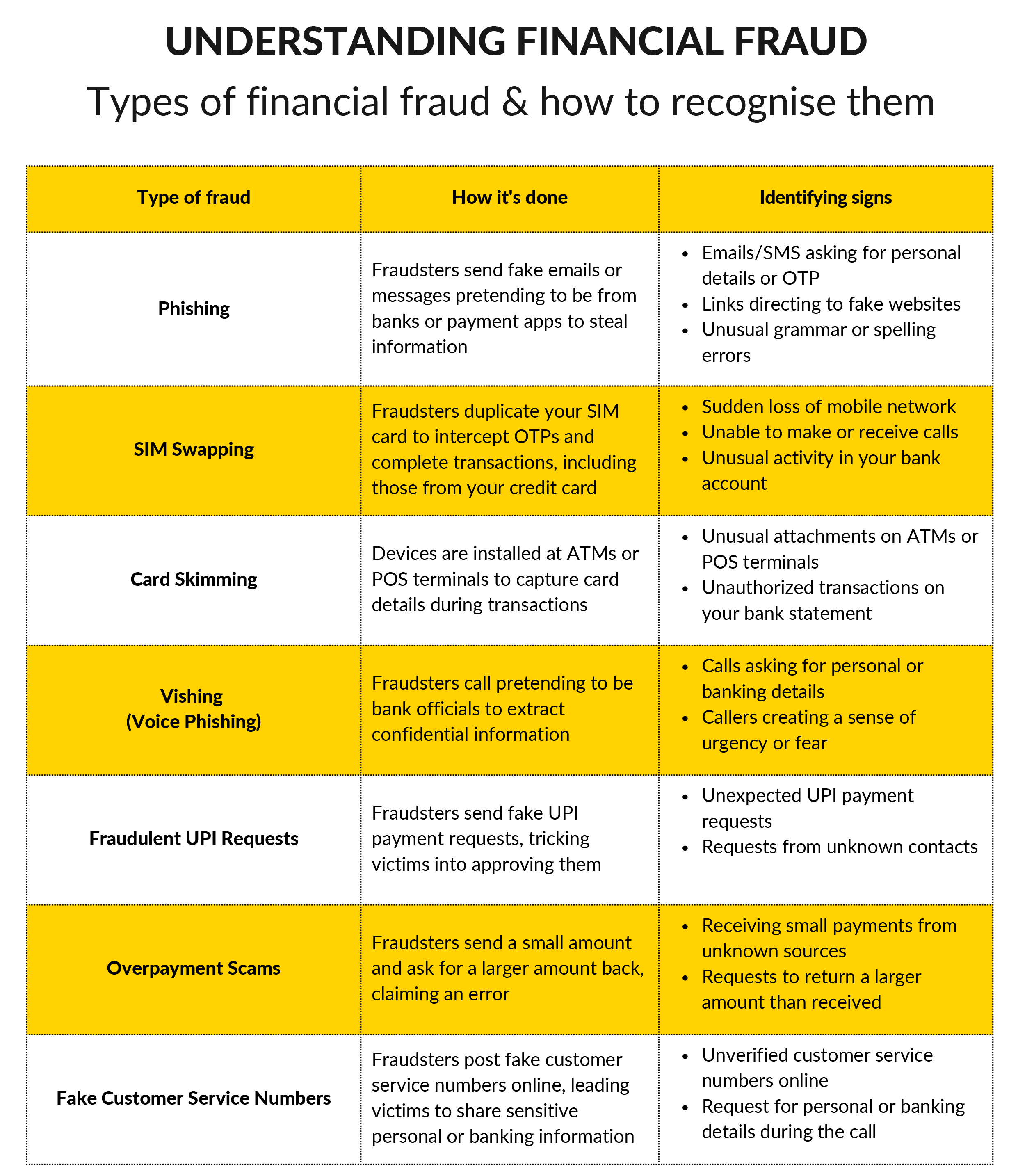

The rising reputation of digital fee strategies, together with bank cards, has led to an uptick in digital monetary fraud. Staying vigilant and conscious has, thus, turn into important. This primer covers varied forms of fraud and the warning indicators to be careful for. Additionally included are sensible fraud-prevention methods you need to use to guard your funds and a glimpse into the Reserve Financial institution of India’s guidelines on bank card fraud prevention that you can see helpful.

- Report the incident instantly: Promptly report the fraudulent incident to your financial institution or UPI app supplier. Right here, time is of the essence – the sooner you report, the upper shall be your probabilities of being eligible for zero eligibility safety, topic to situations.

- Block your playing cards: Request the financial institution to freeze your account and block your card to stop additional misuse.

- Present related particulars: When reporting the incident to the financial institution, present all info reminiscent of emails, SMSs, screenshots, transaction particulars, or another incident-related particulars, if crucial. This documentation will help assist your case.

- Dispute decision: After submitting the report, comply with up on the dispute decision course of. Adhere to the reporting deadline and supply all crucial documentation to maximise probabilities of recovering your funds.

- File a police report: If required, file a criticism with the native cybercrime unit or police which may function an official file and could also be crucial for additional investigations.

- Notify your credit score bureau: Don’t overlook to inform your credit score bureau of the fraudulent incident to stop it from impacting your credit score rating.

- Monitor your accounts: Test your bank card accounts often to trace your transaction exercise. This may assist you to flag and report suspicious immediately.

- Set transaction limits: As a primary line of defence, make use of your bank card’s built-in controls to restrict the place and the way your card can be utilized, i.e., on-line, level of sale terminals, or through faucet & pay. You might also set transaction limits various kinds of transactions to restrict your legal responsibility in case of unauthorised use of your card. Test when you can tweak these settings for home and worldwide transactions.

- By no means share delicate info: Delicate information like bank card particulars, PINs, and login passwords mustn’t ever be shared with anybody. Additionally chorus from sharing private info on-line. Keep away from utilizing public Wi-Fi or getting into delicate banking info over unsecured public networks.

- Arrange transaction alerts & evaluation bank card statements: Transaction alerts, for main and add-on playing cards will provide help to maintain tab on what the cardboard is getting used for. Evaluation your bank card and financial institution statements often to examine for unauthorised transactions.

- By no means go away your card unattended: When making funds at eating places or gas stations, all the time maintain your card within reach when handing it over to the attendant. Use EMV chip playing cards to scale back the chance of skimming and inform the employees promptly when you discover something uncommon with the cardboard slot or Level of Sale machine.

- Store on-line safely: Solely store from trusted and established web sites that provide safe fee gateways. Allow Two-Issue Authentication (2FA) on your accounts for added safety.

- Replace units often: Safety patches and updates are sometimes supplied by the machine producers and software program builders to assist machine homeowners keep protected in opposition to the most recent cyber safety threats.

- Be vigilant: Acquaint your self with the warning indicators of on-line scams. These may very well be suspicious emails/SMSs/web sites, unsolicited fee requests, suspicious hyperlinks, or request for banking info, amongst different issues. If fraudulent exercise happens, promptly report it to your financial institution.

Copyright reserved © 2024 A & A Dukaan Monetary Companies Pvt. Ltd. All rights reserved.