I’m usually not a fan of ILPs (Funding-Linked Plans), however through the years, I’ve reviewed a number of extra well-liked ILPs on the request of my readers. The very first ILP that I wrote about intimately on this weblog was Singlife Develop, which was launched in 2021 and was the primary digital ILP available in the market.

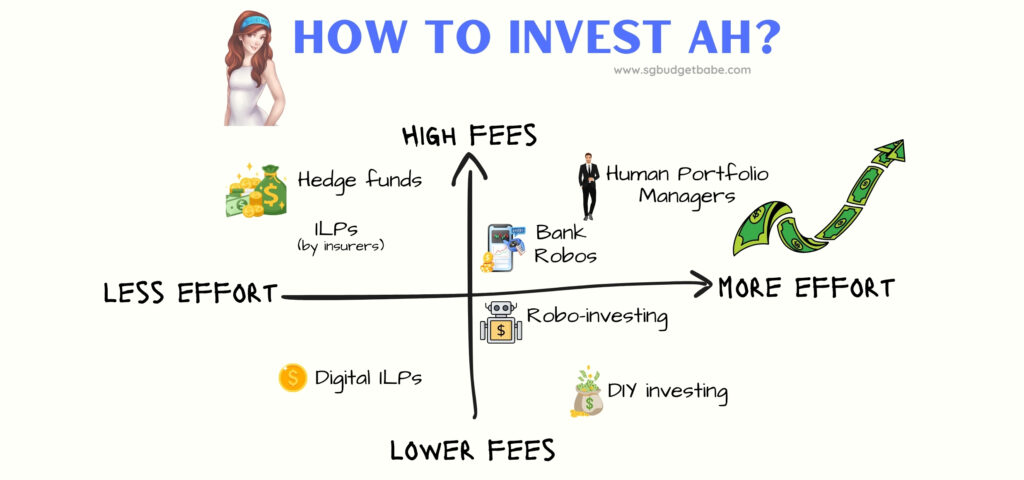

Digital ILPs make for an fascinating breed of product, particularly given how they had been structured to problem conventional ILPs with a few of the following options:

- 100% of premiums are invested upfront

- A fraction of the charges vs. conventional ILPs, since distribution prices and gross sales agent commissions had been being eradicated

- No lock-ins or withdrawal penalties

There are 2 digital ILPs which have since gained traction available in the market, particularly Singlife Positive Make investments (previously Develop) and Tiq Make investments. Many people within the scene had been desirous to see if they might beat the massive boys.

However alas, now that Singlife has introduced they’re discontinuing the ILP, we’re now left with just one contender standing.

If you happen to’re a present Singlife Positive Make investments / Develop policyholder, that is clearly related to you. However even for those who’re not, it nonetheless makes for fairly an fascinating case research on the start and demise of an investment-linked coverage (ILP) that attempted to resolve the criticisms levelled at its predecessors (that are nonetheless thriving right this moment).

The start of Digital ILPs in Singapore

About 8 years in the past, I wrote about how I cancelled my ILP after realising how a lot it was costing me and consuming into my funding returns. Later, to keep away from having individuals following my transfer blindly, I wrote about the professionals and cons of ILPs to assist readers determine for themselves.

So when Singlife Develop (later restructured as Positive Make investments) got here out, their product managers designed a plan that might tackle the criticisms sometimes related to conventional ILPs…whereas retaining the advantages for shoppers. It was a daring imaginative and prescient, with decrease charges, no lock-in intervals, zero withdrawal penalties and with out the necessity for ongoing premium funds. Shortly after, Etiqa launched their very own model of a digital ILP with a fair decrease price and managed by 4 fund managers together with Dimensional and Lion World (whereas Singlife’s funds had been solely through Aberdeen).

There’s little question that digital ILPs are cheaper for the patron. However in that case, why is Singlife pulling the plug on theirs?

Singlife claims it’s due to the product’s “modest efficiency through the years”. My query is – for who? The insurer or the patron? My guess is the previous.

The factor about ILPs is that they’re typically offered and never purchased. Insurance coverage brokers receives a commission excessive commissions (see how excessive right here) which incentivizes them to promote ILPs to their shoppers and guarantee they continue to be dedicated to the plan and proceed to pay for it through the years.

Making an attempt to chop out the salespeople and go DTC (direct to shopper) is a gallant try, however does it pay effectively sufficient for the insurer to justify persevering with the coverage?

Singlife’s cessation of Positive Make investments means that it might not have been, however we’ll by no means know. We will now solely watch to see what occurs with Etiqa’s Tiq Make investments to seek out out extra.

What occurs to Singlife ILP prospects?

In a transfer that can shake up the trade, Singlife will probably be giving again all Singlife Positive Make investments policyholders their premiums paid, on prime of paying a 2.5% curiosity on the annual administration cost that was levied throughout the ILP time period.

This implies even when your portfolio is in a loss, all Singlife Positive Make investments prospects will be capable to exit their ILP with out incurring any capital losses in any respect.

Chances are you’ll consult with Singlife’s web site right here for the small print, however right here’s a fast abstract of the three seemingly eventualities (assuming $10k was the invested beginning capital):

- Your coverage internet asset worth (NAV) is in a loss: You’ll obtain a complete fee of S$10,147.50 which features a fee of S$900 by Singlife to carry the policyowner again to the online capital place (on the level of buy of the SSI ILP coverage) and an extra curiosity fee of S$247.50 by Singlife.

- Your coverage internet asset worth (NAV) is in revenue: You’ll obtain a complete fee of S$11,247.50 which incorporates an curiosity fee of S$247.50 by Singlife.

- Your coverage internet asset worth (NAV) = internet capital: You’ll obtain a complete fee of S$10,147.50 which incorporates an extra curiosity fee of S$247.50 by Singlife.

In case you’re confused by the “Web Capital” time period utilized by Singlife, it refers to your Preliminary Premium + High-ups – Withdrawals/Refunds – Charges.

That is wild, and intensely beneficiant of Singlife to take action. As a substitute of merely reimbursing the annual administration fees, they’ve gone one step additional to pay a 2.5% p.a. curiosity on prime of it. Their transfer will certainly go down in historical past books as one for different insurers to be taught from.

That is the primary time I’ve seen a neighborhood insurer provide to bear any funding losses by the client!

What Occurs Subsequent?

If you happen to at the moment maintain the Singlife ILP, then you possibly can count on to be paid on the next 2 dates:

- Web Asset Worth is refunded to policyholders by thirtieth September 2024

- 2.5% p.a. curiosity on Web Capital is given to policyholders by 18th October 2024

Singlife has mentioned that they are going to ship a closing assertion by 18 Oct 2024 to verify the termination and a abstract of the online funds to be credited to you.

What must you do to take a position the cash that you just get again? Effectively, there are a number of choices (ranked from lowest charges):

Will Digital ILPs survive?

It’s no secret that the excessive charges related to ILPs erode into the funding returns for policyholders, however that’s how the character of conventional ILPs work anyway – tacked with excessive agent upfront commissions, insurer distribution charges and the fund supervisor’s ongoing charges. So it was refreshing to see digital insurers Singlife and Etiqa attempt to sort out this downside by launching a lower-fee, single-premium ILP to compete with the massive boys, however right this moment, Singlife’s resolution to close it down solely makes us marvel why.

As a lot as we would like digital ILPs to work, the fact would possibly simply be that prospects aren’t shopping for sufficient of them to justify the work and cash concerned on the insurers’ finish. And when that occurs, the laborious resolution of closing it for good must be made. In any case, you possibly can’t save the world with out first making certain your personal livelihood.

I guess extra conventional ILPs have been offered up to now 1 yr vs. the mixed gross sales of Singlife Positive Make investments and Etiqa Tiq Make investments. Amidst that backdrop, how can we then count on digital ILPs to outlive?

All eyes on Etiqa now to see how the scene develops from right here.

With love,

Price range Babe